Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

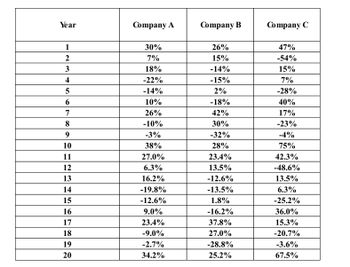

Table attached shows the historical returns for Companies A, B and C

- If one investor has a portfolio consisting of 70% Company A and 30% Company B, what are the average portfolio return and standard deviation? What is Sharpe ratio if the risk-free rate is 3.5%?

2. If another investor has a portfolio consisting of 1/3 Company A, 1/3 Company B and 1/3 Company C, what are the average portfolio return and standard deviation? What is Sharpe ratio if the risk-free rate is 3.5%?

Transcribed Image Text:The table presents the annual percentage changes in performance for three companies—A, B, and C—over a 20-year period. Each cell contains the percentage change for the respective company in that year.

**Detailed Data Summary:**

- **Yearly Performance:**

- For each year (1 to 20), the table lists the percentage change as a separate entry for Company A, Company B, and Company C.

- **Company A:**

- Year 1 experienced a 30% increase.

- There are fluctuations, with notable declines in years 4 (-22%) and 5 (-14%).

- The highest positive change occurred in year 10 with a 38% increase.

- The lowest was in year 14, with a decrease of 19.8%.

- **Company B:**

- Started with a 26% increase in year 1.

- Notable fluctuations include year 3 (-14%) and year 6 (-18%).

- The largest increase was in year 17, with a 37.8% rise.

- The largest decrease was in year 9 with a decline of 32%.

- **Company C:**

- Started off with a high of 47% increase in year 1, then fell drastically in year 2 (-54%).

- Experienced a high increase in year 10 (75%) and a significant drop in year 13 (-48.6%).

- Ended with a 67.5% increase in year 20.

The table offers a clear, year-by-year view of the changes, helping one understand the volatility and growth trends within each company over the two decades.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Using the data in the following table, consider a portfolio that maintains a 60% weight on stock A and a 40% weight on stock B. a. What is the return each year of this portfolio? b. Based on your results from part (a), compute the average return and volatility of the portfolio. c. Show that (i) the average return of the portfolio is equal to the (weighted) average of the average returns of the two stocks, and (ii) the volatility of the portfolio equals the same result as from the calculation in Eq. 11.9. d. Explain why the portfolio has a lower volatility than the average volatility of the two stocks. a. What is the return each year of this portfolio? Enter the return of this portfolio for each year in the table below: (Round to two decimal places.) Year 2012 Portfolio % 2010 % 2011 % b. Based on your results from part (a), compute the average return and volatility of the portfolio. The average return of the portfolio is%. (Round to two decimal places.) 2013 % 2014 % 2015 % The…arrow_forwardAssume the CAPM holds and consider stock X, which has a return variance of 0.09 and a correlation of 0.75 with the market portfolio. The market portfolio's Sharpe ratio is 0.30 and the the risk-free rate is 5%. (a) What is Stock X's expected return? (b) What proportion of Stock X's return volatility (i.e. standard deviation) is priced by the market? Explain why this number is less than 1.arrow_forward*Stock A has a beta of 1.3 and an expected return of 10.2. Stock B has a beta of 0.8 and an expected return of 8.7. If these stocks are priced correctly according to the CAPM, what is the risk-free rate? Give your answer in percentage to the nearest basis point.arrow_forward

- An investor has a portfolio of two assets A and B. The details are shown in the below table. Portfolio Details Asset Expectedreturn Standarddeviation Covariance (A, B) Expected Portfolio Return A 0.06 0.5 0.12 0.1 B 0.08 0.8 Which one of the following statements is NOT correct? a. The portfolio weight in asset A is -100%. b. The correlation of asset A and B’s returns is 0.3. c. The investor can benefit from a fall in the price of asset A. d. The variance of the portfolio is 2.33. e. The order of short selling is borrowing, buying, selling, and returning.arrow_forwardConsider a portfolio consisting of the following three stocks: an expected return of 8%. The risk-free rate is 3%. a. Compute the beta and expected return of each stock. ▪ The volatility of the market portfolio is 10% and it has b. Using your answer from part a, calculate the expected return of the portfolio. c. What is the beta of the portfolio? d. Using your answer from part c, calculate the expected return of the portfolio and verify that it matches your answer to part b.arrow_forwardYou are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: Op 1.45 1.20 0.75 1.00 Portfolio: X Y Z Market Risk-free Rp 11.00% 10.00 8.10 10.40 5.20 Information ratio Op 33.00% 28.00 18.00 23.00 0 Assume that the tracking error of Portfolio X is 9.10 percent. What is the information ratio for Portfolio X? Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 4 decimal places. 02148 0arrow_forward

- Expected return of a portfolio using beta. The beta of four stocks-P, Q, R, and S-are 0.59, 0.89, 1.05, and 1.31, respectively and the beta of portfolio 1 is 0.96, the beta of portfolio 2 is 0.87, and the beta of portfolio 3 is 1.05. What are the expected returns of each of the four individual assets and the three portfolios if the current SML is plotted with an intercept of 4.5% (risk-free rate) and a market premium of 12.0% (slope of the line)? ..... What is the expected return of stock P? % (Round to two decimal places.)arrow_forwardPortfolio Suppose rA ~ N (0.05, 0.01), rB ~ N (0.1, 0.04) with pA,B = 0.2 where rA and rB are CCR’s. a) Suppose you construct a portfolio with 50% for A and 50% for B. Find the variance of the portfolio CCR. b) Find the portfolio expected gross return. c) Find the expected portfolio CCR.arrow_forwardYou are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: Portfolio Y Z Market Risk-free Rp 16.00% бр 32.00% 15.00 27.00 7.30 17.00 11.30 5.80 22.00 0 Bp 1.90 1.25 0.75 1.00 0 Assume that the tracking error of Portfolio X is 13.40 percent. What is the information ratio for Portfolio X? Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 4 decimal places. Information ratioarrow_forward

- Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is foundto be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the requiredreturn on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (A) to beta of B(B). d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to payreturns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standarddeviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also hasstandard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whetherasset A and B are overvalued or undervalued, and explain why. (Hint: Beta of asset i (??) =???????, where ??,?? are standard deviations of asset i and marketportfolio, ??? is the correlation between asset i and the market portfolio)Question 2. Foreign exchange marketsStatoil, the national…arrow_forwardAssume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found to be halfof the required return (RB) on stock B. The risk-free rate (Rf) is one-fourthof the required return on A. Return on market portfolio is denoted by RM. Find the ratioof betaof A(A) tobeta of B(B). Thank you for your help.arrow_forwardPortfolio theory with two assets E(R1)=0.15 E(01)= 0.10 W1=0.5 E(R2)=0.20 E(02) = 0.20 W2=0.5 Calculate the expected return and the standard deviation of the two portfolios if r1,2 = 0.4 and -0.60 respectively.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education