FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

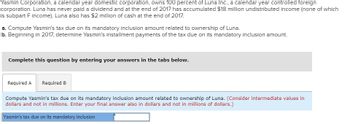

Transcribed Image Text:Yasmin Corporation, a calendar year domestic corporation, owns 100 percent of Luna Inc., a calendar year controlled foreign

corporation. Luna has never paid a dividend and at the end of 2017 has accumulated $18 million undistributed income (none of which

is subpart F income). Luna also has $2 million of cash at the end of 2017.

a. Compute Yasmin's tax due on its mandatory inclusion amount related to ownership of Luna.

b. Beginning in 2017, determine Yasmin's installment payments of the tax due on its mandatory inclusion amount.

Complete this question by entering your answers in the tabs below.

Required A Required B

Compute Yasmin's tax due on its mandatory inclusion amount related to ownership of Luna. (Consider intermediate values in

dollars and not in millions. Enter your final answer also in dollars and not in millions of dollars.)

Yasmin's tax due on its mandatory inclusion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- darrow_forwardBirdcallington Ltd. is a CCPC that earns $200,000 in active taxable income in 2014, all of which is earned within Canada. Calculate their taxes owing assuming that no corporations are associated with them and provincial taxes are 8% on all forms of income. (ensure you use the long form method - including showing the small business deduction, generate rate reduction, etc. if relevant).arrow_forwardNicole and Mohammad (married taxpayers filing jointly) are equal owners in an S corporation. The company reported sales revenue of $410,000 and expenses of $287,000. The corporation also earned $21,000 in taxable interest and dividend income and had $13,650 investment interest expense. Required: How are these amounts reported for tax purposes in the following schedules? > Answer is complete but not entirely correct. Schedule A Schedule B Schedule E $ $ $ Amount 0X 21,000✔ 13,650 xarrow_forward

- At the beginning of the current year, Maple Corporation (a calendar year taxpayer) has accumulated E & P of $140,000. During the year, Maple incurs a $120,000 loss from operations that accrues ratably. On July 1, Maple distributes $85,000 in cash to Asya, its sole shareholder. Assume Asya has sufficient basis for the distribution. How is Asya taxed on the distribution? Of the $85,000 distribution, ($fill in the blank 1) is taxed as a dividend and ($fill in the blank 2) represents a return of capital.arrow_forwardWhat is the taxable income if the taxpayer had chosen itemized deduction? * D. Co. is a domestic corporation with the following data for 2002 (first year of operations): Gross profit from sales Dividend from domestic corporation Capital gain on sale of land in the Philippines held for two years (sold at P1,000,000) Capital gains on sale of shares of domestic corporation held for two months (direct sale to buyer) Business expenses Capital loss on bonds of domestic corporation held for 6 months P2,000.000 20,000 200,000 120,000 1,100,000 30,000arrow_forwardDo not give image formatarrow_forward

- Weather, Inc., a domestic corporation, operates in both Fredonia and the United States. This year, the business generated taxable income of $975,000 from foreign sources and $1,462,500 from U.S. sources. All of Weather's foreign-source income is in the general limitation basket. Weather's total taxable income is $2,437,500. Weather pays Fredonia taxes of $365,625. Assume a 21% U.S. income tax rate. Do not round any division and if required, round your final answer to the nearest dollar. What is Weather's FTC for the tax year?arrow_forwardWhat is the income tax imposed on the corporate income earned by Bulldog and the income tax on the bonus paid to Rojas? (No plagiarism)arrow_forwardFederal Income Tax II Please show work by EXCEL Tristan, who is single, operates three sole proprietorships that generate the following information in 2023 (none are "specified services" businesses). (LO .4) Tristan chooses not to aggregate the businesses. She also earns $150,000 of wages from an unrelated business, and her modified taxable income (before any QBI deduction) is $380,000. a. What is Tristan's QBI deduction? b. Assume that Tristan can aggregate these businesses. Determine her QBI deduction if she decides to aggregate the businesses.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education