FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

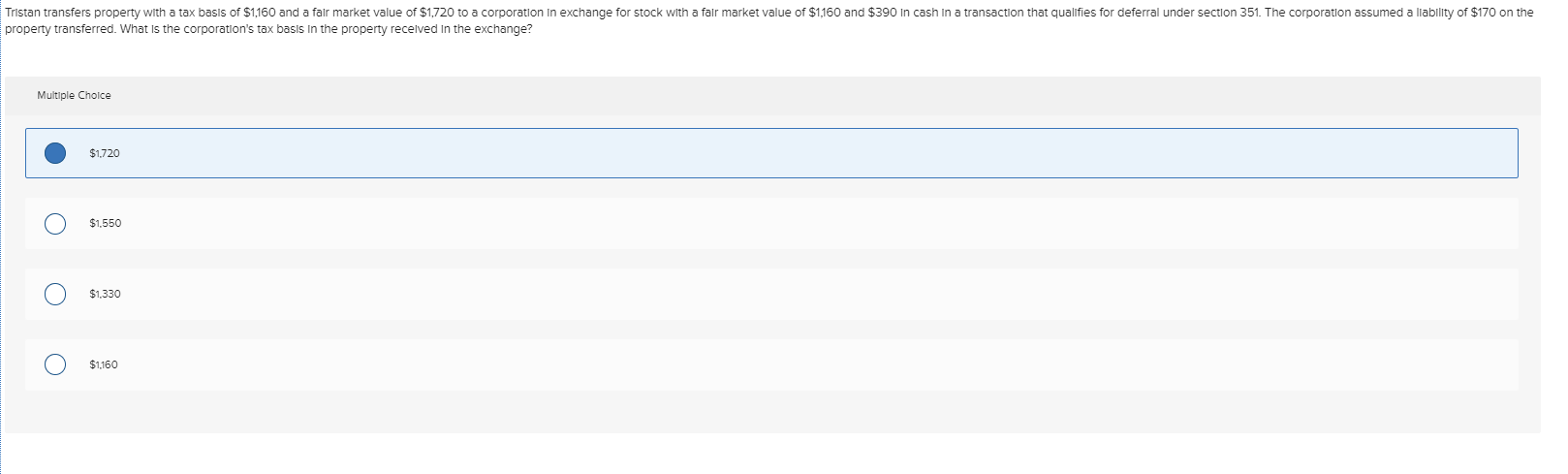

Transcribed Image Text:Tristan transfers property with a tax basis of $1,160 and a falr market value of $1,720 to a corporation In exchange for stock with a falr market value of $1,160 and $390 In cash in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $170 on the

property transferred. What Is the corporation's tax basis In the property recelved In the exchange?

Multiple Cholce

$1,720

$1,550

$1,330

$1,160

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rock Corporation distributed property with a fair market value of $100,000 and an adjusted basis of $70,000 to Ann, a shareholder of Rock Corporation. Prior to the distribution, Rock Corporation had a deficit in accumulated earnings and profits of $200,000 and current earnings and profits of $20,000. Ann has stock basis in Rock Corporations of $90,000. Assume that Ann is an individual in the 37% tax bracket. Determine Ann’s tax liability for this distribution.arrow_forwardTwo different trusts have the same grantor and beneficiary. The income tax dueof the first trust is P35,000 before consolidation. Both trusts have already paidthe income tax due on their separate taxable income. Consolidation of the twotrusts resulted to a total income tax due of P184,000. How much is the incometax still due for the second trust?arrow_forwardCasey transfers property with a tax basis of $2,180 and a fair market value of $6,100 to a corporation in exchange for stock with a fair market value of $4,500 and $575 in cash in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $1,025 on the property transferred. Casey also incurred selling expenses of $391. What is the amount realized by Casey in the exchange?arrow_forward

- Antoine transfers property with a tax basis of $524 and a fair market value of $647 to a corporation in exchange for stock with a fair market value of $569 in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $78 on the property transferred. What is Antoine's tax basis in the stock received in the exchange? Multiple Choice O $647 O $524 $569 O$446.arrow_forwardB Corporation, a calendar year-end, accrual-basis taxpayer, is owned 75 percent by Bonnie, a cash-basis taxpayer. On December 31, 2022, the corporation accrues interest of $4,000 on a loan from Bonnie and also accrues a $15,000 bonus to Bonnie. The bonus is paid to Bonnie on February 1, 2023; the interest is not paid until 2024. How much can B Corporation deduct on its 2023 tax return for these two expenses? a. $15,000 b. $19,000 c. $4,000 d. $0 e. $12,000arrow_forwardYour client has made previous lifetime gifts that have fully exhausted his applicable credit amount. He has asked you to advise him about the tax consequences of transferring his closely held business, valued at $350,000, to his daughter in exchange for a lump sum payment of $300,000. You should inform him that the most important tax implication of this intrafamily business transfer is that A) he will be making a taxable gift of $50,000, because the value of the transferred business exceeds the lump sum payment of $300,000. B) he will be making a taxable gift of $350,000, because the Chapter 14 rules require his retained interest to be valued at zero. C) he will have to include $50,000 minus one annual exclusion in adjusted taxable gifts in his estate tax calculation as an adjusted taxable gift. D) none of the above.arrow_forward

- Prepare Natura Company's journal entries to record the following transactions involving its short-term investments in held-to-maturity debt securities, all of which occurred during the current year. a. On June 15, paid $180,000 cash to purchase Remed's 90-day short-term debt securities ($180,000 principal), dated June 15, that pay 7% interest. b. On September 16, received a check from Remed in payment of the principal and 90 days' interest on the debt securities purchased in transaction a. Note: Use 360 days in a year. Do not round your intermediate calculations. View transaction list Journal entry worksheet < 1 2 On June 15, paid $180,000 cash to purchase Remed's 90-day short-term debt securities ($180,000 principal), dated June 15, that pay 7% interest. Note: Enter debits before credits. Transaction a. Record entry General Journal Clear entry Debit Credit View general journalarrow_forwardA complex trust has taxable income of $29,900 in the current year. The $29,900 includes $5,000 of rental income and $25,000 of taxable interest income, reduced by the $100 personal exemption. The trust makes no distributions during the year. What is the trust’s total tax liability?arrow_forwardAt the beginning of the current year, Maple Corporation (a calendar year taxpayer) has accumulated E & P of $140,000. During the year, Maple incurs a $120,000 loss from operations that accrues ratably. On July 1, Maple distributes $85,000 in cash to Asya, its sole shareholder. Assume Asya has sufficient basis for the distribution. How is Asya taxed on the distribution? Of the $85,000 distribution, ($fill in the blank 1) is taxed as a dividend and ($fill in the blank 2) represents a return of capital.arrow_forward

- The ABC company bought land 2 years ago for $20,000. The FMV, now is $24,000 the corporation still owes $15,000 on this purchase. The company makes a non liquidating distribution of this property to a stockholder who accepted the debt. What is the tax effect to the shareholder of receiving this distribution? A. This is no tax effect to an owner who receives a nonliquidating distribution B. Shareholder must recognize income of $9000 C. Shareholder must recognize income of $20,000 D. Shareholder must recognize income of $24,000arrow_forwardA non-U.S. corporation investor held a real estate asset (a parcel of land) that that was purchased for $100,000,000 for 10 years and will sell it for $130,000,000. The investor gain on the sale of the asset is considered to in a business that is effectively connected to a U.S. trade or business (ECI). Compute the tax on the sale assuming that the investor held the asset directly (consider double tax - both ECI and branch profits tax) __________________ Compute the tax to the investor if held through US corporation (consider both entity level tax and FDAP tax on the distributions) with no treaty rates and a plan of liquidation in the year of sale _______________________arrow_forwardAram's taxable income before considering capital gains and losses is $82,000. Determine Aram's taxable income and how much of the income will be taxed at ordinary rates in each of the following alternative scenarios (assume Aram files as a single taxpayer) Required: a. Aram sold a capital asset that he owned for more than one year for a $5,440 gain, a capital asset that he owned for more than one year for a $720 loss, a capital asset that he owned for six months for a $1,640 gain, and a capital asset he owned for two months for a $1,120 loss. b. Aram sold a capital asset that he owned for more than one year for a $2.220 gain, a capital asset that he owned for more than one year for a $2,940 loss, a capital asset that he owned for six months for a $420 gain, and a capital asset he owned for two months for a $2.340 loss c. Aram sold a capital asset that he owned for more than one year for a $2.720 loss, a capital asset that he owned for six months for a $4,640 gain, and a capital asset…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education