Concept explainers

Full Tax Co. is incorporated and tax resident in Barbados. The audited financial statements for Full Tax Co. for year-end December 31, 2022, show an accounting profit after tax of $5,500,000

after charging the following:

Depreciation $1,500,000- Tax for the year $500,000

- Property Tax $900,000

- Interest Expense $15,000

- Preference Dividends $40,000

- Legal Fees $1,110,000

- Insurance $750,000

Bad Debts $40,000- Foreign Travel $20,000

- Repairs and Maintenance $1,500,000

- General Expense $600,000

Other information

1. Property Tax of $600,000 was paid for the property on which the company’s factory is located; $300,000 for the office premises and $100,000 for the director’s home.

2. The insurance was paid for the factory and office premises.

3. The bad debt expense includes a general provision of $10,000 and a specific provision of $30,000.

4. The company paid interim ordinarily dividends totaling $100,000.

5. Repairs and Maintenance include for $500,000 removing the office ceramic floor titles and replacing it with wooden flooring.

6. Included in the company’s total assessable income is exempt income of $50,000. $16,500 relates to expenses incurred in earning this exempt income.

7. Legal fees include:

- $40,0000 in respect of recovery of commercial debts for Full Tax Co.

- $10,000 in respect of recovery of commercial debts for Half Tax Co. The company was reimbursed this amount.

- $15,000 in respect of recovery of commercial debts for One-Third Tax Co. The company was not reimbursed this amount.

- $50,000 relating to the purchase of new subsidiary

- $400,000 to increase the share capital of the company

8. General expenses include $72,000 for the school fees of the director’s son.

9. The capital allowances have been calculated at $130,550. Based on the items included in the fixed asset schedule.

10.There was an increase in wages of $1,000,000 which qualifies for Employment Tax Credit (all other conditions to qualify for this credit was met).

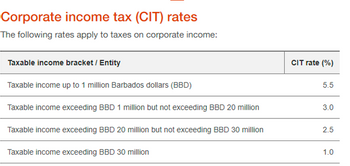

11. The tax rates for general Barbados are attached as picture

12. Assume capital allowance rate of 5 % p. A for building/ leasehold improvements.

13. All amounts are in Barbadian currency.

14. As at the 31 December 2020, the company has prior year’s tax losses as follows:

2013 - $300,000

2015 - $5,000,000

2020 - $4,000,000

Tax losses can be carried forward for a maximum of 7 years and is restricted to 50% of the tax income in the current year.

Required

- Calculate the Corporation Tax Liability of Full Tax Co. for Y/A: 2022.

- Using the Barbados Income Tax Act or any other relevant document explain the treatment of the items included or omitted from the income tax computation.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Hunt Taxidermy, Inc., is concerned about the taxes paid by the company in 2021. In addition to $42.4 million of taxable income, the firm received $2,975,000 of interest on state-issued bonds and $1,000,000 of dividends on common stock it owns in Oakdale Fashions, Inc. (Use corporate tax rate of 21 percent for your calculations.) Calculate Hunt Taxidermy's tax liability. (Enter your answer in dollars not in millions. Round your answer to the nearest dollar amount.) Tax liability $ 9,154,425arrow_forwardHunt Taxidermy, Inc., is concerned about the taxes paid by the company in 2021. In addition to $7.5 million of taxable income, the firm received $614,000 of interest on state-issued bonds and $340,000 of dividends on common stock it owns in Oakdale Fashions, Inc. (Use corporate tax rate of 21 percent for your calculations.) Calculate Hunt Taxidermy’s tax liability. (Enter your answer in dollars not in millions. Round your answer to the nearest dollar amount.) Calculate Hunt Taxidermy’s average tax rate. (Round your answer to 2 decimal places.) Calculate Hunt Taxidermy’s marginal tax rate.arrow_forwardJackel, Inc. has the following information for the current tax year: Gross sales $350,000 Cost of goods sold 50,000 Dividends received from 10% owned domestic corporation 40,000 Operating expenses 30,000 Charitable contributions 45,000 What is Jackel's taxable income? Correct Answer should be $259,000arrow_forward

- Luong Corporation, a calendar year, accrual basis corporation, reported $1.15 million of net income after tax on its financial statements prepared in accordance with GAAP. The corporation's books and records reveal the following information: • Luong's federal income tax expense per books was $203,000. • Luong's book income included $13,000 of dividends received from a domestic corporation in which Luong owns a 25 percent stock interest, and $5,500 of dividends from a domestic corporation in which Luong owns a 5 percent stock interest. Luong recognized $13,000 of capital losses this year and no capital gains. • Luong recorded $9,600 of book expense for meals not provided by a restaurant and $11,500 of book expense for entertainment costs. • Luong's depreciation expense for book purposes totaled $403,000. MACRS depreciation was $475,000. Required: a. Compute Luong's federal taxable income and regular tax liability. b. Prepare a Schedule M-1, page 6, Form 1120, reconciling Luong's book…arrow_forwardSt. George, Incorporated reported $711,800 net income before tax on this year’sfinancial statement prepared in accordance with GAAP. The corporation’s recordsreveal the following information:Four years ago, St. George realized a $283,400 gain on the sale of investmentproperty and elected the installment sale method to report the sale for taxpurposes. Its gross profit percentage is 50.12, and it collected $62,000 principaland $14,680 interest on the installment note this year.Five years ago, St. George purchased investment property for $465,000 cash froman LLC. Because St. George and the LLC were related parties, the LLC’s $12,700realized loss on the sale was disallowed for tax purposes. This year, St. George soldthe property to an unrelated purchaser for $500,000.A flood destroyed several antique carpets that decorated the floors of corporateheadquarters. Unfortunately, St. George’s property insurance does not coverdamage caused by rising water, so the loss was uninsured. The carpets’…arrow_forwardHarry Kane Chartered Accountants (Harry Kane) and O’Giroud Manufacturing plc (O’Giroud) just signed theirfirst audit engagement letter. You are the Audit Manager responsible for audit of O’Giroud’s Financial Statementsfor the year ended December 31, 2020. In addition to the extract of the Financial Statements below, O’Giroud has Profit before Tax of $30,000,000 (2019 - $31,000,000).O’Giroud Manufacturing plcFinancial Statements (Extract)Year Ended December 31, 2020Balance 2020 ($) 2019 ($)Cash 1,500,000 2,000,000Inventory 1,900,000 900,000Payables 1,000,000 990,000Receivables 800,000 810,000Property, Plant & Equipment 150,000,000 100,000,000Loans 12,000,000 10,000,000Payroll Expenses 4,900,000 6,500,000 Which balances would you consider to be significant to this year’s audit, based on the following,I. Materiality for Planning Purposes II. Analytical Procedures used at the Planning Stagearrow_forward

- XYZ is a calendar-year corporation that began business on January 1, 2021. For the year, it reported the following information in its current-year audited income statement. Notes with important tax information are provided below. XYZ corporation Income statement For current year Book Income Revenue from sales $ 40,000,000 Cost of Goods Sold (27,000,000) Gross profit $ 13,000,000 Other income: Income from investment in corporate stock 300,0001 Interest income 20,0002 Capital gains (losses) (4,000) Gain or loss from disposition of fixed assets 3,0003 Miscellaneous income 50,000 Gross Income $ 13,369,000 Expenses: Compensation (7,500,000)4 Stock option compensation (200,000)5 Advertising (1,350,000) Repairs and Maintenance (75,000) Rent (22,000) Bad Debt expense (41,000)6 Depreciation (1,400,000)7 Warranty expenses (70,000)8 Charitable donations (500,000)9 Meals (all at restaurants) (18,000) Goodwill impairment (30,000)10…arrow_forwardTennis Pro is headquartered in Virginia. Assume it has a state income tax base of $240,000 after making the appropriate adjustments. Of this amount, $60,000 was non-business income.The non- business income included the following: $8,000 of dividend income, $15,000 of interest income, $37,000 of royalty income for an intangible used in Maryland. Tennis Pro has the following sales, payroll and property factors: Virginia Maryland Sales 40% 20% Payroll 80% 5% Property 90% 5% Assume that Virginia uses an equally weighted three-factor formula. Assuming a Virginia corporate tax rate of 6 percent, what is Tennis Pro's Virginia state tax liability? (Round your answer to the nearest whole number.)arrow_forwardOcean Ltd recorded an accounting profit before tax of $50,000 for the year ended 30 June 2020. Included in the accounting profit were the following income and expenses: Rent revenue Interest revenue Bad debts expense An extract of the Statement of Financial Position for 30 June 2020 revealed the following: Accounts receivable Allowance for doubtful debts Interest receivable Rent Revenue in Advance $46,000 $28,000 $34,000 The company tax rate is 30%. 2020 $96,000 ($44,000) $40,000 $22,000 2019 $56,000 ($18,000) $24,000 $38,000 Required: Calculate taxable income (loss) and record the necessary journal entry for current income tax expense for the year ended 30 June 2020.arrow_forward

- The audited financial statements for New Life Manufacturing for year-end December 31, 2022,show an accounting profit after tax of $16,500,000 after charging the following:• Depreciation $2,500,000`• Tax for the year $500,000• Property Tax $1,000,000• Interest expense $15,000• Preference dividends of $40,000• Legal fees $1,110,000• Insurance of $750,000• Bad debts $40,000• Foreign Travel $20,000• Repairs and Maintenance $1,500,000• General expenses $600,000Other Information1. Property Tax of $600,000 was paid for the property on which the company’s factory islocated; $300,000 for the office premises and $100,000 for the CEO’s home.2. The insurance was paid for the factory and office premises.3. Loss on disposal of fixed assets $350,0004. Income Tax Refund of $700,000 was included as part of the entity’s income.5. The bad debt expense includes a general provision of $10,000 and a specific provision of$30,000.6. The company paid final ordinary dividends totaling $100,000.7. Repairs and…arrow_forwardi need the answer quicklyarrow_forwardAlpesharrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education