Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

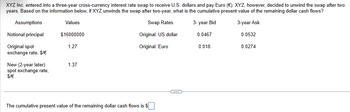

Transcribed Image Text:XYZ Inc. entered into a three-year cross-currency interest rate swap to receive U.S. dollars and pay Euro (€). XYZ, however, decided to unwind the swap after two

years. Based on the information below, if XYZ unwinds the swap after two-year, what is the cumulative present value of the remaining dollar cash flows?

Assumptions

Values

Notional principal

$16000000

Original spot

exchange rate, $/€

1.27

New (2-year later)

1.37

spot exchange rate,

$/€

Swap Rates

3-year Bid

3-year Ask

Original: US dollar

0.0467

0.0532

Original: Euro

0.018

0.0274

The cumulative present value of the remaining dollar cash flows is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose a German importer owes an Australian exporting company 150,000 AUD, due in three months. S_0 (EUR/AUD) 0.60 Se (EUR/AUD) 0.50 (0.3) and 0.65 (0.7) Premium on AUD call option R = EUR0.02 Exercise exchange rate E = 0.62 Time to expiry 3 months What is the expected value of payables in AUD under hedge Will the option to hedge be undertaken on the basis of expected spot rate? Explain.arrow_forwardAssume a risk-free asset in the U.S. is currently yielding 2.7 percent while a Canadian risk-free asset is yielding 2.8 percent and the current spot rate is Can$1.2849 = $1. What is the approximate 6-month forward rate if interest rate parity holds? Can$1.2855 Can$1.2838 Can$1.2843 Can$1.2862 Can$1.2836arrow_forwardCompany A (a U.S. MNC) wants to borrow £10,000,000 at a fixed rate for five year. Company B (a U.K. MNC) wants to borrow $16,000,000 at a fixed rate for five year. Today's exchange rate is £1- $1.6. The information below summarizes what each company can do without using swaps. Company A Company B $ Loans 8 10.6 £ Loans 11.6 12.4 If Company A wants to save 0.3% of the £10,000,000 loan through a Swap Bank, and If Company B wants to save 0.2% of the $16,000,000 loan through a Swap Bank. How much can the Swap bank earn on pound (£) loans (in terms of %) after meeting Company A and Company B's demand? (if your answer is 1.34%, just enter "1.34". If your answer is -1.34%, just enter"-1.34").arrow_forward

- You are US company, 500,000 BP (British Pound) payable to UK in one year. Answer in terms of US$. Information for Forward Contract: Forward exchange rate (one yr): 1.54 $/BP Information for Money Market Instruments (MMI): Current exchange rate: 1.50 $/BP Investment return at Aerion Fund Management (in UK): 6% annual Interest rate of borrowing from Bank of America (in USA): 2% annual Information you need for Currency Options Contract: Options premium: 0.015 $/BP Interest rate of borrowing from Bank of America (USA): 2% annual Allowed to exercise options at 1.54 $/BP What are the costs of MMI? (Answer in US$ of course. You are US company!)arrow_forwardSubject:- financearrow_forwardAssume Carlton enters into a three-year fixed-for-fixed swap agreement to receive Swiss Franc and pay U.S. dollars annually, on a notional amount of $4,000,000. The spot exchange rate at the time of the swap is SF0.8/$. Assume that one year into the swap agreement, Carlton decides it wishes to unwind the swap agreement and settle it in dollars. Assuming that a two-year fixed rate of interest on the Swiss Franc is now 2.59%, and a two-year fixed rate of interest on the dollar is now 5.90%, and the spot rate of exchange is now SF0.54/$. To Carlton, what is the swap agreement's net present value (in dollars)? two decimal places.) (Keep the sign and Euro-€ Swiss franc U. S. dollar Japanese yen Years Bid Bid Ask Bid Ask Ask Bid Ask 2 3.08 3.12 1.76 1.68 5.43 5.46 0.45 0.49 3 3.25 3.29 2.12 2.17 5.54 5.59 0.56 0.59arrow_forward

- Goodyear, a U.S. firm, sells tires to Airbus UK, and will receive payment of £1,000,000 in one year. Goodyear's bank quotes the information below: o The spot exchange rate is o The 1-year interest rate on dollars is ius = 2.00% e$/£ $1.50/£ %3D o The 1-year interest rate on pounds is iUK = 5.50% o The 1-year forward rate on pounds is fs/£ = $1.45/£ %3D In addition, Goodyear contacts private forecasters in the market and concludes: o The 1-year-ahead expected exchange rate on the Pound is eex £ = $1.40/£arrow_forwardThe current spot exchange rate is AUD 1.4925 = USD1. The Australian risk-free rate is 1.5% p.a. compounded continuously, whereas the US risk-free rate is 2.2% p.a. compounded continuously. The no-arbitrage price on a 9-month forward contract written on the exchange rate is likely to be _______________ AUD 1.485 / USD USD 0.667 / AUD AUD 0.674 / USD AUD 1.500 / USDarrow_forwardAn investor in England purchased a 91-day $1,000 par T-bill for $987.65. At that time, the exchange rate was $1.75 per pound. At maturity, the exchange rate was $1.83 per pound. What was the investor’s holding period return in pounds?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education