FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

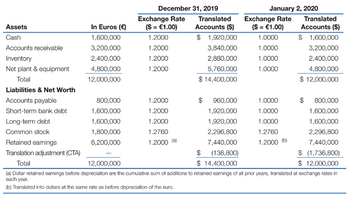

Ganado Europe (A). Using facts in the chapter for Ganado Europe, assume the exchange rate on January 2, 2020, in Exhibit 11.5 dropped in value from $1.2000 = €1.00 to $0.9000 = €1.00 (rather than to $1.0000 = €1.00). Recalculate Ganado Europe’s translated

- What is the amount of translation gain or loss?

- Where should the translation gain or loss appear in the financial statements?

Transcribed Image Text:Assets

Cash

Accounts receivable

Inventory

Net plant & equipment

Total

Liabilities & Net Worth

Accounts payable

Short-term bank debt

Long-term debt

Common stock

Retained earnings

Translation adjustment (CTA)

Total

In Euros (€)

1,600,000

3,200,000

2,400,000

4,800,000

12,000,000

800,000

1,600,000

1,600,000

1,800,000

6,200,000

December 31, 2019

Exchange Rate

($ = €1.00)

1.2000

1.2000

1.2000

1.2000

1.2000

1.2000

1.2000

1.2760

1.2000 (a)

Translated

Accounts ($)

$ 1,920,000

3,840,000

2,880,000

5,760,000

$ 14,400,000

$

960,000

1,920,000

1,920,000

2,296,800

7,440,000

$ (136,800)

$ 14,400,000

January 2, 2020

Translated

Accounts ($)

Exchange Rate

($ = €1.00)

1.0000

1.0000

1.0000

1.0000

1.0000

1.0000

1.0000

1.2760

1.2000 (b)

$ 1,600,000

3,200,000

2,400,000

4,800,000

$ 12,000,000

800,000

1,600,000

1,600,000

2,296,800

7,440,000

$ (1,736,800)

$ 12,000,000

12,000,000

(a) Dollar retained earnings before depreciation are the cumulative sum of additions to retained earnings of all prior years, translated at exchange rates in

each year.

(b) Translated into dollars at the same rate as before depreciation of the euro.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Suppose that the current exchange rate is €1.00 = $1.80. The indirect quote, from the U.S. perspective is Group of answer choices €0.6250 = $1.00. €1.80 = $1.00 €1.00 = $1.80. €0.5556 = $1.00 A. €0.6250 = $1.00. B. €1.80 = $1.00 C. €1.00 = $1.80. D. €0.5556 = $1.00arrow_forwardGive typed solution only In January 2023, the exchange rate between Euro (€) and U.S. dollar ($) is $0.99/€.The nominal interest rate for the E.U. and U.S for the next 1-year period is 11%and 8%, respectively. Also, the real interest rate for the E.U. and U.S for the next1-year period is 5% and 6%, respectively. What would you forecast the exchangerate to be at around January 2024?arrow_forwardHan Co wishes to predict the exchange rate between the dollar ($) and the euro (€), based on the following information: Spot exchange rate $1= €1.6515 Dollar interest rate 4.5% per year Euro interest rate 6.0% per year Which of the following is the one-year forward rate, using interest rate parity theory? O $1= €1.2386 O $1= €1.6752 O $1= €2.2020 O $1= €1.6281arrow_forward

- D3)arrow_forwardPlease use this information to answer the question below: A US firm's expected Accounts Receivables in Euro Zone due in 1 year Current Spot Rate (SR) for EUR Annual interest rate in US (Rh) Annual interest rate in Euro Zone (RF) EUR 15,000,000 USD 1.25 5% O USD 17,578,125 OEUR 13,392,857 EUR 18,750,000 USD 16,741,071 12% If the firm uses money market hedge, one year from now, their accounts receivables will fetch them:arrow_forwardGanado Europe (B). Using facts in the chapter for Ganado Europe, assume as in Problem 11.1 that the exchange rate on January 2, 2020, in Exhibit 11.5 dropped from $1.2000 = €1.00 to $0.9000 = €1.00 (Rather than to $1.000/€). Recalculate Ganado Europe’s translated balance sheet for January 2, 2020, with the new exchange rate using the temporal rate method. What is the amount of translation gain or loss? Where should it appear in the financial statements? Why does the translation loss or gain under the temporal method differ from the loss or gain under the current rate method?arrow_forward

- Assume that you are a retail customer. Use the information below to answer the following question. Exchange Rate - Bid Exchange Rate - Ask Interest Rate APR S0($/€) $ 1.42 = € 1.00 $ 1.45 = € 1.00 i$ 4 % F360($/€) $ 1.48 = € 1.00 $ 1.50 = € 1.00 i€ 3 % If you had borrowed $1,000,000, traded them for euros at the spot rate, and invested those euros in Europe, how many euros do you receive in one year?arrow_forwardTB SA Qu. 06-69 If you had borrowed $1,000,000.... Use the information below to answer the following question. Exchange Rate $ 1.60 €1.00 $1.58 € 1.00 So ( $/ €) F360 ($/C) Interest Rate is ic APR 28 4% If you had borrowed $1,000,000, traded them for euro at the spot rate, and invested those euros in Europe, how many euros will you receive in one year?arrow_forward1 . PL Co purchased goods on credit from a US supplier costing $US 225,000 on 5th June 2020 when the exchange rate was A$1 = US0.69 . On 30 June 2020, balance date , the exchange rate was A$1 = US0.72 . PL Co paid the US supplier on 7th July 2020 when the exchange rate was A$1 = 0.74. Required : Prepare the journal entries for the abovearrow_forward

- N2. Accountarrow_forwardplease help me solve this. Explain to me step by step how to find the answerarrow_forwardUse the information below to answer the following questions. Currency per U.S. $ 1.2380 1.2353 Australia dollar 6-months forward Japan Yen 6-months forward U.K. Pound 6-months forward 100.3600 100.0200 .6789 .6784 Suppose interest rate parity holds, and the current six month risk-free rate in the United States is 5 percent. Use the approximate interest rate parity equation to answer the following questions. a. What must the six-month risk-free rate be in Australia? (Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What must the six-month risk-free rate be in Japan? (Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Australian risk-free rate b. Japanese risk-free rate c. Great Britain risk-free rate c. What must the six-month risk-free rate be in Great Britain? (Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) % % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education