Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

need answer of this question provide correct option with calculation

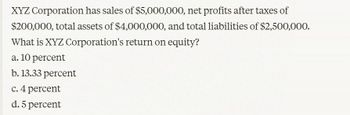

Transcribed Image Text:XYZ Corporation has sales of $5,000,000, net profits after taxes of

$200,000, total assets of $4,000,000, and total liabilities of $2,500,000.

What is XYZ Corporation's return on equity?

a. 10 percent

b. 13.33 percent

c. 4 percent

d. 5 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume Skyler Industries has debt of $4,500,000 with a cost of capital of 7.5% and equity of $5,500,000 with a cost of capital of 10.5%. What is Skylers weighted average cost of capital?arrow_forwardBrower Co. is considering the following alternative financing plans: Income tax is estimated at 40% of income. Determine the earnings per share of common stock, assuming that income before bond interest and income tax is 2,000,000.arrow_forwardAssume you are given the following relationships for the Haslam Corporation:Sales/total assets 1.2Return on assets (ROA) 4%Return on equity (ROE) 7%Calculate Haslam’s profit margin and liabilities-to-assets ratio. Suppose half its liabilities are in the form of debt. Calculate the debt-to-assets ratio.arrow_forward

- Y3K, Incorporated, has sales of $5,000, total assets of $3,200, and a debt-equity ratio of 1.10. If its return on equity is 14 percent, what its net income? Multiple Choice о O $76.80 $448.00 $136.53 $700.00 ڈےarrow_forwardUsing the DuPont method, evaluate the effects of the following relationships for the Butters Corporation. A.Butters Corporation has a profit margin of 5.5 percent and its return on assets (investment) is 8.75 percent. What is its assets turnover? Round your answer to 2 decimal places. ______ times B.If the Butters Corporation has a debt-to-total-assets ratio of 65.00 percent, what would the firm’s return on equity be? Note: Input your answer as a percent rounded to 2 decimal places. C.What would happen to return on equity if the debt-to-total-assets ratio decreased to 60.00 percent? Input your answer as a percent rounded to 2 decimal places.arrow_forwardSamuel Corp. provides the following information: EBIT = $386.50 Tax (TC ) = 21% Debt = $700 RU = 10% Question: What is the value of Samuel’s equity?arrow_forward

- QUESTION: CATHERINE'S CONSULTING HAS NET INCOME OF $4,400 AND TOTAL EQUITY OF $39,450. THE DEBT-EQUITY RATIO IS 1 AND THE PLOWBACK RATIO IS 40 PERCENT. WHAT IS THE RETURN ON ASSETS? QUESTION: AL'S MARKETS EARNS $0.12 IN PROFIT FOR EVERY $1 OF EQUITY AND BORROWS $0.65 FOR EVERY $1 OF EQUITY. WHAT IS THE FIRM'S RETURN ON ASSETS? A) 12.00 PERCENT B) 7.27 PERCENT C) 8.33 PERCENT D) 15.15 PERCENT E) 13.75 PERCENTarrow_forwardAssume the following relationships for the Caulder Corp.: Sales/Total assets 2.2x Return on assets (ROA) 6% Return on equity (ROE) 15% a. Calculate Caulder's profit margin assuming the firm uses only debt and common equity, so total assets equal total invested capital. Round your answer to two decimal places. % b. Calculate Caulder's debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardWhat is the equity multiplier? Return on equity? Net income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning