Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Kindly help me with accounting questions

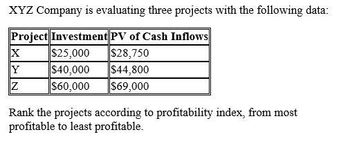

Transcribed Image Text:XYZ Company is evaluating three projects with the following data:

Project Investment PV of Cash Inflows

☑

$25,000

$28,750

Y

$40,000

$44,800

Z

$60,000

$69,000

Rank the projects according to profitability index, from most

profitable to least profitable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Company has three potential projects from which to choose. Selected information on each of the three projects follows: Project A Project B Project C Investment required $44,400 $55,700 $53,100 Net present value of project $49,100 $74,100 $69,100 Using the profitability index, rank the projects from most profitable to least profitable. A, B, C B, A, C B, C, A C, B, Aarrow_forwardMustafa Inc. has three potential investment projects but can choose only one to invest in. Below is financial information on these projects: Project Investment Net Present Value 1 $300,000 $61,500 2 $325,000 $77,000 3 $215,000 $62,000 Use the profitability index, which project should the company choose?arrow_forwardPerkins Corporation is considering several investment proposals, as shown below: Investment required Net present value A $128,000 Investment Proposal B C $ 160,000 $ 96,000 $153,600 $ 240,000 $ 134,400 If the profitability index is used, the ranking of the projects from most to least profitable would be: A, C, B, D D, B, C, A B, D, C, A B, D, A, C D $ 120,000 $264,000arrow_forward

- If a $300,000 investment has a project profitability index of 0.25, what is the netpresent value of the project?a. $75,000b. $225,000c. $25,000d. $275,000arrow_forwardThe senior management of Netherworld Ltd is evaluating four project proposals and will select one project to invest in. The following summary information is available: Project Code Initial Investment Required Net Present Value Project life (years) A 172,000 48,000 7 B 155,000 48,000 12 C 115,000 39,100 7 D 141,000 38,500 3 Required: Calculate the profitability index for each project. In order of preference, rank the four projects in terms of net present value and the profitability index. Which project do you think should be chosen?arrow_forwardUsing the profitability index, which of the following mutually exclusive projects should be accepted? Project A: NPV = $14,387; NINV = $38,260Project B: NPV = $78,121; NINV = $99,710Project C: NPV = $9,541; NINV = $11,500arrow_forward

- Nile Inc. wants to choose the bettter of two mutually exclusive projects that expand warehouse capacity. The projects cash flows are shown in the following table attached. The cost of capital is 14% a. Calculate the IRR for each of the projects . Assess the acceptabiity of each project on the basis of the IRRs. b. Which project is preferred?arrow_forwardFollowing is information on two alternative investment projects being considered by Tiger Company. The company requires a 6% return from its investments. Project X1 Project X2 Initial investment $ (114,000) $ (188,000) Net cash flows in: Year 1 42,000 85,500 Year 2 52,500 75,500 Year 3 77,500 65,500 Compute the internal rate of return for each of the projects using Excel functions. Based on internal rate of return, indicate whether each project is acceptable. Note: Round your answers to 2 decimal places.arrow_forwardThe Whenworth Corporation is trying to choose between the following two mutually exclusive design projects: Year Cash Flow (I) Cash Flow (II) -$84,000 33,900 44,000 50,000 -$42,000 12,600 31,500 25,500 1 a-1. If the required return is 17 percent, what is the profitability index for each project? (Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.) a-2. If the company applies the profitability index decision rule, which project should it take? b-1. If the required return is 17 percent, what is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b-2. If the company applies the net present value decision rule, which project should it take? a-1. Project I Project II а-2. b-1. Project I Project IIarrow_forward

- The management of Winstead Corporation is considering the following three investment projects (Ignore income taxes.): Project Q Project R Project S Investment required $ 57,200 $ 97,200 $ 176,000 Present value of cash inflows $ 62,092 $ 111,792 $ 193,320 The only cash outflows are the initial investments in the projects. Required: Rank the investment projects using the project profitability index.arrow_forwardI want to correct answer general accountingarrow_forwardPerkins Corporation is considering several investment proposals, as shown below: $112,000 $ 134,400 OD, B, C, A OB, D, A, C O A, C, B, D O B, D, C, A B $140,000 $ 210,000 Investment Proposal с $ 84,000 $ 117,600 Investment required Present value of future net cash flows If the profitability index is used, the ranking of the projects from most to least profitable would be: D $ 105,000 $ 216,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning