Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Given answer accounting questions

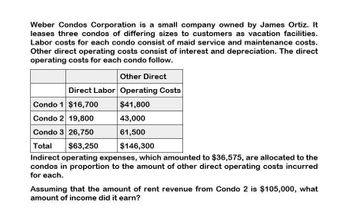

Transcribed Image Text:Weber Condos Corporation is a small company owned by James Ortiz. It

leases three condos of differing sizes to customers as vacation facilities.

Labor costs for each condo consist of maid service and maintenance costs.

Other direct operating costs consist of interest and depreciation. The direct

operating costs for each condo follow.

Other Direct

Direct Labor Operating Costs

Condo 1 $16,700

$41,800

Condo 2 19,800

43,000

Condo 3 26,750

61,500

Total

$63,250

$146,300

Indirect operating expenses, which amounted to $36,575, are allocated to the

condos in proportion to the amount of other direct operating costs incurred

for each.

Assuming that the amount of rent revenue from Condo 2 is $105,000, what

amount of income did it earn?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Patterson Lawn Co. wants to determine the cost of each lawn care maintenance job. The Company has two operating departments, one that performs lawn care services for commercial properties and one that services residential properties. Both operating departments are supported by two service departments, administrative and machine maintenance. Costs for each of these supporting departments are as follows: Administrative Machine Maintenance Total cost $576,000 $3,825,000 The following estimates that are related to the operating departments is as follows: Commercial Residential Total properties properties # of employees 68 60 128 # of customers 225 260 485 # of billable hours 23,000 22,000 45,000 Total overhead cost* $ 525,000 $ 450,000 $ 975,000 *Note that total overhead cost includes costs allocated from service departments and other overhead costs. The Company uses the…arrow_forwardHicks Contracting collects and analyzes cost data in order to track the cost of installing decks on new home construction jobs. The following are some of the costs that they incur. Classify these costs as fixed or variable costs and as product or period costs. Lumber used to construct decks ($12.00 per square foot) Carpenter labor used to construct decks ($10 per hour) Construction supervisor salary ($45,000 per year) Depreciation on tools and equipment ($6,000 per year) Selling and administrative expenses ($35,000 per year) Rent on corporate office space ($34,000 per year) Nails, glue, and other materials required to construct deck (varies per job)arrow_forwardTate Inc. and Booth Inc. are two small manufacturing companies that are considering leasing a cutting machine together. If Tate rents the machine on its own, it will cost $26,000. If Booth rents the machine alone, it will cost $14,000. If they rent the machine together, the cost will decrease to $36,000. Q. Calculate Tate’s and Booth’s respective share of fees under the stand-alone cost-allocation method.arrow_forward

- Tate Inc. and Booth Inc. are two small manufacturing companies that are considering leasing a cutting machine together. If Tate rents the machine on its own, it will cost $26,000. If Booth rents the machine alone, it will cost $14,000. If they rent the machine together, the cost will decrease to $36,000. Q. Calculate Tate’s and Booth’s respective share of fees using the incremental cost-allocation method assuming (a) Tate is the primary party and (b) Booth is the primary party.arrow_forwardMatt Simpson owns and operates Quality Craft Rentals, which offers canoe rentals and shuttle service on the Nantahala River. Customers can rent canoes at one station, enter the river there, and exit at one of two designated locations to catch a shuttle that returns them to their vehicles at the station they entered. Following are the costs involved in providing this service each year: Variable Fixed Costs Costs $ 3,100 3,800 6,200 7,720 6,800 21,800 Canoe maintenance $ 9.00 Licenses and permits Vehicle leases Station lease Advertising Operating costs 7.00 7.00 Quality Craft Rentals began business with a $27,000 expenditure for a fleet of 30 canoes. These are expected to last 10 more years, at which time a new fleet must be purchased. Rentals have been stable at about 6,800 per year. Required: Matt is happy with the steady rental average of 6,800 per year. For this number of rentals, what price should he charge per rental for the business to make an annual 16% before-tax return on…arrow_forwardValue chain and classification of costs, computer company. Dell Computer incurs the following costs:a. Utility costs for the plant assembling the Latitude computer line of productsb. Distribution costs for shipping the Latitude line of products to a retail chainc. Payment to David Newbury Designs for design of the XPS 2-in-1 laptopd. Salary of computer scientist working on the next generation of serverse. Cost of Dell employees’ visit to a major customer to demonstrate Dell’s ability to interconnect withother computersf. Purchase of competitors’ products for testing against potential Dell productsg. Payment to business magazine for running Dell advertisementsh. Cost of cartridges purchased from outside supplier to be used with Dell printersarrow_forward

- Zachary Company makes and sells lawn mowers for which it currently makes the engines. It has an opportunity to purchase the engines from a reliable manufacturer. The annual costs of making the engines are shown here. Cost of materials (14,700 units x $19) Labor (14,700 units × $25) Depreciation on manufacturing equipment* Salary of supervisor of engine production Rental cost of equipment used to make engines Allocated portion of corporate-level facility-sustaining costs Total cost to make 14,700 engines *The equipment has a book value of $101,000 but its market value is zero. Required $ 279,300 367,500 37,000 84,000 16,000 79,000 $ 862,800 a. Determine the maximum price per unit that Zachary would be willing to pay for the engines. b. Determine the maximum price per unit that Zachary would be willing to pay for the engines, if production increased to 18,350 units. Note: For all requirements, round intermediate and final answers to 2 decimal places. a. Maximum price per unit b. Maximum…arrow_forwardAdams Company makes and sells lawn mowers for which it currently makes the engines. It has an opportunity to purchase the engines from a reliable manufacturer. The annual costs of making the engines are shown here. Cost of materials (14,200 Units x $27) Labor (14,200 Units x $14) Depreciation on manufacturing equipment* Salary of supervisor of engine production Rental cost of equipment used to make engines Allocated portion of corporate-level facility-sustaining costs Total cost to make 14,200 engines $ 383,400 198,800 22,000 74,000 15,000 86,000 $779,200 *The equipment has a book value of $105,000 but its market value is zero. Required a. Determine the maximum price per unit that Adams would be willing to pay for the engines. b. Determine the maximum price per unit that Adams would be willing to pay for the engines, if production increased to 18,300 units. (For all requirements, Round your answers to 2 decimal places.) a. Maximum price per unit b. Maximum price per unitarrow_forwardZachary Company makes and sells lawn mowers for which it currently makes the engines. It has an opportunity to purchase the engines from a reliable manufacturer. The annual costs of making the engines are shown here. $ 272,000 Cost of materials (13,600 Units x $20) Labor (13,600 Units x $30) Depreciation on manufacturing equipment* Salary of supervisor of engine production Rental cost of equipment used to make engines Allocated portion of corporate-level facility-sustaining costs 408,000 29,000 74,000 12,000 79,000 Total cost to make 13,600 engines $ 874,000 *The equipment has a book value of $106,000 but its market value is zero. Required a. Determine the maximum price per unit that Zachary would be willing to pay for the engines. b. Determine the maximum price per unit that Zachary would be willing to pay for the engines, if production increased to 17,900 units. (For all requirements, Round your answers to 2 decimal places.) a. Maximum price per unit b. Maximum price per unitarrow_forward

- Matt Simpson owns and operates Quality Craft Rentals, which offers canoe rentals and shuttle service on the Nantahala River. Customers can rent canoes at one station, enter the river there, and exit at one of two designated locations to catch a shuttle that returns them to their vehicles at the station they entered. Following are the costs involved in providing this service each year: Canoe maintenance Licenses and permits Vehicle leases Station lease Advertising Operating costs Fixed Costs Variable Costs $ 9.50 $ 3,000 3,700 0 6,100 0 7,620 0 6,700 21,700 7.50 7.50 Quality Craft Rentals began business with a $28,000 expenditure for a fleet of 30 canoes. These are expected to last 10 more years, at which time a new fleet must be purchased. Rentals have been stable at about 7,000 per year. Required: Matt is happy with the steady rental average of 7,000 per year. For this number of rentals, what price should he charge per rental for the business to make an annual 16% before-tax return on…arrow_forwardJean and Tom Perritz own and manage Happy Home Helpers, Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The following total costs are associated with the total cleanings: Required: 1. Calculate the prime cost per cleaning. 2. Calculate the conversion cost per cleaning. 3. Calculate the total variable cost per cleaning. 4. Calculate the total service cost per cleaning. 5. What if rent on the office that Jean and Tom use to run HHH increased by 1,500? Explain the impact on the following: a. Prime cost per cleaning b. Conversion cost per cleaning c. Total variable cost per cleaning d. Total service cost per cleaningarrow_forwardClassify Costs Following is a list of various costs incurred in producing replacement automobile parts. With respect to the production and sale of these auto parts, classify each cost as either variable, fixed, or mixed. 1. Oil used in manufacturing equipment 2. Plastic 3. Property taxes, 165,000 per year on factory building and equipment 4. Salary of plant manager 5. Cost of labor for hourly workers 6. Packaging 7. Factory cleaning costs, 6,000 per month 8. Metal 9. Rent on warehouse, 10,000 per month plus 25 per square foot of storage used 10. Property insurance premiums, 3,600 per month plus 0.01 for each dollar of property over 1,200,000 11. Straight-line depreciation on the production equipment 12. Hourly wages of machine operators 13. Electricity costs, 0.20 per kilowatt-hour 14. Computer chip (purchased from a vendor) 15. Pension cost, 1.00 per employee hour on the jobarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning