FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

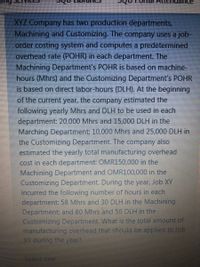

Transcribed Image Text:XYZ Company has two production departments,

Machining and Customizing. The company uses a job-

order costing system and computes a predetermined

overhead rate (POHR) in each department. The

Machining Department's POHR is based on machine-

hours (Mhrs) and the Customizing Department's POHR

is based on direct labor-hours (DLH). At the beginning

of the current year, the company estimated the

following yearly Mhrs and DLH to be used in each

department: 20,000 Mhrs and 15,000 DLH in the

Marching Department; 10,000 Mhrs and 25,000 DLH in

the Customizing Department. The company also

estimated the yearly total manufacturing overhead

cost in each department: OMR150,000 in the

Machining Department and OMR100,000 in the

Customizing Department. During the year, Job XY

incurred the following numbber of hours in each

department: 58 Mhrs and 30 DLH in the Machining

Department; and 80 Mhrs and 50 DLH in the-

Customizing Department. What is the total amount of

manufacturing overhead that should be applied to Job

XY during the year?

Select one

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 5) Munist, Corporation has two production departments, Forming and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates: Machine-hours Direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour Job T617: Machine-hours Direct labor-hours Direct materials Direct labor cost Forming S Avelin Davi S Forming 18,000 2,000 During the current month the company started and finished Job T617. The following data were recorded for this job: 99,000 www 2.10 Finishing 90 30 940 960 S Finishing The total job cost for Job T617 is closest to: (Round your intermediate calculations…arrow_forwardCraig Company uses a predetermined overhead rate to assign overhead to jobs. Because Craig's production is machine intensive, overhead is applied on the basis of machine hours. The expected overhead for the year was $5,412,800, and the practical level of activity is 398,000 machine hours. During the year, Craig used 404,000 machine hours and incurred actual overhead costs of $5,411,400. Craig also had the following balances of applied overhead in its accounts: Work-in-process inventory $ 621,090 Finished goods inventory 627,270 Cost of goods sold 1,841,640 Required: Question Content Area 1. Compute a predetermined overhead rate for Craig. Round your answer to the nearest cent. $fill in the blank 2450b2fed067063_1 per machine hour 2. Compute the overhead variance, and label it as under- or overapplied.$fill in the blank 2450b2fed067063_2 Question Content Area 3. Assuming the overhead variance is immaterial, prepare the journal entry to dispose of…arrow_forwardSultan Company uses an activity-based costing system. At the beginning of the year, the company made the following estimates of cost and activity for its five activity cost pools: Activity Cost Pool Labor-related Purchase orders Parts management Board etching General factory Activity Measure Direct labor-hours Number of orders Number of part types Number of boards Machine-hours Expected Overhead Cost $ 233,600 $ 9,360 $ 80,000 $59,850 $ 236,500 Expected Activity 29,200 DLHS 234 orders 100 part types 1,710 boards 21,500 MHS Required: 1. Compute the activity rate for each of the activity cost pools. 2. The expected activity for the year was distributed among the company's four products as follows: Expected Activity Activity Cost Pool Labor-related (DLHS) Purchase orders (orders) Parts management (part types) Board etching (boards) General factory (MHs) Product A Product B Product C Product D 4,400 74 25 430 3,300 16,100 29 3,300 50 44 530 5,400 81 13 18 750 8,100 3,600 6,500 Using the…arrow_forward

- Landen Corporation uses a job-order costing system. At the beginning of the year, the company made the following estimates: Direct labor-hours required to support estimated production Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per direct labor-hour Variable manufacturing overhead cost per machine-hour 70,000 35,000 $ 210,000 $ 1.40 $ 2.80 During the year, Job 550 was started and completed. The following information is available with respect to this job: Direct materials Direct labor cost $ 215 $ 231 15 5 Direct labor-hours Machine-hours Required: 1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach: a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550. c. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would…arrow_forwardFeauto Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHS). The company has two products, 163E and E761, about which it has provided the following data: Direct materials per unit Direct labor per unit Direct labor-hours per unit Annual production (units) The company's estimated total manufacturing overhead for the year is $2,760,000 and the company's estimated total direct labor-hours for the year is 60,000. Activities and Activity Measures Assembling products (direct labor-hours) Preparing batches (batches) Product support (product variations) Total Direct labor-hours Batches Product variations The company is considering using a form of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below: Multiple Choice O O O $138.00 $44.10 I63E $18.30 $16.50 1.00 30,000…arrow_forwardDelph Delph Company uses a job-order costing system with a plantwide predetermined overhead rate based on machine- hours. At the beginning of the year, the company estimated that 56,000 machine-hours would be required for the period's estimated level of production. It also estimated $1,000,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $4.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Machine-hours Molding 21,000 Fabrication 35,000 Total 56,000 Fixed manufacturing overhead cost $ 780,000 $220,000 $1,000,000 Variable manufacturing overhead cost per machine-hour $ 4.00 $1.00 During the year, the company had no beginning or ending inventories and it started, completed, and…arrow_forward

- Landen Corporation uses a job-order costing system. At the beginning of the year, the company made the following estimates: Direct labor-hours required to support estimated production Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per direct labor-hour Variable manufacturing overhead cost per machine-hour During the year, Job 550 was started and completed. The following information is available with respect to this job: Direct materials Direct labor cost Direct labor-hours Machine-hours $ 216 $ 327 15 5 Required: 1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach: a. Compute the plantwide predetermined overhead rate. b. Compute the total manufacturing cost of Job 550. c. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550? 2. Assume…arrow_forwardComans Corporation has two production departments, Milling and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department’s predetermined overhead rate is based on machine-hours and the Customizing Department’s predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates: Milling Customizing Machine-hours 16,000 11,000 Direct labor-hours 18,000 6,000 Total fixed manufacturing overhead cost $ 92,800 $ 28,800 Variable manufacturing overhead per machine-hour $ 1.20 Variable manufacturing overhead per direct labor-hour $ 5.00 During the current month the company started and finished Job A319. The following data were recorded for this job: Job A319: Milling Customizing Machine-hours 50 40 Direct labor-hours 60 30 Direct materials $ 430 $ 180 Direct labor cost $ 800 $ 540…arrow_forwardArabica Manufacturing uses a predetermined overhead allocation rate based on the number of machine hours. At the beginning of the year, it estimated total manufacturing overhead costs to be $1,040,000, total number of direct labor hours to be 4,500, and total number of machine hours to be 24,000 hours. What was the predetermined overhead allocation rate? (Round your answer to the nearest cent.) A. $36.49 per direct labor hour B. $231.11 per machine hour C. $53.33 per direct labor hour D. $43.33 per machine hourarrow_forward

- a. Predetermined overhead rate b. Manufacturing overhead applied c. Manufacturing cost d. Selling price e. f. Customizing predetermined overhead rate g. Manufacturing overhead applied job L Forming predetermined overhead rate per MH per MH per MHarrow_forwardMoody Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates: Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Required: 1. Compute the plantwide predetermined overhead rate. 2. During the year, Job 400 was started and completed. The following information was available with respect to this job: Direct materials Direct labor cost Machine-hours used $ 400 $ 210 32 Compute the total manufacturing cost assigned to Job 400. 3. If Job 400 includes 60 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 120% of its total manufacturing cost, then what selling price per unit would it have established for Job 400? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 152,000 $…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education