FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:X

WileyPLUS

Class Specifications | Sorted

yment Opp

LE

https://edugen.wileyplus.com/edugen/student/mainfr.uni

Downloadable eTextbook

tice

Gradebook

ORION

Assignment

ment

NEXT

BACK

PRINTER VERSION

FULL SCREEN

CALCULATOR

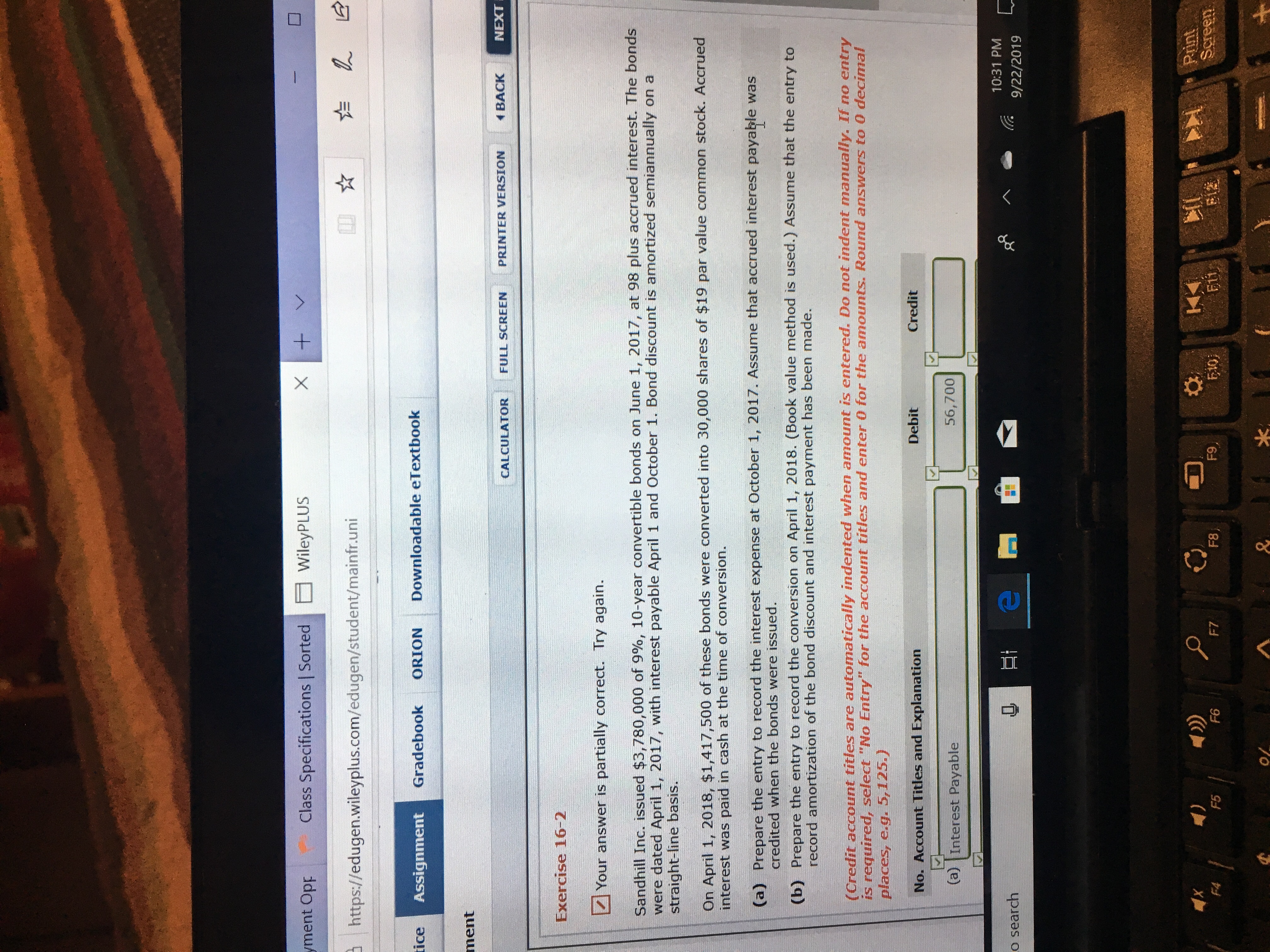

Exercise 16-2

Your answer is partially correct. Try again.

Sandhill Inc. issued $3,780,000 of 9%, 10-year convertible bonds on June 1, 2017, at 98 plus accrued interest. The bonds

were dated April 1, 2017, with interest payable April 1 and October 1. Bond discount is amortized semiannually on a

straight-line basis.

On April 1, 2018, $1,417,500 of these bonds were converted into 30,000 shares of $19 par value common stock. Accrued

interest was paid in cash at the time of conversion.

(a) Prepare the entry to record the interest expense at October 1, 2017. Assume that accrued interest payable was

credited when the bonds were issued.

(b) Prepare the entry to record the conversion on April 1, 2018. (Book value method is used.) Assume that the entry to

record amortization of the bond discount and interest payment has been made.

(Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry

is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal

places, e.g. 5,125.)

Credit

Debit

No. Account Titles and Explanation

56,700

(a) Interest Payable

10:31 PM

o search

9/22/2019

Print

Screen

F9

E12

E10

F8

F7

F6

F5

F4

k

&

+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- answer with formula and calculationsarrow_forwardHow do I journalize the bonds at face amount?arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardASsignmentiMain.do?invoker=& takeAssignmentSessionLocator%3D&inprogress%-false rk eBook Calculator Print Item Compute Bond Proceeds, Amortizing Premium by Interest Method, and Interest Expense Ware Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware Co. issued $90,000,000 of five-year, 12% bonds at a market (effective) interest rate of 10%, with interest payable semiannually. Compute the following: a. The amount of cash proceeds from the sale of the bonds. Use the tables of present values in Exhibit 8 and Exhibit 10. Round to the nearest dollar. b. The amount of premium to be amortized for the first semiannual interest payment period, using the interest method. Round to the nearest dollar. C. The amount of premium to be amortized for the second semiannual interest payment period, using the interest method. Round to the nearest dollar. d. The amount of the bond interest expense for the first year. Round to the nearest dollar. SHEET.A... SHEET KSHEET.A...…arrow_forwardGodaarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education