FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

On June 30

question attached in ss below

thnak you for the help

appareicated it

4i2opt24

y2oy4p

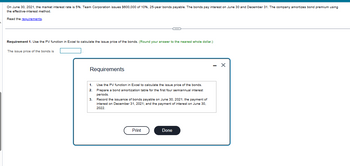

Transcribed Image Text:On June 30, 2021, the market interest rate is 5%. Team Corporation issues $600,000 of 10%, 25-year bonds payable. The bonds pay interest on June 30 and December 31. The company amortizes bond premium using

the effective-interest method.

Read the requirements

Requirement 1. Use the PV function in Excel to calculate the issue price of the bonds. (Round your answer to the nearest whole dollar.)

The issue price of the bonds is

Requirements

1

2

3.

Use the PV function Excel to calculate the issue price of the bonds.

Prepare a bond amortization table for the first four semiannual interest

periods.

Record the issuance of bonds payable on June 30, 2021; the payment of

interest on December 31, 2021; and the payment of interest on June 30,

2022.

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- * 0O T # 3 la Uni X L Grades for Cristian Catala: 22s X WP Ch7quiz with TF5 WP NWP Assessment Player UI Ap X + tion.wiley.com/was/ui/v2/assessment-player/index.html?launchld%3Dafd8fa6a-bc9b-4f11-82e4-3c0d1d4a7063#/question/8 TF5 Question 9 of 10 -/1 Cullumber Consulting Company is headquartered in Atlanta and has branch offices in Nashville and Birmingham. Cullumber uses an activity-based costing system. The Atlanta office has its costs for Administration and Legal allocated to the two branch offices. Cullumber has provided the following information: Activity Cost Pool Cost Driver Costs Administration % of time devoted to branch $703000 Legal Hours spent on legal research $141000 Hours % of time spend devoted to branch on legal research Nashville 000 Birmingham How much of Atlanta's cost will be allocated to Nashville? (round to nearest dollar) O $632900 O $670862 O $672962 O $675200 Save for Later Attemnts: 0 of 1 used MacBook Pro G Search or type URL 000 +, 000 %23 %24 7. 8. 4. 9-…arrow_forwardThe following  transactions occurred for Lawrence engineering Post the transactions to the T-accountsarrow_forwardu Online Cour X (78) Whats x M Your AccoL X M Inbox (2,74 X SP2021-AC X Answered: Ek My Home * CengageN X Bartleby Q x + D X A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?inprogress=true FMovies | Watch M. BIO201 Connect 10. M Gmail > YouTube Fourth Homework O eBook Patents 6. MC.12.06 Instructions Chart Of Accounts General Journal 7. MC.12.07 Instructions 8. MCС.12.08 Mystic Pizza Company purchased a patent from Prime Pizza Plus on January 1, 2019, $72,000. The patent has a remaining legal life of 9 years. 9. МC.12.09 Required: 10. MC.12.10 Prepare the journal entries to record the acquisition and the amortization for 2019, assuming Mystic Pizza amortizes its patents using the 11. RE.12.01.BLANKSHEET straight-line method over the life of the asset. 12. RE.12.02 13. RE.12.03.BLANKSHEET 14. RE.12.04.BLANKSHEET 15. RE.12.05.BLANKSHEET 16. RE.12.06.BLANKSHEET 17. RE.12.07.BLANKSHEET 18. RE.12.08 O V I 12:52arrow_forward

- * My Home x : CengageNOWv2 | Online teachin x b Home | bartleby x + A v2.cengagenow.com/iln/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false M Gmail YouTube Maps Blackboard HW #10 - Chpt 22 1 eBook E Print Item Schedule of Cash Payments for a Service Company Oakwood Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $124,500 April 115,800 Мay 105,400 Depreciation, insurance, and property taxes represent $26,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. 60% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May. Oakwood Financial Inc.…arrow_forwardQuestion 3arrow_forward1 2 m 4n 07 9. White 9 A Talk S Aint Ia O ENG 10 O Annota S Annota SAnnota M Recibic I Downl ssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false 台☆* + Facebook 6 Student Center Bb Blackboard WhatsApp Ggrammarly unemployment > |国Readi Maps Zoom Mark Turney owns Creative Corners. He does his banking at United Federal Bank (UFB) in Tucson, Arizona. The amounts in his general ledger for payroll taxes and the employee's withholding of Social Security, Medicare, and federal income tax as of April 15 of the current year show the following: Social Security tax payable (employer and employee), $3,020; Medicare tax payable (employer and employee), $734; FUTA tax payable, $84; SSUTA tax payable, $414; and Employees income tax payable, $4,622. Journalize the payment of the Form 941 deposit to UFB and the payment of the SUTA tax to the State of Arizona as of April 15, 20--. If an amount box does not require an entry, leave it blank. Page: POST. DATE DESCRIPTION…arrow_forward

- - Homework A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Ffaytechcc.blackboard.co... E User Management,.. H https://outlook.offi.. O FES Protection Plan System 7- North C.. 用Re mework Exercises i Soved Help Save & Exit Submit Check my work Required: Record the following transactions of Fashion Park in a general journal, Fashion Park must charge 6 percent sales tax on all sales. The company uses the perpetual inventory system. (Round your intermediate calculations and final answers to the nearest whole dollar value.) DATE TRANSACTIONS 20X1 Sold merchandise for cash, $2,540 plus sales tax. The cost of merchandise sold was $1,540. The customer purchasing merchandise for cash on April 2 returhed $270 of the merchandise; provided a cash refund to the customer. The cost of returned merchandise was $170. Sold merchandise on credit to Jordan Clark; issued Sales Slip 908 for $1,090 plus tax, terms n/30. The cost of the merchandise sold was…arrow_forwardITS-The Political S A M7: Assignment No.1 10201Ox/aMzlzNzk 1NTQxNDg2/details ВА.. e Home | Edmodo O Spoliarium by Juan.. w You searched for Re.. W Operating Performa... 1 Otn.docxlo. Open with Activity No.: Topic : The Worksheet Problems The following are all the steps in the accounting cycle. List them they should be done. 1. the order in which Closing entries are journalized and posted to the ledger. - An unadjusted trial balance is prepared. - An optional end-of-period spreadsheet (worksheet) is prepared. -A post-closing trial balance is prepared. - Adjusting entries are journalized and posted to the ledger. - Transactions are analyzed and recorded in the journal. Adjustment data are assembled and analyzed. -Financial statements are prepared An adjusted trial balance is prepared Transactions are posted to the ledger 2. 7. 8. 6. 10 The balances for the accounts listed below appeared in the Adjusted Tral Balance columns of the work the Income Statement columns or iobtndicato ther cach…arrow_forward同 Mail - Edjouline X Bb Content- ACG2 X CengageNOWv X (58) YouTube + Microsoft Office X PowerPoint from Towards a A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker%=Dassignments&takeAssignmentSessionLocator=assignment-take&inpro. of mail YouTube Maps eBook Show Me How apter Nine Determine Due Date and Interest on Notes .09-03.BLANKSHEET Determine the due date and the amount of interest due at maturity on the following notes: L09-04.BLANKSHEET Date of Note Face Amount Interest Rate Term of Note 09-03.ALGO January 10* $40,000 90 days a. b. March 19 180 days 000 8. 09-04.ALGO June 5 30 days 000'06 d. September 8 90 days 90-60 3. 000'9E e. November 20 60 days 9-11 4. 000' *Assume that February has 28 days. 9-12 Assume 360-days in a year when computing the interest. -19 Note Due Date Interest > -20 (2) (b) 9-22 -24 (p) (a) 890- 8/12 items Check My Work ( Previous Next LE V O 10: Narrow_forward

- Conne X + meducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fmybsc.bryantstratton.edu%252Fwe - Connect Assignment 1 i Saved F Required information [The following information applies to the questions displayed below.] Following are the transactions of a new company called Pose-for-Pics. August 1 M. Harris, the owner, invested $14,500 cash and $62,350 of photography equipment in the company. August 2 The company paid $4,000 cash for an insurance policy covering the next 24 months. August 5 The company purchased supplies for $2,755 cash. August 20 The company received $2,950 cash from taking photos for customers. August 31 The company paid $885 cash for August utilities. Open a ledger account for Cash in balance column format. Post general journal entries that impact cash from above transaction ledger account for cash. ces 101: Cash Date Debit Credit Balance of 10 www www Next > ( Rain off and on re to search ins O 4 R 15 % 5 T 40 6 O Y 17 < Prev…arrow_forwardBookmarks People Tab Window Help 192.168.1.229 60 83% Wed 12:20 PM Chapter 10 Homework (Applice X CengageNOWv2 | Online teach x lim/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false ☆ 青N Login Common A... A Common Black Co... *No Fear Shakespe... b Hamlet, Prince of... E 12th Grade PVA H.. O Paraphrasing Tool.. eBook Labor Variances. Verde Company produces wheels for bicycles. During the year, 656,000 wheels were produced. The actual labor used was 364,000 hours at $9.20 per hour. Verde has the following labor standards: 1) $10.40 per hour; 2) 0.48 hour per wheel. Required: 1. Compute the labor rate variance. 2. Compute the labor efficiency variance. Previous Next Check My Workarrow_forwardO Mail - Edjouline X E Content - ACG2 X * CengageNOW. X O (58) YouTube * from Towards a X m/ilm/takeAssignment/takeAssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inpro. Q < ☆ STIOW Me TOW Percent of Sales Method At the end of the current year, Accounts Receivable has a balance of $410,000; Allowance for Doubtful Accounts has a credit balance of $3,500; and sales for the year total $1,850,000. Bad debt expense is estimated at 3/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Adjusted Balance Debit (Credit) Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable. Check My Work Previous Next V O 11:51arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education