Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need help for this accounting question not use

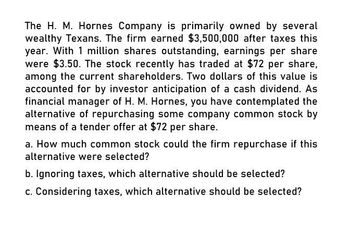

Transcribed Image Text:The H. M. Hornes Company is primarily owned by several

wealthy Texans. The firm earned $3,500,000 after taxes this

year. With 1 million shares outstanding, earnings per share

were $3.50. The stock recently has traded at $72 per share,

among the current shareholders. Two dollars of this value is

accounted for by investor anticipation of a cash dividend. As

financial manager of H. M. Hornes, you have contemplated the

alternative of repurchasing some company common stock by

means of a tender offer at $72 per share.

a. How much common stock could the firm repurchase if this

alternative were selected?

b. Ignoring taxes, which alternative should be selected?

c. Considering taxes, which alternative should be selected?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Bhupatbhaiarrow_forwardYou have been asked to value Brilliant Enterprises, a publicly traded IT services firm, and have collected the following information: After-tax operating income last year = $100 million Net income last year = $82.5 million Book value of equity at start of this year = $750 million Book value of debt at start of this year = $250 million Capital expenditure last year = $80 million Depreciation last year = $30 million Increase in non-cash working capital last year = $10 million a) Assuming that Brilliant Enterprises will maintain its return on capital and reinvestment rate from last year for the next 3 years, estimate the free cash flow for the company for each of the next 3 years. b) After year 3, Brilliant expects its growth rate to decline to 3% and the return on capital to be 9% in perpetuity. Assuming that its cost of capital is 8%, estimate the terminal value at the end of the third year. c) Assuming that Brilliant has a cost of capital of 10% for the next 3…arrow_forwardYou are considering an Investment in Roxie's Bed & Breakfast Corp. During the last year, the firm's Income statement listed an addition to retained earnings of $4.8 million and common stock dividends of $2.2 million. Roxie's year-end balance sheet shows common stockholders' equity of $35 million with 10 million shares of common stock outstanding. The common stock's market price per share was $9.00. What is Roxle's Bed & Breakfast's book value per share? (Round your answer to 2 decimal places.) Book value per share What is Roxie's Bed & Breakfast's earnings per share? (Round your answer to 2 decimal places.) Earnings per share Calculate the market-to-book ratio. (Round your answer to 2 decimal places.) Market-to-book ratio times Calculate the price-earnings ratio. (Round your answer to 2 decimal places.) Price-earnings ratio timesarrow_forward

- Over the years, McLaughlin Corporation's stockholders have provided 2.2 mil USD of capital. This capital was provided when new stocks were purchased and also management was allowed to retain some of the firm's earnings. The firm now has 2.20 million shares of common stock outstanding. The shares sell at a price of 34.5 USD per share. Calculate the value that McLaughlin's management added to stockholder wealth over the years.arrow_forwardI have 2 different companies- I need to know what the (1) what the earnings per share for each company are, (2) the price-earnings ratio for each company, & (3) which company would you invest in? 1st company has shares that are $27 per share-annual dividend of $.45 and after tax income for this year is $42 million and projected earnings this year are $47 million & there is 25 million number of outstanding shares. 2nd company has shares that are $55 per share-annual dividend of .$65 and after tax income for this year is $135 million and projected earnings this year are $122 million & there is 135 million outstanding shares.arrow_forwardYou are considering an investment in Roxie's Bed & Breakfast Corp. During the last year, the firm's income statement listed an addition to retained earnings of $7.80 million and common stock dividends of $2.70 million. Roxie's year-end balance sheet shows common stockholders' equity of $40.5 million with 15 million shares of common stock outstanding. The common stock's market price per share was $9.50. What is Roxie's Bed & Breakfast's book value per share? (Round your answer to 2 decimal places.) Book value per share What is Roxie's Bed & Breakfast's earnings per share? (Round your answer to 2 decimal places.) Earnings per share Calculate the market-to-book ratio. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Market-to-book ratio times Calculate the price-earnings ratio. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Price-earnings ratio timesarrow_forward

- I really need help on calculating the earning per share here As a stockholder of Bozo Oil Company, you receive its annual report. In the financial statements, the firm has reported assets of $15 million, liabilities of $10 million, after-tax earnings of $2.85 million, and 2.10 million outstanding shares of common stock. Calculate the earnings per share of Bozo Oil’s common stock. Note: Round your answer to 2 decimal places. Assuming a share of Bozo Oil’s common stock has a market value of $40, what is the firm’s price-earnings ratio? Note: Round your intermediate calculation to 2 decimal places and final answer to the nearest whole number. Calculate the book value of a share of Bozo Oil’s common stock. Note: Round your answer to 2 decimal places.arrow_forwardYou are an investment adviser. One of your clients approaches you for your advice on investing inequity shares of Theta Company. You have collected the following data:Earnings per share last year $6.00Payout ratio 0.40Return on equity 0.30Cost of equity capital 0.20The company plans to increase the payout ratio to 60% from year 5.Required:i) Estimate the price of an equity share of this company using an appropriate dividenddiscount model and advise your client whether they should buy a share of the company.ii) Your client is keen to know whether there are any growth opportunities from theirinvestment. Explain to your client the meaning of this concept using appropriatecalculations.iii) If there are positive or negative growth opportunities, explain the reason for suchopportunities.arrow_forwardJoy wants to invest his funds in shares in one of the two existing manufacturing companies. The following information about the dividend paid during the seven years of the Year Brown Company Avel Company 2000 500 300 2001 600 557 2002 665 615 2003 675 640 2004 785 790 2005 800 815 2006 815 795 If you as an investment consultant who is conducting an analysis of the two companies, with Using trend analysis, which company would you recommend to Joy for his investment in 2010? (work with complete procedure)arrow_forward

- At year end, Sampson Company's balance sheet showed total assets of $80 million, total liabilities of $50 million, and 1,000,000 shares of common stock outstanding. Next year, Malta is projecting that it will have net income of $2.9 million. If the average P/E multiple in Malta's industry is 16, (and this is an average stock) what should be the price of Sampson's stock? O $50.43 O $46.40 O $44.57 O $41.60arrow_forwardThe Hastings Sugar Corporation has the following pattern of net income each year, and associated capital expenditure projects. The firm can earn a higher return on the projects than the stockholders could earn if the funds were paid out in the form of dividends. Year Net Income Profitable CapitalExpenditure 1 $ 11 million $ 8 million 2 24 million 11 million 3 9 million 7 million 4 19 million 7 million 5 23 million 8 million The Hastings Corporation has 2 million shares outstanding. (The following questions are separate from each other). If the marginal principle of retained earnings is applied, how much in total cash dividends will be paid over the five years? (Enter your answer in millions.) If the firm simply uses a payout ratio of 40 percent of net income, how much in total cash dividends will be paid? (Enter your answer in millions and round your answer to 1…arrow_forwardXijiang issued 1000 shares at the beginning of fiscal year (t=0), and the net profit at the end of fiscal year (t=1) is expected to be 2million won. (zhuxijiang plans to pay a total of 800000 won as dividends to shareholders at the end of the accounting year, and the rest will be retained for internal reinvestment. (Zhou) the average self capital profit margin (roe= current net profit of the accounting year / self capital at the beginning of the accounting year) of Xijiang in each accounting year will be maintained at 20%. (shares) Xijiang's dividend policy and self capital profit margin will continue to be maintained. The annual required rate of return (RRR) of the enterprise in the market is 16%. If the dividend growth rate (or profit growth rate) of the company is equal to the return on self capital (ROE) multiplied by the internal retention rate, please answer the following questions. The dividend discount model is used to calculate the stock price at the beginning of the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning