Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Need help with this question

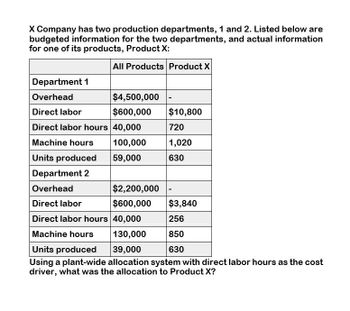

Transcribed Image Text:X Company has two production departments, 1 and 2. Listed below are

budgeted information for the two departments, and actual information

for one of its products, Product X:

All Products Product X

Department 1

Overhead

$4,500,000

Direct labor

$600,000

$10,800

Direct labor hours 40,000

720

Machine hours

100,000

1,020

Units produced

59,000

630

Department 2

Overhead

$2,200,000

Direct labor

$600,000

$3,840

Direct labor hours 40,000

256

Machine hours

130,000

850

Units produced

39,000

630

Using a plant-wide allocation system with direct labor hours as the cost

driver, what was the allocation to Product X?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardRenata Company has four departments: Materials, Personnel, Manufacturing, and Packaging. Information follows. Department Materials Personnel Manufacturing Packaging Employees Square Feet Asset Values $ 7,900 4,740 45,820 20,540 $ 79,000 38 19 76 57 64,750 9,250 92,500 18,500 Total 190 185,000 The four departments share the following indirect expenses for supervision, utilities, and insurance according to their allocation bases. Indirect Expense Supervision Utilities Cost Allocation Base $ 84,400 Number of employees 69,000 Square feet occupied 32,000 Asset values $ 185,400 Insurance Total Allocate each of the three indirect expenses to the four departments. Supervision Cost to be Allocated Allocation Base Percent of Allocation Base Allocated Cost expenses Department Numerator Denominator % of Total Materials Personnel Manufacturing Packaging Totals Cost to be Allocated Utilities Allocation Base Percent of Allocation Base Allocated Cost Department Numerator Denominator % of Total…arrow_forwardRenats Company has four departments: Materials, Personnel, Manufacturing, and Packaging. Information follows. Employees Square Feet Asset values $ 18,358 4,148 Department Materials Personal Manufacturing Packaging Total Supervision expences Department Materials Personnel Manufacturing Packaging Totals Utilitiec The four departments share the following Indirect expenses for supervision, utilities, and insurance according to their allocation bases. Indirect Expense Cost Allocation Base Supervision utilities $82,880 Number of employees 59,888 Square feet occupied 27,880 Asset values $ 168,000 Insurance Total Department Materials Personnel Manufacturing Packaging Allocate each of the three Indirect expenses to the four departments. Totals 58 Incurance Department Materials Personnel Manufacturing Packaging 8 70 64 Totals 66,500 9,500 95,000 19,808 198,800 Allocation Base 38,648 15,878 $ 69,000 Allocation Bate Allocation Base Percent of Allocation Baca Numerator Denominator of Total Percent…arrow_forward

- Renata Company has four departments: Materials, Personnel, Manufacturing, and Packaging. Information follows. Department Square Feet Asset Values Employees Materials 40 60,000 $ 9,750 Personnel 8 7,500 1,300 Manufacturing Packaging 64 67,500 33,800 48 15,000 20,150 Total 160 150,000 $ 65,000 The four departments share the following indirect expenses for supervision, utilities, and insurance according to their allocation bases. Indirect Expense Supervision Utilities Insurance Total Cost $ 83,000 Number of employees Allocation Base 55,000 Square feet occupied 25,000 Asset values $ 163,000 Allocate each of the three indirect expenses to the four departments.arrow_forwardThe Hsu Manufacturing Company has two service departments: Maintenance and Accounting. The Maintenance Department's costs of $390,600 are allocated on the basis of machine hours. The Accounting Department's costs of $110,400 are allocated on the basis of the number of employees within a specific department. The direct departmental costs for A and B are $340,000 and $540,000, respectively. Maintenance Accounting A B Machine hours 875 40 2,550 240 Number of employees 2 2 8 4 What is the cost of the Accounting Department's cost allocated to Department A (rounded to the nearest whole dollar) using the step method and assuming the Maintenance Department's costs are allocated first? Multiple Choice $77,027. $73,600. $68,482. $77,281.arrow_forwardThe Hsu Manufacturing Company has two service departments: Maintenance and Accounting. The Maintenance Department's costs of $300,000 are allocated on the basis of machine hours. The Accounting Department's costs of $120,000 are allocated on the basis of the number of employees within a specific department. The direct departmental costs for A and B are $300,000 and $500,000, respectively. Maintenance Accounting A B Machine hours 480 20 2,300 200 Number of employees 2 2 8 4 What is the cost of the Accounting Department's cost allocated to Department A using the step method and assuming the Maintenance Department's costs are allocated first? Note: Do not round intermediate calculations.arrow_forward

- Godoarrow_forwardThe Hsu Manufacturing Company has two service departments: Maintenance and Accounting. The Maintenance Department's costs of $449,500 are allocated on the basis of machine hours. The Accounting Department's costs of $138,000 are allocated on the basis of the number of employees within a specific department The direct departmental costs for A and B are $350,000 and $550,000, respectively. Maintenance Accounting A В Machine hours 675 45 2,850 250 Number of employees 8 4 What is the Maintenance Department's cost allocated to Department B (rounded to the nearest whole dollar) using the step method and assuming the Maintenance Department's costs are allocated first? Multiple Choice $413,250. $367,250.arrow_forwardCan you please give me answer this accounting question?arrow_forward

- The Hsu Manufacturing Company has two service departments: Maintenance and Accounting. The Maintenance Department's costs of $489,600 are allocated on the basis of machine hours. The Accounting Department's costs of $122,400 are allocated on the basis of the number of employees within a specific department. The direct departmental costs for A and B are $210,000 and $410,000, respectively. Maintenance Accounting A B Machine hours 895 80 2,400 320 Number of employees 2 2 8 4 What is the Maintenance Department's cost allocated to Department A using the direct method? Note: Do not round intermediate calculations.arrow_forwardPQR Company produces two items that go through two departments, production and packing. Details are as below: Product A Product B Material cost per unit Direct Labour cost per unit Actual Units produced Actual machine hours used Rs 2 Rs 3 Rs 1 Rs 1.5 50 million 10 million 4,000 500 Direct Labour hours 800 100 Data for production and packing department is as follows: Production Department Production Department Expected Manufacturing OH Rs 50,000,000 Rs 25,000,000 Cost Driver Machine Hours Labour Hours Budgeted Cost Driver 5,000 machine hours 1,000 labour hours Calculate total per unit cost of Product A and Product B as well as over and under absorption if Actual Overheads at the end of the period were Rs 65 million.arrow_forwardService Department Cost Allocation Presented below are certain operating data for the four departments of Tally Manufacturing Company. Service Production 1 2 1 2 Total manufacturing overhead costs either identifiable with or allocated to each department $120,000 $144,000 $180,000 $196,000 Square feet of factory floor space 80,000 160,000 Number of factory workers 60 20 Planned direct labor hours for the year 40,000 60,000 Allocate, to the two production departments, the costs of service departments 1 and 2, using factory floor space and number of workers, respectively, as bases. Do not round bases when calculating reallocations of service departments. Production 1 2 Identifiable and allocated overhead Reallocation of service departments: Dept. 1 Factory floor space Dept. 2 Number of factory workers Total manufacturing overhead What is the apparent overhead rate for each…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning