Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Min...

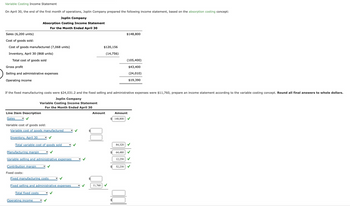

Transcribed Image Text:Variable Costing Income Statement

On April 30, the end of the first month of operations, Joplin Company prepared the following income statement, based on the absorption costing concept:

Sales (6,200 units)

Cost of goods sold:

Joplin Company

Absorption Costing Income Statement

For the Month Ended April 30

Cost of goods manufactured (7,068 units)

Inventory, April 30 (868 units)

Total cost of goods sold

Gross profit

Selling and administrative expenses

Operating income

$148,800

$120,156

(14,756)

(105,400)

$43,400

(24,010)

$19,390

If the fixed manufacturing costs were $24,031.2 and the fixed selling and administrative expenses were $11,760, prepare an income statement according to the variable costing concept. Round all final answers to whole dollars.

Joplin Company

Variable Costing Income Statement

For the Month Ended April 30

Amount

Amount

$ 148,800

Line Item Description

Sales

Variable cost of goods sold:

Variable cost of goods manufactured

Inventory, April 30

Total variable cost of goods sold

84,320

Manufacturing margin

64,480

Variable selling and administrative expenses

12,250

Contribution margin

52,230

Fixed costs:

Fixed manufacturing costs

Fixed selling and administrative expenses

Total fixed costs

Operating income

11,760

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Absorption and variable costing income statements for two months and analysis During the first month of operations ended July 31, Head Gear Inc. manufactured 6,400 hats, of which 5,200 were sold. Operating data for the month are summarized as follows: During August, Head Gear Inc. manufactured 4,000 hats and sold 5,200 hats. Operating data for August are summarized as follows: Instructions 1. Using the absorption costing concept, prepare income statements for (a) July and (b) August. 2. Using the variable costing concept, prepare income statements for (a) July and (b) August. 3. A. Explain the reason for the differences in the amount of operating income in (1) and (2) for July. B. Explain the reason for the differences in the amount of operating income in (1) and (2) for August. 4. Based on your answers to (1) and (2), did Head Gear Inc. operate more profitably in July or in August? Explain.arrow_forwardIncome Statements under Absorption and Variable Costing In the coming year, Kalling Company expects to sell 28,700 units at 32 each. Kallings controller provided the following information for the coming year: Required: 1. Calculate the cost of one unit of product under absorption costing. 2. Calculate the cost of one unit of product under variable costing. 3. Calculate operating income under absorption costing for next year. 4. Calculate operating income under variable costing for next year.arrow_forwardSummarized data for Walrus Co. for its first year of operations are: A. Prepare an income statement under absorption costing B. Prepare an income statement under variable costingarrow_forward

- At the end of the first year of operations, 21,500 units remained in the finished goods inventory. The unit manufacturing costs during the year were as follows: Determine the cost of the finished goods inventory reported on the balance sheet under (a) the absorption costing concept and (b) the variable costing concept.arrow_forwardOn March 31, the end of the first month of operations, Barnard Inc. manufactured 15,000 units and sold 12,000 units. The following income statement was prepared, based on the variable costing concept: Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept.arrow_forwardThe following data were adapted from a recent income statement of Caterpillar Inc. (CAT) for the year ended December 31: Assume that 8,500 million of cost of goods sold and 4,000 million of selling, administrative, and other expenses were fixed costs. Inventories at the beginning and end of the year were as follows: Also, assume that 30% of the beginning and ending inventories were fixed costs. a. Prepare an income statement according to the variable costing concept for Caterpillar Inc. Round numbers to nearest million. b. Explain the difference between the amount of operating income reported under the absorption costing and variable costing concepts. Round numbers to nearest million.arrow_forward

- Cost of Goods Manufactured, Income Statement W. W. Phillips Company produced 4,000 leather recliners during the year. These recliners sell for 400 each. Phillips had 500 recliners in finished goods inventory at the beginning of the year. At the end of the year, there were 700 recliners in finished goods inventory. Phillips accounting records provide the following information: Required: 1. Prepare a statement of cost of goods manufactured. 2. Compute the average cost of producing one unit of product in the year. 3. Prepare an income statement for external users.arrow_forwardOn October 31, the end of the first month of operations, Maryville Equipment Company prepared the following income statement, based on the variable costing concept: Prepare an income statement under absorption costing.arrow_forwardWeighted Average Method, Unit Costs, Valuing Inventories Byford Inc. produces a product that passes through two processes. During November, equivalent units were calculated using the weighted average method: The costs that Byford had to account for during the month of November were as follows: Required: 1. Using the weighted average method, determine unit cost. 2. Under the weighted average method, what is the total cost of units transferred out? What is the cost assigned to units in ending inventory? 3. CONCEPTUAL CONNECTION Bill Johnson, the manager of Byford, is considering switching from weighted average to FIFO. Explain the key differences between the two approaches and make a recommendation to Bill about which method should be used.arrow_forward

- Absorption-Costing Income Statement Refer to the data for Osterman Company above. Required: 1. Calculate the cost of goods sold under absorption costing. 2. Prepare an income statement using absorption costing. Use the following information for Brief Exercises 3-23 and 3-24: During the most recent year, Osterman Company had the following data:arrow_forwardSalespersons report and analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Instructions 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. (Round whole percent to one digit after decimal point.) 2. Which salesperson generated the highest contribution margin ratio for the year and why? 3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.arrow_forwardUse the following information for Exercises 2-47 through 2-49. Jasper Company provided the following information for last year: Last year, beginning and ending inventories of work in process and finished goods equaled zero. Exercise 2-49 Income Statement Refer to the information for Jasper Company on the previous page. Required: 1. Prepare an income statement for Jasper for last year. Calculate the percentage of sales for each line item on the income statement. (Note: Round percentages to the nearest tenth of a percent.) 2. CONCEPTUAL CONNECTION Briefly explain how a manager could use the income statement created for Requirement 1 to better control costs.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning