FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

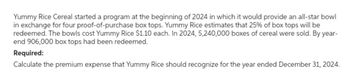

Transcribed Image Text:Yummy Rice Cereal started a program at the beginning of 2024 in which it would provide an all-star bowl

in exchange for four proof-of-purchase box tops. Yummy Rice estimates that 25% of box tops will be

redeemed. The bowls cost Yummy Rice $1.10 each. In 2024, 5,240,000 boxes of cereal were sold. By year-

end 906,000 box tops had been redeemed.

Required:

Calculate the premium expense that Yummy Rice should recognize for the year ended December 31, 2024.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello Sir, if you have the answer to this question, please send me an instant message and if not, cancel.arrow_forward9arrow_forwardDuring 2023, the Beach Restaurant had sales revenues and food costs of $730,000 and $515,000, respectively. During 2024, Beach plans to introduce a new menu item that is expected to increase sales revenues by $105,000 and food costs by $47,000. Assuming no changes are expected for the other food items, operating profits for 2024 are expected to increase by: Mutiple Choice $273.000 $105.000 $58.000 $47.000arrow_forward

- Required information [The following information applies to the questions displayed below.] Mel's Meals 2 Go purchases cookies that it includes in the 10,000 box lunches it prepares and sells annually. Mel's kitchen and adjoining meeting room operate at 70 percent of capacity. Mel's purchases the cookies for $0.62 each but is considering making them instead. Mel's can bake each cookie for $0.20 for materials, $0.18 for direct labor, and $0.61 for overhead without increasing its capacity. The $0.61 for overhead includes an allocation of $0.38 per cookie for fixed overhead. However, total fixed overhead for the company would not increase if Mel's makes the cookies. Mel himself has come to you for advice. "It would cost me $0.99 to make the cookies, but only $0.62 to buy. Should I continue buying them?" Materials and labor are variable costs, but variable overhead would be only $O.23 per cookie. Two cookies are put into every lunch. Required: a. Prepare a schedule to show the differential…arrow_forwardRefer to the following data of Good Food Snack House (in the photo) _____22. What is their Cash Conversion Cycle if their Operating Cycle is 135 days?A. 104 days B. 105 days C. 106 days D. 107 days _____23. What is the Average Inventory of Good Food Snack House?A. Php 1,067,570 B. Php 1,607,057 C. Php 1,765,070 D. Php 5,017,657arrow_forward3) A newly opened grocery store, to attract customers, started giving 5 loyalty points for each dollar spent in the store. These points can be redeemed in blocks of 5000 and customers are eligible to receive a winter jacket. Since it was newly opened it did not have any past record of how many customers will exercise this offer, but because of the winter season round the corner, it is hoping that 90% of the people will make use of this redemption offer. The store purchases these jackets directly from the manufacturer at $40 per each. In the month of October, the total sales of the store were $480,000. Please calculate the loyalty redemption amount that the store needs to provide for October in its books of accounts.arrow_forward

- Sports Haven purchased 600 bottles of flavored water at $1.40 each. Experience has indicated that, due to expiration dates, 5% of the bottles will be sold at cost. Find the price at which the bottles of flavored water must be sold to cover a 15% markup on selling price. Round to the nearest cent.arrow_forwardBrandin Grocers gives one loyalty point to its customers for every dollar spent in the store. The loyalty points will not expire. Customers can redeem these points and are eligible to receive a box of cookies if they redeem 100 points. Brandin Grocers purchase these cookie boxes from the baker @ $3 a box. Because the offer is so popular, 98 per cent of the customers redeem their loyalty points to get the box of cookies.In the month of December 20x1, the total sales recorded in the Store were $ 442,000. You are required to calculate the liability amount and provide the necessary entries.arrow_forwardTeddy Dog Food Incorporated (TDFI) currently makes and sells one type and size of dog food, a 16 ounce bag of all-natural freeze-dried chicken. TDFI sells each bag of food for $10. The Variable Expense per bag of food is $6. Fixed Expenses per month total $300. If TDFI sells three extra bags of dog food, by how much does TDFI's overall profit increase? Omit the dollar sign in your answer.arrow_forward

- On January 1, 20x1, Lawrence Lenders loaned $9.6 million to Wilkins Food Products, Inc. to purchase a frozen food storage facility. Wilkins signed a three-year, 4% installment note to be paid in three equal payments at the end of each year. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Prepare the following for Lawrence Lenders: 1. Prepare the journal entry for lending the funds on January 1, 20x1. 2. Prepare an amortization schedule for the three-year term of the installment note. 3. Prepare the journal entry for the first installment payment received on December 31, 20x1. 4. Prepare the journal entry for the third installment payment received on December 31, 20x3. Complete this question by entering your answers in the tabs below. Req 2 Saved Req 1 3 and 4 2021 Prepare an amortization schedule for the three-year term of the installment note. (Enter your answers in whole dollars.) Dec. 31 Cash…arrow_forwardBlackstone Company purchased a new software system costing $35,000. To finance the purchase, Blackstone signed a contract agreeing to pay the cost over the next 8 years, with a payment due every six months; the first payment will be made six months from the date of purchase. Blackstone's usual interest rate is 10%. What is the amount of the payment required (rounded to the nearest dollar)? 's usual 096, What is the amount of the Select one: O a. 16,030 O b. 6,560 O c. 3,229 d. 2,575 e. None of the abovearrow_forwardVictoria Company sells bedsheets for P3,000 per set. There is a promotion wherein if a customer buys 4 sets in a single transaction, the customer receives a coupon for one additional set for free. Customers should go to the entity's website, fill out a request form, input the coupon number and submit online before the expiration date. It is expected that 80% of the coupons will be redeemed. During 2022, the entity sold 1,000 sets at P3,000 per set or P3,000,000. During 2023, the entity delivered 75 free additional sets. Compute the deferred revenue from coupons on December 31, 2023.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education