SWFT Individual Income Taxes

43rd Edition

ISBN: 9780357391365

Author: YOUNG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Perk's basis in this land is $ ??

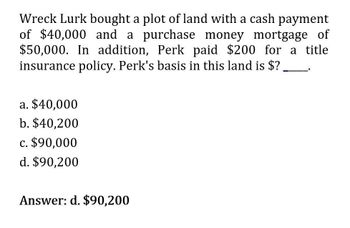

Transcribed Image Text:Wreck Lurk bought a plot of land with a cash payment

of $40,000 and a purchase money mortgage of

$50,000. In addition, Perk paid $200 for a title

insurance policy. Perk's basis in this land is $?

a. $40,000

b. $40,200

c. $90,000

d. $90,200

Answer: d. $90,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardBrenda Baines sells land to Carla Chandler for $15,000 cash and a piece of equipment with an adjusted basis of 43. $15,000 and a fair market value of $20,000. The land was subject to a $25,000 mortgage which Carla assumed. Brenda incurred $2,500 in selling expenses. What is the amount realized by Brenda? a. $55,000 b. $60,000 c. $52,500 d. $57,500arrow_forwardcan you please solve this?? general accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT