Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Do fast answer of this accounting questions

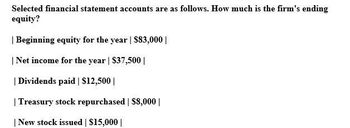

Transcribed Image Text:Selected financial statement accounts are as follows. How much is the firm's ending

equity?

| Beginning equity for the year | $83,000 |

| Net income for the year | $37,500 |

| Dividends paid | $12,500 |

| Treasury stock repurchased | $8,000 |

| New stock issued | $15,000 |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Compute the amount of liabilities for Company E at the beginning of the year. End of Year $ Assets Equity, beginning of year Add: Stock issuances Add: Net income 115,920 Less: Cash dividends Equity, end of year Beginning of Year Assets $ = = = 101,010 = $ $ $ Liabilities + 91,576 + 6,500 8,642 15,142 11,000 24,344 Liabilities 101,010 + + GA $ Equity 24,344 Equityarrow_forwardI need this question financial accountingarrow_forwardWhat is the amount of net income for the year?arrow_forward

- What is the total dollar return on these accounting question?arrow_forwardFinn, Inc. began the year with a balance in retained earnings of $16,800 and 32,000 shares of $1 par common stock outstanding. During the year, the company reported sales of $98,000, expenses of $80,800, and declared and paid a $0.20 per share cash dividend. How much is the balance in the Retained Earnings account at the end of the year? Select one: a. $10,800 b. $27,600 c. $43,600 d. $34,000arrow_forwardEquator Corporation has the following data available on December 31 for the year just ended:Average total assets for the year $ 800,000Total stockholders' equity at the beginning of the yearTotal stockholders' equity at the end of the year 600,000Net Income 250,000Interest expense 30,000Preferred dividends 50,000525,000The company’s return on assets for the year is closest toa. 21.25%.b. 25.00%.c. 31.25%.d. 44.44%.arrow_forward

- For the year ended Decemberarrow_forwardGiven the following information, what is the ratio of liabilities to stockholders' equity? Fixed assets (net) at year-end $400,000 Average fixed assets 450,000 Total assets 500,000 Long-term liabilities 300,000 Total liabilities 350,000 Total stockholders' equity 250,000 Total liabilities and stockholders' equity 500,000 Interest expense 5,000 Income before income tax 150,000 Net income 100,000 O a. 0.7 O b. 1.2 O c. 1.4 O d. 0.6arrow_forwardGeneral accountingarrow_forward

- What is the target stock price in one year on these financial accounting question?arrow_forwardEaster Egg and Poultry Company has $1,700,000 in assets and $681,000 of debt. It reports net income of $148,000. a. What is the firm's return on assets? Note: Enter your answer as a percent rounded to 2 decimal places. Return on assets b. What is its return on stockholders' equity? Note: Enter your answer as a percent rounded to 2 decimal places. Return on equity ......... Profit margin % c. If the firm has an asset turnover ratio of 1 times, what is the profit margin (return on sales)? Note: Enter your answer as a percent rounded to 2 decimal places. % %arrow_forwardConsider the following data....accounting questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning