Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

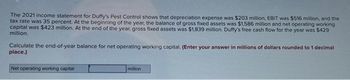

Transcribed Image Text:The 2021 income statement for Duffy's Pest Control shows that depreciation expense was $203 million, EBIT was $516 million, and the

tax rate was 35 percent. At the beginning of the year, the balance of gross fixed assets was $1,586 million and net operating working

capital was $423 million. At the end of the year, gross fixed assets was $1,839 million. Duffy's free cash flow for the year was $429

million.

Calculate the end-of-year balance for net operating working capital. (Enter your answer in millions of dollars rounded to 1 decimal

place.)

Net operating working capital

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume that today is December 31, 2022, and the following information applies to XavierAirlines:-After-tax operating income [EBIT (1 - T)] for the just ended year is $900 million.-The depreciation expense for the just ended year was $140 million.-The capital expenditure for the just ended year was $225 million.-There was no change in net operating working capital from the previous year.-Analysts estimate that Xavier’s free cash flow is expected to grow on average, at a rate of8% per year for the next 5 years after which growth is expected to moderate to 4% at aconstant rate.-The weighted average cost of capital (WACC) for Xavier is 10%.-The market value of the company's debt is $2.875 billion.-Xavier has 300 million shares of stock are outstanding.Using the corporate valuation model approach, what should be:a. The value of Xavier Airlines today (the firm)?b. The value of Xavier Airlines’ Common Equity?c. The intrinsic value of Xavier’s stock price today?arrow_forwardDuring 2020 Quail, Inc. had sales of $86,000. In addition, during 2020 Quail received $4,000 in cash that was still unearned at the end of 2020. The company had cost of goods sold of $44,000, and it paid $40,000 for inventory during the year. What was Quail's gross profit for 2020? O $42,000 $56,000 O $46,000 O $50,000 None of the abovearrow_forwardForaker Inc. has sales of $52,900, costs of $35,443, depreciation expense of $3,480, and interest expense of $2,105. If the tax rate is 21%, the operating cash flow (OCF) is:arrow_forward

- In 2023, Amalgamated Industries' net fixed assets decreased from $380,000 to $260,000. depreciation expense for the period was $90,000. What was Net Capital Spending for 2023? $150,000 ($210,000) $170,000 ($30,000) $290,000arrow_forwardAn after-tax cash flow analysis produced the data below for the year 2013. Determine the after-tax cash flow for 2013? Before-Tax-and-Loan = $23,000 Loan Principal Payment = $3,203 Loan Interest Payment = $3,878 Depreciation Deduction = $12,490 Taxable Income = $6,633 Taxes Due = $1,658 [enter your answer as a whole number, with no dollar sign or comma] 17,465arrow_forwardThis year, FCF Inc. has earnings before interest and taxes of $9,630,000, depreciation expenses of $1,200,000, capital expenditures of $1,700,000, and has increased its net working capital by $600,000. If its tax rate is 35%, what is its free cash flow?arrow_forward

- The owner of a bicycle repair shop forecasts revenues of $240,000 a year. Variable costs will be $70,000, and rental costs for the shop are $50,000 a year. Depreciation on the repair tools will be $30,000. Prepare an income statement for the shop based on these estimates. The tax rate is 20%. Calculate the operating cash flow for the repair shop using the three methods given below: Dollars in minus dollars out. Adjusted accounting profits. Add back depreciation tax shield.arrow_forwardFor 2020, Electro Tech Inc. has reported earnings before interest and taxes (ebit) of $6.5 million; capital expenditures of $1.2 million; and depreciation of $0.7 million. Net working capital for 2020 is $1.0 million and for 2019 is $0.7 million. The tax rate for Electro Tech is 35%. Calculate Electro Tech’s free cash flowarrow_forwardHammett, Inc., has sales of $90,509, costs of $33,530, depreciation expense of $10,890, and interest expense of $3,410. If the tax rate is 37 percent, what is the operating cash flow, or OCF?arrow_forward

- A chemical company has a total income of 1.62 million per year and total expenses of 716057 not including depreciation. At the start of the first year of operation, a composite account of all depreciable assets shows a value of 1.24 with a MACRS recovery period of 7 years, and a straight-line recovery period of 9.4 years. Thirty-five percent of all profits before taxes must be paid out for income taxes. What would be the reduction in income tax charges for the first year of operation if the MACRS method were used for the depreciation accounting instead of the straight-line method?-arrow_forwardThe 2021 Income statement for Egyptian Nolse Blasters shows that depreciation expense is $80 million, NOPAT is $239 million. At the end of the year, the balance of gross fixed assets was $650 million. The change in net operating working capital during the year was $70 million. Egyptian's free cash flow for the year was $180 million. Calculate the beginning-of-year balance for gross fixed assets. (Enter your answer in millions of dollars.) Gross fixed assets millionarrow_forwardSee the explanation below to work the problem. XYZ Company, a 'for-profit' business, had revenues of $12 million in 2022. Expenses other than depreciation totaled 75 percent of revenues. XYZ Company, must pay taxes at a rate of 40 percent of pretax (operating) income. All revenues were collected in cash during the year, and all expenses other than depreciation were paid in cash. Depreciation originally was $1.5 million; however, a change in the depreciation schedule (still within GAAP) has now made the depreciation expense DOUBLE. Based on this change in depreciation expense, what would XYZ's net income now be? Select one or more: a. so b. $3,000,000 c. $1,500,000 Od. Not enough information to tellarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education