FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please refer to the requirements and data tables to answer the operating income for 2020, then calculate the per unit amounts for 2020. I already determined the new selling price and purchase price for 2020.

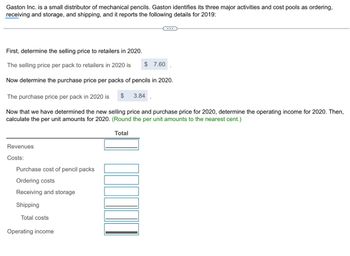

Transcribed Image Text:Gaston Inc. is a small distributor of mechanical pencils. Gaston identifies its three major activities and cost pools as ordering,

receiving and storage, and shipping, and it reports the following details for 2019:

First, determine the selling price to retailers in 2020.

The selling price per pack to retailers in 2020 is $ 7.60

Now determine the purchase price per packs of pencils in 2020.

The purchase price per pack in 2020 is

$

3.84

Now that we have determined the new selling price and purchase price for 2020, determine the operating income for 2020. Then,

calculate the per unit amounts for 2020. (Round the per unit amounts to the nearest cent.)

Revenues

Costs:

Purchase cost of pencil packs

Ordering costs

Receiving and storage

Shipping

Total costs

Operating income

Total

Transcribed Image Text:work

Inc. is a s

ng and stor

lick the icor

lick the icor

the require

Requirement

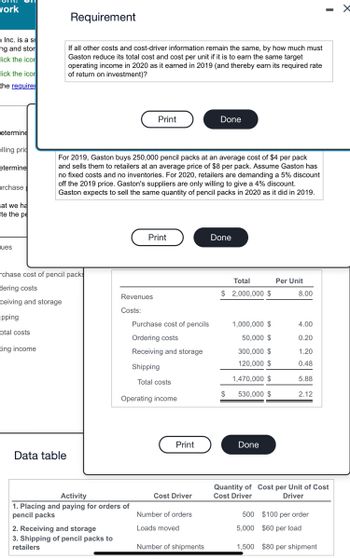

If all other costs and cost-driver information remain the same, by how much must

Gaston reduce its total cost and cost per unit if it is to earn the same target

operating income in 2020 as it earned in 2019 (and thereby earn its required rate

of return on investment)?

Print

Done

etermine

elling pric

etermine

urchase

at we ha

te the pe

For 2019, Gaston buys 250,000 pencil packs at an average cost of $4 per pack

and sells them to retailers at an average price of $8 per pack. Assume Gaston has

no fixed costs and no inventories. For 2020, retailers are demanding a 5% discount

off the 2019 price. Gaston's suppliers are only willing to give a 4% discount.

Gaston expects to sell the same quantity of pencil packs in 2020 as it did in 2019.

ues

chase cost of pencil packs

dering costs

ceiving and storage

ipping

otal costs

ting income

Data table

Print

Done

Total

Per Unit

$ 2,000,000 $

8.00

Revenues

Costs:

Purchase cost of pencils

1,000,000 $

4.00

Ordering costs

50,000 $

0.20

Receiving and storage

300,000 $

1.20

120,000 $

0.48

Shipping

1,470,000 $

5.88

Total costs

$

530,000 $

2.12

Operating income

Activity

1. Placing and paying for orders of

pencil packs

2. Receiving and storage

3. Shipping of pencil packs to

retailers

Print

Done

Cost Driver

Quantity of Cost per Unit of Cost

Cost Driver

Driver

Number of orders

Loads moved

500

5,000

$100 per order

$60 per load

Number of shipments

1,500 $80 per shipment

x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Ward Hardware used the FIFO inventory costing method in 2024. Ward plans to continue using the FIFO method in future years. Which accounting principle is most relevant to Ward's decision? O A. Disclosure Principle O B. Materiality Concept OC. Conservatism O D. Consistency Principlearrow_forwardCost of goods manufactured equals $90000 for 2019. Finished goods inventory is $2000 at the beginning of the year and $5500 at the end of the year. Beginning and ending work in process for 2019 are $4000 and $5000, respectively. How much is cost of goods sold for the year? $92500 $86500 $88000 $93500arrow_forwardcompute the material loading charge percentage for sutton's Electronic Repair Shop for the year 2020arrow_forward

- please explain how they get these answers?arrow_forwardToolum Corporation began operations on January 1, 2020, and uses the average-cost method of pricing inventory. Management is contemplating a change ininventory methods for 2023. The following information is available for the years2020–2022 Requirements:(Ignore all tax effects.)a. Prepare the journal entry necessary to record a change from the average-costmethod to the FIFO method in 2023. Show all workings b. Determine net income to be reported for 2020, 2021, and 2022, after givingeffect to the change in accounting policy.arrow_forwardMm.20. Subject :- Accountarrow_forward

- Hi, How do I calculate the correct amounts for this question?arrow_forwardOn January 1, 2020, Bay Inc. adopted dollar-value LIFO, and its inventory priced at current costs was $60,000. The following information is available on its inventories for 2020 through 2022. Year EndingInventoryat December 31 Year-EndConversionFactor* 2020 $68,000 1.10 2021 80,000 1.22 2022 72,000 1.15 *Computed as: Current (year-end) price index ÷ Base-year price index Compute the ending inventory on a dollar-value LIFO basis for each year, 2020 through 2022. Note: Do not round until your final answer. Round your final answer to the nearest whole dollar. Dollar-value LIFO ending inventory, 2020 Answer Dollar-value LIFO ending inventory, 2021 Answer Dollar-value LIFO ending inventory, 2022 Answer Question 2 Not yet answered Marked out of 25.00 Flag question Question text Estimating Inventory Using Gross Profit Method The following data is from Netflicks Company for 2020. Sales revenue $240,000 Beginning inventory 32,000…arrow_forward‒The company uses LIFO periodic inventory method. Given the following information, what LIFO liquidation profit in 2020, if any, does the firm disclose in a footnote. Please put the after tax profit (21 percent) Year Units Purchased Cost Per Unit Units Sold Sales Price Per Unit 2018 400 5 150 11 2019 200 6 125 12 2020 300 8 550 15arrow_forward

- Required information [The following information applies to the questions displayed below.] Raleigh Department Store uses the conventional retail method for the year ended December 31, 2019. Available information follows: a. The inventory at January 1, 2019, had a retail value of $43,000 and a cost of $33,210 based on the conventional retail method. b. Transactions during 2019 were as follows: Gross purchases Purchase returns Purchase discounts Gross sales Sales returns Employee discounts Freight-in Net markups Net markdowns Cost $249,510 6,300 4,800 26,500 Retail $470,000 22,000 446,500 8,000 4,500 23,000 22,000 Sales to employees are recorded net of discounts. c. The retail value of the December 31, 2020, inventory was $55,080, the cost-to-retail percentage for 2020 under the LIFO retail method was 76%, and the appropriate price index was 102% of the January 1, 2020, price level. d. The retail value of the December 31, 2021, inventory was $47,250, the cost-to-retail percentage for…arrow_forwardA company purchased merchandise to be resold at increasing costs during the year 2020. The purchases were made at the following costs January 1,2020 (Carried over from 2019) 20 unit at $10 January 25,2020 purchase 40 unit at $11 June 20, 2020 purchase 40 unit at $12 October 10, 2020 purchase 50 unit at $13 Assuming the FIFO periodic cost flow assumption, what will be the company's cost of goods sold for the 120 items sold in 2020? Select one:A. $1,386B. $1,380C. $1,460D. $1,400arrow_forwardi need the answer quicklyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education