FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Calculate the price index for 2025. Assume that the December 2, 2025, purchase cost is the current cost of inventory. (The beginning inventory is the base layer priced at $21 per unit)

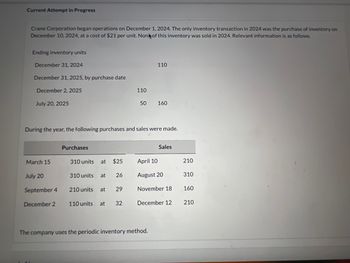

Transcribed Image Text:Current Attempt in Progress

Crane Corporation began operations on December 1, 2024. The only inventory transaction in 2024 was the purchase of inventory on

December 10, 2024, at a cost of $21 per unit. Non of this inventory was sold in 2024. Relevant information is as follows.

Ending inventory units

December 31, 2024

December 31, 2025, by purchase date

110

December 2, 2025

July 20, 2025

110

50

160

During the year, the following purchases and sales were made.

Purchases

Sales

March 15

310 units at $25

April 10

210

July 20

310 units at 26

August 20

310

September 4

210 units at

29

November 18

160

December 2

110 units at

32

December 12

210

The company uses the periodic inventory method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Crane Company adopted the dollar-value LIFO method on January 1, 2025 (using internal price indexes and multiple pools). The following data are available for inventory pool A for the 2 years following adoption of LIFO. At Base-Year At Current-Year Inventory Cost Cost 1/1/25 $190,700 $190,700 12/31/25 251,800 276,980 12/31/26 256,100 286,832 Computing an internal price index and using the dollar-value LIFO method, at what amount should the inventory be reported at December 31, 2026? Price index Dollar-value LIFO inventory A December 31, 2026arrow_forwardFlint Corporation began operations on January 1, 2025, with a beginning inventory of $30,360 at cost and $50,600 at retail. The following information relates to 2025. Net purchases ($108,290 at cost) Net markups Net markdowns Sales revenue Retail $149,600 10,000 4,900 128,300 * Assume instead that Flint decides to adopt the dollar-value LIFO retail method. The appropriate price indexes are 100 at January 1 and 110 at December 31. Compute the ending inventory to be reported in the balance sheet. (Round ratios for computational purposes to 2 decimal places, e.g. 78.72% and final answer to 0 decimal places, e.g. 28,987.) Ending inventory using the dollar-value LIFO retail method $ 1arrow_forwardSuppose this information is available for PepsiCo, Inc. for 2020, 2021, and 2022. (c) (in millions) Beginning inventory Ending inventory Cost of goods sold Sales revenue (a) Inventory turnover ratio Your answer is correct. Inventory turnover ratio 2020 Days in inventory $116,000 317,500 895,000 1,120,000 1,595,500 1,195,000 eTextbook and Medial Calculate the inventory turnover for 2020, 2021, and 2022. (Round answers to 1 decimal places, e.g. 15.2.) Gross profit rate 2020 2021 2020 $317,500 2020 410,500 Calculate the inventory turnover for 2020, 2021, and 2022. (Round answers to 1 decimal places, e.g. 15.2.) 4.1 times 4.1 times 2020 2022 89 days $410,500 476,500 1,297,500 1,894,000 Calculate the days in inventory for 2020, 2021, and 2022. (Round answers to 1 decimal places, e.g. 15.2.) 2021 % 2021 3.1 times. 2021 3.1 Calculate the gross profit rate for 2020, 2021, and 2022. (Round answers to 1 decimal places, e.g. 15.2 %) 2021 times 117 days 2022 2022 2022 2022 125 2.9 2.9 times times…arrow_forward

- Adjusting Balance Sheet and Income Statement for LIFO to FIFO In its December 2019 10-K, Phillips 66 reported the following information ($ millions). 2019 Assets 2019 Inventories 2019 LIFO Reserve 2018 LIFO Reserve Tax Rate $52,848 $3,398 $3,870 $2,610 22% a. Determine the necessary adjustments to the following balance sheet line items for 2019. Note: Round your answers to the nearest whole dollar. Adjustment (S in millions) Inventories $4 6,008 x Total assets %24 Deferred tax liabilkies $ 54,108 x 277 x Equity 0 x b. Determine the necessary adjustments to the following income statement line items for 2019. Note: Round your answers to the nearest whole dollar. Adjustment ($ in millions) Cost of goods sold %24 0 x Pretax income %24 0 x Income tax expense $ 0 x Net income %24arrow_forwardHsieh Company adopted the dollar-value LIFO method on January 1, 2020 (using internal price indexes and multiplepools). The following data are available for inventory pool A for the 2 years following adoption of LIFO:At Base- At CurrentInventory Year Cost Year Cost1/1/2020 $334,000 $334,00012/31/2020 361,000 375,44012/31/2021 412,000 449,080arrow_forwardPresented below is information related to Splish Company. December 31, 2022 December 31, 2023 December 31, 2024 December 31, 2025 December 31, 2026 December 31, 2027 2022 2023 Date 2024 2025 2026 2027 $ $ $ $ $ Ending Inventory (End-of-Year Prices) $ $83,600 117,832 Compute the ending inventory for Splish Company for 2022 through 2027 using the dollar-value LIFO method. 116,501 131,709 157,765 190,224 Ending Inventory 83,600 207,802 Price Index 100 100 104 119 129 139 144arrow_forward

- This problem consists of TWO parts Part One: Galaxy Corporation has a beginning inventory in 2023 of $1,400,000 and an ending inventory of $1,694,000. The price level has increased from 100 at the beginning of 2023 to 110 at the end of 2023. Calculate the ending inventory value using the dollar value LIFO method. Part Two: At the end of 2024, Galaxy's inventory is $1,886,000 in terms of a price level of 115 which exists at the end of 2024. Calculate the inventory value at the end of 2024 using the dollar value LIFO method. Problem Five (4 points) Maxwell Corporation provides you with the following inventory related to its inventory at December 31, 2023: Inventory Original Cost Replacement Net Realizable Net Realizable Appropriate Item per Unit Cost Value Value Less Inventory Value A $.65 $.45 B.45.40 Normal Profit at 12/31/23 C.70.75 D.75.65 E.90.85 The normal selling price is $1.00 per unit for All items. Disposal costs amount to 10% of the selling price and a normal profit is 30% of…arrow_forwardOn January 1, 2019, Lexor Company adopted the dollar-value-LIFO method of inventory costing. Lexor's ending inventory records appear as follows: Year Current cost Index 2019 $ 42,000 100 (1.00) 2020 58,000 110 (1.10) 2021 60,100 120 (1.20) 2022 68,200 130 (1.30) Compute the ending inventory for the years 2019, 2020, 2021, and 2022, using the dollar-value LIFO method. Round to the nearest dollar. Show all work. You can use the previous homework template that you used forarrow_forwardSunland Company adopted the dollar-value LIFO method of inventory valuation on December 31, 2019. Its inventory at that date was $1109000 and the relevant price index was 100. Information regarding inventory for subsequent years is as follows: Date December 31, 2020 December 31, 2021 December 31, 2022 Inventory at Current Prices $1285000 1460000 1625000 Current Price Index 106 124 129 What is the cost of the ending inventory at December 31, 2021 under dollar-value LIFO?arrow_forward

- Patel Company adopted the dollar-value inventory method on 12/31 / 20 . Inventory data are as follows: Inventory Price Year at Yr End Index 2020 5,785 1.00 2021 9,2501.23 202211,225 1.36 20238,575 1.25 2024 16,425 1.40 Instructions : Calculate the inventory for must show your work . 20, 2021, 2022, 20 and 2024.arrow_forwardPresented below is information related to Sheffield Company. December 31, 2022 December 31, 2023 December 31, 2024 December 31, 2025 December 31, 2026 December 31, 2027 2022 2023 2024 2025 Date 2026 2027 Ending Inventory (End-of-Year Prices) $ $82,100 117,104 114,835 129,516 154,985 183,168 Compute the ending inventory for Sheffield Company for 2022 through 2027 using the dollar-value LIFO method. Price Index Ending Inventory 100 104 119 129 139 144arrow_forwardCrane Company adopted the dollar-value LIFO inventory method on December 31, 2020. Crane's entire inventory constitutes a single pool. On December 31, 2020, the inventory was $968000 under the dollar- value LIFO method. Inventory data for 2021 are as follows: 12/31/21 inventory at year-end prices $ 1300000 Relevant price index at year end (base year 2020) 108 Using dollar value LIFO, Crane's inventory at December 31, 2021 is (Round intermediate calculations and final answer to 0 decimal places, e.g. 10,000.) $1300000. $1203704. $1222560. $1045440.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education