FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

![Required information

[The following information applies to the questions displayed below.]

Raleigh Department Store uses the conventional retail method for the year ended December 31, 2019. Available

information follows:

a. The inventory at January 1, 2019, had a retail value of $43,000 and a cost of $33,210 based on the conventional retail

method.

b. Transactions during 2019 were as follows:

Gross purchases

Purchase returns

Purchase discounts

Gross sales

Sales returns

Employee discounts

Freight-in

Net markups

Net markdowns

Cost

$249,510

6,300

4,800

26,500

Retail

$470,000

22,000

446,500

8,000

4,500

23,000

22,000

Sales to employees are recorded net of discounts.

c. The retail value of the December 31, 2020, inventory was $55,080, the cost-to-retail percentage for 2020 under the

LIFO retail method was 76%, and the appropriate price index was 102% of the January 1, 2020, price level.

d. The retail value of the December 31, 2021, inventory was $47,250, the cost-to-retail percentage for 2021 under the LIFO

retail method was 75%, and the appropriate price index was 105% of the January 1, 2020, price level.](https://content.bartleby.com/qna-images/question/87f377c8-556b-40c3-ad73-583aac17d9d0/ac117d3a-b7dd-40fa-a235-3dbb2274c1ea/470ks7_thumbnail.png)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

Raleigh Department Store uses the conventional retail method for the year ended December 31, 2019. Available

information follows:

a. The inventory at January 1, 2019, had a retail value of $43,000 and a cost of $33,210 based on the conventional retail

method.

b. Transactions during 2019 were as follows:

Gross purchases

Purchase returns

Purchase discounts

Gross sales

Sales returns

Employee discounts

Freight-in

Net markups

Net markdowns

Cost

$249,510

6,300

4,800

26,500

Retail

$470,000

22,000

446,500

8,000

4,500

23,000

22,000

Sales to employees are recorded net of discounts.

c. The retail value of the December 31, 2020, inventory was $55,080, the cost-to-retail percentage for 2020 under the

LIFO retail method was 76%, and the appropriate price index was 102% of the January 1, 2020, price level.

d. The retail value of the December 31, 2021, inventory was $47,250, the cost-to-retail percentage for 2021 under the LIFO

retail method was 75%, and the appropriate price index was 105% of the January 1, 2020, price level.

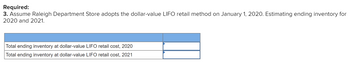

Transcribed Image Text:Required:

3. Assume Raleigh Department Store adopts the dollar-value LIFO retail method on January 1, 2020. Estimating ending inventory for

2020 and 2021.

Total ending inventory at dollar-value LIFO retail cost, 2020

Total ending inventory at dollar-value LIFO retail cost, 2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Presented below is information related to Splish Company. December 31, 2022 December 31, 2023 December 31, 2024 December 31, 2025 December 31, 2026 December 31, 2027 2022 2023 Date 2024 2025 2026 2027 $ $ $ $ $ Ending Inventory (End-of-Year Prices) $ $83,600 117,832 Compute the ending inventory for Splish Company for 2022 through 2027 using the dollar-value LIFO method. 116,501 131,709 157,765 190,224 Ending Inventory 83,600 207,802 Price Index 100 100 104 119 129 139 144arrow_forwardOn January 1, 2019, Lexor Company adopted the dollar-value-LIFO method of inventory costing. Lexor's ending inventory records appear as follows: Year Current cost Index 2019 $ 42,000 100 (1.00) 2020 58,000 110 (1.10) 2021 60,100 120 (1.20) 2022 68,200 130 (1.30) Compute the ending inventory for the years 2019, 2020, 2021, and 2022, using the dollar-value LIFO method. Round to the nearest dollar. Show all work. You can use the previous homework template that you used forarrow_forwardPROBLEM 1. Wharf Company uses a perpetual inventory system and values its inventory at lower of cost or market. Its accounting records indicate the following information relating to inventory: Inventory Cost $ 60,000 Date January 1, 2019 December 31, 2019 December 31, 2020 Market $ 60,000 102,000 88,000 115,000 109,000 Required: Prepare the required journal entries at December 31, 2019, and December 31, 2020, to record the inventory at lower of cost or market using the following methods: a. Direct method b. Allowance methodarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education