FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

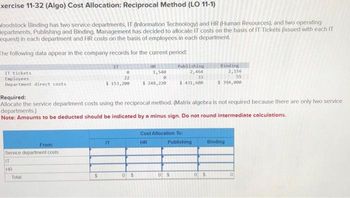

Transcribed Image Text:Exercise 11-32 (Algo) Cost Allocation: Reciprocal Method (LO 11-1)

Woodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating

epartments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT

equest) in each department and HR costs on the basis of employees in each department.

The following data appear in the company records for the current period:

IT tickets

Employees

Department direct costs

From:

Service department costs

IT

HR

Total

$

IT

0

22

$ 153,200

IT

Required:

Allocate the service department costs using the reciprocal method. (Matrix algebra is not required because there are only two service

departments.)

Note: Amounts to be deducted should be indicated by a minus sign. Do not round intermediate calculations.

HR

1,540

0

$ 248,220

0$

Publishing

2,464

33

$ 431,600

Cost Allocation To:

HR

Publishing

05

Binding

0 $

2,156

55

$394,000

Binding

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Renata Company has four departments: Materials, Personnel, Manufacturing, and Packaging. Information follows. Department Square Feet Asset Values Employees Materials 26 30,000 $ 9,300 Personnel 13 12,000 2,480 Manufacturing Packaging 52 66,000 37,820 39 12,000 12,400 Total 130 120,000 $ 62,000 The four departments share the following indirect expenses for supervision, utilities, and insurance according to their allocation bases. Indirect Expense Supervision Utilities Insurance Total Cost $ 82,700 Number of employees Allocation Base 52,000 Square feet occupied 23,500 Asset values $ 158,200 Allocate each of the three indirect expenses to the four departments.arrow_forwardThe following is a partially completed departmental expense allocation spreadsheet for Brickland. It reports the total amounts of direct and indirect expenses for its four departments. Purchasing department expenses are allocated to the operating departments on the basis of purchase orders. Maintenance department expenses are allocated based on square footage. Compute the amount of Maintenance department expense to be allocated to Fabrication. Operating costs No. of purchase orders Sq. ft. of space Multiple Choice O $6,400. $9,900. $8,100. $9,000. $25,600. Purchasing Maintenance Fabrication Assembly $32,000 $18,000 $96,000 16 3,300 $62,000 4 2,700arrow_forwardThe following is a partially completed departmental expense allocation spreadsheet for Brickland. It reports the total amounts of direct and indirect expenses for its four departments. Purchasing department expenses are allocated to the operating departments on the basis of purchase orders. Maintenance department expenses are allocated based on square footage. Compute the amount of Maintenance department expense to be allocated to Fabrication. (Do not round your intermediate calculations.) Purchasing Maintenance Fabrication Assembly Operating costs No. of purchase orders Sq. ft. of space $48,000 $27,600 $112,000 $78,000 15 4,100 1,900 Multiple Choice $12,000. $18,860. $13,800. $8,740.arrow_forward

- Solomon Information Services, Incorporated, has two service departments: human resources and billing. Solomon's operating departments, organized according to the special Industry each department serves, are health care, retall, and legal services. The billing department supports only the three operating departments, but the human resources department supports all operating departments and the billing department. Other relevant information follows. Number of employees Annual cost* Annual revenue Req A1 Department Human Resources Billing Health Care Retail Req A2 Legal Services Total 20 $ 900,000 Complete this question by entering your answers in the tabs below. Allocation Rate Req B1 *This is the operating cost before allocating service department costs. Required a. Allocate service department costs to operating departments, assuming that Solomon adopts the step method. The company uses the number of employees as the base for allocating human resources department costs and department…arrow_forwardUsing the sequential method, Pone Hill Company allocates Janitorial Department costs based on square footage serviced. It allocates Cafeteria Department costs based on the number of employees served. It has determined to allocate Janitorial costs before Cafeteria costs. It has the following information about its two service departments and two production departments, Cutting and Assembly: Number of Employees 20 10 60 20 Costs Janitorial Department $450,000 Cafeteria Department 200,000 Cutting Department 1,500,000 Assembly Department 3,000,000 Square Feet 100 10,000 2,000 8,000 The percentage (proportional) usage of the Janitorial Department by the Cutting Department is Oa. 20% Ob. 9.9% Oc. 80% Od. 10%arrow_forwardPronghorn's Medical operates three support departments and two operating units, Surgery and ER. The support departments are allocated based on the hours used. The cost of operating the accounting (acct), administration (admin), and human resources (HR) departments is $258900, $147700, and $70800, respectively. Information on the hours used are as follows: Acct Admin HR Surgery ER Hours in Acct 20 48 360 220 Hours in Admin 16 8 120 80 Hours in HR 8 4 65 130 What are the total costs allocated from the accounting department to the operating units? (Do not round the intermediate calculations.) O $0. O $275878. O $273926. O $264975.arrow_forward

- Cheyenne's Medical operates three support departments and two operating units, Surgery and ER. The support departments are allocated based on the hours used. The cost of operating the accounting (acct), administration (admin), and human resources (HR) departments is $271000, $158300, and $68800, respectively. Information on the hours used are as follows: Acct Admin HR Surgery ER Hours in Acct 20 48 360 220 Hours in Admin 16 8 120 80 Hours in HR 8 4 65 130 What are the total costs allocated to the surgery department from the supporting departments? (Do not round the intermediate calculations.) O $280035. O $282405. O $256681. O $0.arrow_forwardInterdepartment Services: Step Method O'Brian's Department Stores allocates the costs of the Personnel and Payroll departments to three retail sales departments, Housewares, Clothing, and Furniture. In addition to providing services to the operating departments, Personnel and Payroll provide services to each other. O'Brian's allocates Personnel Department costs on the basis of the number of employees and Payroll Department costs on the basis of gross payroll. Cost and allocation information for June is as follows: Direct department cost Number of employees Gross payroll Personnel Payroll Housewares Clothing Furniture $7,300 $3,800 $12,300 $20,000 $15,650 5 Total costs $ 2 $6,100 $2,800 Payroll 0 (a) Determine the percentage of total Personnel Department services that was provided to the Payroll Department. (Round your answer to one decimal place.) 12.5 X% (b) Determine the percentage of total Payroll Department services that was provided to the Personnel Department. (Round your answer…arrow_forwardUramilabenarrow_forward

- PLease show work Not sure how to calulate properly IS Personnel Administration Residential Commercial Number of IS service tickets 90 120 75 1,410 940 Number of employees 35 40 27 138 162 Square footage occupied 3,900 8,000 3,800 16,100 69,500 The costs of the service departments and the allocation basis for each department follow. Department Direct Cost Allocation Base Information Systems (IS) $ 17,000 IS service tickets Personnel 24,000 Employees Administration 20,700 Square footage occupied Assume that the company allocates service department costs to production departments using the direct method. What amount of Information Systems (IS) Department costs will be allocated to the Commercial Department? Assume the same method of allocation as in requirement (a). What amount of personnel department costs is allocated to the residential department? I keep getting mixed uparrow_forwardThe accounting department of a large limousine company is analyzing the costs of its services. The cost data and level of activity for the past 16 months follow. Month Special Analyses CustomerAccounts PaychecksProcessed AccountingService Costs 1 2 325 1,029 $ 63,800 2 4 310 993 68,900 3 2 302 1,268 64,000 4 1 213 1,028 61,300 5 2 222 984 61,600 6 0 214 712 50,800 7 1 131 762 51,020 8 1 123 739 54,300 9 0 115 708 50,500 10 2 296 1,232 64,800 11 2 213 978 58,000 12 1 222 929 57,500 13 2 217 1,059 62,200 14 2 132 942 54,900 15 4 300 1,299 71,530 16 4 315 1,283 64,800 Totals 30 3,650 15,945 $ 959,950 In…arrow_forwardhelp mearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education