Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

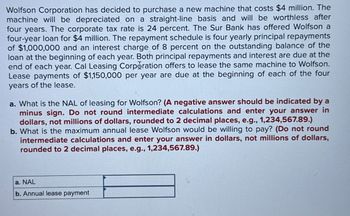

Transcribed Image Text:Wolfson Corporation has decided to purchase a new machine that costs $4 million. The

machine will be depreciated on a straight-line basis and will be worthless after

four years. The corporate tax rate is 24 percent. The Sur Bank has offered Wolfson a

four-year loan for $4 million. The repayment schedule is four yearly principal repayments

of $1,000,000 and an interest charge of 8 percent on the outstanding balance of the

loan at the beginning of each year. Both principal repayments and interest are due at the

end of each year. Cal Leasing Corporation offers to lease the same machine to Wolfson.

Lease payments of $1,150,000 per year are due at the beginning of each of the four

years of the lease.

a. What is the NAL of leasing for Wolfson? (A negative answer should be indicated by a

minus sign. Do not round intermediate calculations and enter your answer in

dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.)

b. What is the maximum annual lease Wolfson would be willing to pay? (Do not round

intermediate calculations and enter your answer in dollars, not millions of dollars,

rounded to 2 decimal places, e.g., 1,234,567.89.)

a. NAL

b. Annual lease payment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 8 images

Knowledge Booster

Similar questions

- Temple Corporation purchased a piece of real estate, paying $4,000,000 cash and financing $7,000,000 of the purchase price with a 10-year, 15% installment note. The note calls for equal monthly payments that will result in the debt being completely repaid by the end of the tenth year. In this situation: A: The aggregate amount of the monthly payments is $7,000,000. B: Each monthly payment is greater than the amount of interest accruing each month. C: The portion of each payment representing interest expense will increase over the 10year period, since principal is being paid off, yet the payment amount does not decrease. D: The portion of each monthly payment representing repayment of principal remains the same throughout the 10-year period.arrow_forwardA company plans to make four annual deposits of $4,250 each to a special building fund. The fund's assets will be invested in mortgage instruments expected to pay interest at 12% on the fund's balance. Determine how much will be accumulated in the fund after four years under each of the following situations: 1. The $4250 annual deposit are made at the end of each of the four years and interest is compounded annually. 2. The $4250 annual deposit are made at the beginning of each of the four years and interest is compounded annually. 3. The $4250 annual deposit are made at the beginning of each of the four years and interest is compounded quarterly. 4. The $4250 annual deposit are made at the beginning of each of the four years interest is compounded annually, and interest earned is withdrawn at the end of each year.arrow_forwardA company receives a 5-year $100 million loan commitment from Wells Fargo at a fixed rate of 4.5%. The up-front commitment fee is 40 basis points and the unused portion of the loan is charged 15 basis points. The bank borrows a total of $45 million at the beginning of the year and none thereafter. The following is true, except: A The interest paid on the drawdown amount for the full year is $2,025,000. B The interest rate paid on the drawdown amount for the full year is 4.90% C The fee for the loan commitment for the full year is $400,000. D The fee for the unused portion of the loan commitment for the full year is $82,500arrow_forward

- Lush Gardens Co. bought a new truck for $56,000. It paid $6,160 of this amount as a down payment and financed the balance at 4.47% compounded semi-annually. If the company makes payments of $1,800 at the end of every month, how long will it take to settle the loan? Express the answer in years and months, rounded to the next payment period You plan to save money for a down payment of $32,000 to purchase an apartment. You can only afford to save $6,000 at the end of every 6 months into an account that earns interest at 5.50% compounded monthly. How long will it take you to save the planned amount? Express the answers in years and months, rounded to the next payment periodarrow_forwardTitusville Petroleum Company is considering pledging its receivables to finance an increase in working capital. Citizens National Bank will lend the company 85 percent of the pledged receivables at 3 percentage points above the prime rate (currently 6%). The bank charges a service fee equal to 1.4 percent of the pledged receivables. The interest costs and the service fee are payable at the end of the borrowing period. Titusville has $2 million in receivables that can be pledged as collateral. The average collection period is 40 days. Assume that there are 365 days per year. Determine the annual financing cost to Titusville of this receivables-backed loan. Round your answer to two decimal places. %arrow_forwardWhite Corporation has decided to purchase a new machine that costs $3.2 million. The machine will be depreciated on a straight-line basis and will be worthless after four years. The corporate tax rate is 35%. The Black Bank has offered White a 4-year loan for $3.2 million. The repayment schedule is four yearly principal repayments of $800,000 and an interest charge of 9% on the outstanding balance of the loan at the beginning of each year. Both principal repayments and interest are due at the end of each year. Grey Leasing Corporation offers to lease the same machine to White. Lease payments of $950,000 per year are due at the beginning of each of the four years of the lease. a. Should White lease the machine or buy it with bank financing? b. What is the annual lease payment that will make White indifferent to whether it leases the machine or purchases it?arrow_forward

- Ontario Credit Union borrowed $275,000 at 9.5% compounded semi-annually from League Central to build an office complex. The loan agreement requires payment of interest at the end of every 6 months In addition, the credit union is to make equal payments into a sinking fund so that the principal can be retired in total after 20 years Interest earned by the fund is 8% compounded semi-annually (a) What is the semi-annual interest payment on the debt? (b) What is the size of the semi-annual deposits into the sinking fund? (c) What is the total annual cost of the debt? (d) What is the interest earned by the fund in the 32nd payment interval? (e) What is the book value of the debt after 16 years? (f) Prepare a partial sinking fund schedule showing details, including the book value of the debt, for the first three payments, the last three payments, and the totals. (a) The interest payment is $ (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal…arrow_forwardMelody Dairy has a line of credit with its bank. The firm plans to borrow $400,000 at a rate of 10 percent. The bank requires a 15% compensating balance and the firm currently maintains $20,000 in its account at the bank that can be used to meet the compensating balance requirement. Determine the annual finance cost to Melody of this loan.arrow_forwardStinson Corporation borrowed $85,000 at 8% compounded quarterly to buy a warehouse. Monthly payments of $1200 were made over the term of the loan. Construct a partial amortization schedule showing the last 2 payments. Determine the total amount paid to settle the loan. Show work, not just the answer. Determine the total principal repaid. Determine the total amount of interest paid. Show work, not just the answer.arrow_forward

- Cranes Limited took a loan of $ 450,000 at 4% compounded monthly from its bank to train its employees on new safety measures. If it made semi annual payments to amortize the loan in 4 years, construct the amortization table.arrow_forwardGeneral Computers Inc. purchased a computer server for $54,000. It paid 40.00% of the value as a down payment and received a loan for the balance at 4.50% compounded semi-annually. It made payments of $2,800.81 at the end of every quarter to settle the loan. a. How many payments are required to settle the loan? 0 payments Round up to the next payment b. Fill in the partial amortization schedule for the loan, rounding your answers to two decimal places.arrow_forwardRanger Enterprises is considering pledging its receivables to finance a needed increase in working capital. Its commercial bank will lend 70 percent of the pledged receivables at 2.5 percentage points above the prime rate, which is currently 10 percent. In addition, the bank charges a service fee equal to 2 percent of the pledged receivables. Both interest and the service fee are payable at the end of the borrowing period. Ranger’s average collection period is 55 days, and it has receivables totaling $7 million that the bank has indicated are acceptable as collateral. Calculate the annual financing cost for the pledged receivables. Assume that there are 365 days per year. Round your answer to two decimal places. %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education