FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

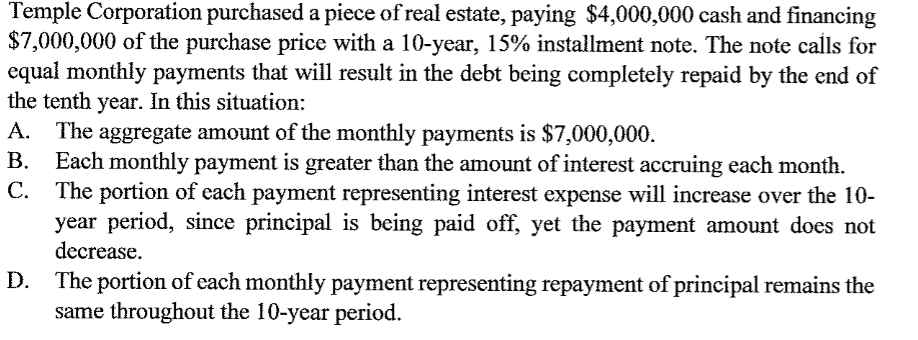

Transcribed Image Text:Temple Corporation purchased a piece of real estate, paying $4,000,000 cash and financing

$7,000,000 of the purchase price with a 10-year, 15% installment note. The note calls for

equal monthly payments that will result in the debt being completely repaid by the end of

the tenth year. In this situation:

The aggregate amount of the monthly payments is $7,000,000.

B. Each monthly payment is greater than the amount of interest accruing each month.

C.

A.

The portion of each payment representing interest expense will increase over the 10-

year period, since principal is being paid off, yet the payment amount does not

decrease.

The portion of each monthly payment representing repayment of principal remains the

same throughout the 10-year period.

D.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 2. ABC Realty sold a piece of land for P250,000. A down payment of P50,000 was made and the remainder is to be paid in equal semiannual installments, the first due 6 months after the date of sale. The interest is 8% compounded semiannually and the debt is to be amortized in 5 years. a. How much semiannual payment is required? b. What will the total amount of the payment be? c. How much interest will be paid? d. What is the total cost of the property? e. Prepare an amortization schedule for the present value of the loan after making the down payment.arrow_forwardThe Flemings secured a bank loan of $400,000 to help finance the purchase of a house. The bank charges interest at a rate of 4%/year on the unpaid balance, and interest computations are made at the end of each month. The Flemings have agreed to repay the loan in equal monthly installments over 25 years. What should be the size of each repayment if the loan is to be amortized at the end of the term? (Round your answer to the nearest cent.)arrow_forwardLibby Company purchased equipment by paying $5,600 cash on the purchase date and agreed to pay $5,600 every six months during the next four years. The first payment is due six months after the purchase date. Libby's incremental borrowing rate is 8%. The equipment reported on the balance sheet as of the purchase date is closest to: (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided.)arrow_forward

- Tricana Corporation borrowed $80,000.00 at 4% compounded quarterly for 9 years to buy a warehouse. Equal payments are made at the end of every 3 months. (a) (b) (c) (d) Determine the size of the quarterly payments. Compute the interest included in payment 16. Determine the principal repaid in payment period 11. Construct a partial amortization schedule showing details of the first three payments, the last three payments, and totals. (a) The size of the quarterly payment is S (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) (b) The interest included in payment 16 is $. (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) (c) The principal repaid in payment period 11 is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) (d) Complete the table below for the first three payments in the…arrow_forwardA company plans to make four annual deposits of $4,250 each to a special building fund. The fund's assets will be invested in mortgage instruments expected to pay interest at 12% on the fund's balance. Determine how much will be accumulated in the fund after four years under each of the following situations: 1. The $4250 annual deposit are made at the end of each of the four years and interest is compounded annually. 2. The $4250 annual deposit are made at the beginning of each of the four years and interest is compounded annually. 3. The $4250 annual deposit are made at the beginning of each of the four years and interest is compounded quarterly. 4. The $4250 annual deposit are made at the beginning of each of the four years interest is compounded annually, and interest earned is withdrawn at the end of each year.arrow_forwardThe Flemings secured a bank loan of $272,000 to help finance the purchase of a house. The bank charges interest at a rate of 4%/year on the unpaid balance, and interest computations are made at the end of each month. The Flemings have agreed to repay the loan in equal monthly installments over 25 years. What should be the size of each repayment if the loan is to be amortized at the end of the term? (Round your answer to the nearest cent.)$arrow_forward

- A $560,000 townhome in Richmond Hill was purchased with a down payment of 20% of the amount. A 20-year mortgage was taken for the balance. The negotiated fixed interest rate was 5.25% compounded semi-annually for a three-year term with repayments made at the end of every month. a. What is the size of the monthly payment? Round to the nearest cent b. What was the principal balance at the end of the three-year term? Round to the nearest cent c. By how much did the amortization period shorten if the size of the periodic payments were increased by 15% starting from the 37th payment? Assume the same interest rate. monthsarrow_forwardOn January 1, Year 1, Brown Company borrowed cash from First Bank by issuing a $107,000 face-value, four-year term note that had an 6 percent annual interest rate. The note is to be repaid by making annual cash payments of $30,879 that include both interest and principal on December 31 of each year. Brown used the proceeds from the loan to purchase land that generated rental revenues of $59,000 cash per year. b. Prepare an income statement and balance sheetfor each of the four years. Rent revenue is collected in cash at the end of each year. (Hint: Record the transactions for each year in T-accounts before preparing the financial statements.)arrow_forwardA corporation has decided to use borrowed capital to finance a portion of an equipment purchase. The equipment will be partially financed by borrowing $40,000 on a 2-year contract at 7% interest compounded annually, with the loan to be repaid in two equal EOY installments. The average inflation rate during this period is expected to be 2%. Determine the loan payment amount.arrow_forward

- A property is available for sale that could normally be financed with a fully amortizing $82,000 loan at a 10 percent rate with monthly payments over a 25-year term. Payments would be $745.13 per month. The builder is offering buyers a mortgage that reduces the payments by 50 percent for the first year and 25 percent for the second year. After the second year, regular monthly payments of $745.13 would be made for the remainder of the loan term. Required: a. How much would you expect the builder to have to give the bank to buy down the payments as indicated? b. Would you recommend the property be purchased if it was selling for $5,000 more than similar properties that do not have the buydown available? Complete this question by entering your answers in the tabs below. Required A Required B How much would you expect the builder to have to give the bank to buy down the payments as indicated? Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. Down…arrow_forwardCulver Inc. bought an Internet domain name by issuing a $276,000, 6-year, non-interest-bearing note to Ti-Mine Corp. with an effective yield of 10%. The note is repayable in 6 annual payments of $46,000 made at the end of each year. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Prepare the journal entry to record the purchase of the intangible asset. (Round factor values to 5 decimal places, eg. 1.25124 and final answer to O decimal places, eg. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Notes Payablearrow_forwardYour company purchased $95,000 of equipment $15,000 cash downpayment and the rest with a note. The equipement has ten-year useful life and a salvage value of $4,000. All principal and interest on the note is due in three years. Calculate the month's interest expense on the Equipment loan. It is a five year note with interest (3 percent) and principle payable at the end of year 5.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education