FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

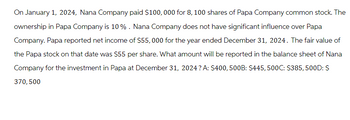

Transcribed Image Text:On January 1, 2024, Nana Company paid $100,000 for 8, 100 shares of Papa Company common stock. The

ownership in Papa Company is 10%. Nana Company does not have significant influence over Papa

Company. Papa reported net income of $55,000 for the year ended December 31, 2024. The fair value of

the Papa stock on that date was $55 per share. What amount will be reported in the balance sheet of Nana

Company for the investment in Papa at December 31, 2024? A: $400, 500B: $445, 500C: $385,500D: $

370, 500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- There are two companies (Heart and Apt). Here is financial data from the past year. All dollar amounts for sales, total assets and net income are in millions. The risk free rate (UST securities) = 4%. hearts: Sales $ 9,350 $ 8,930 Net Income $ 902 $ 1,460 ROA 8.8% 7.6% ROE 30.2% 13.96% Current ratio 1.88x 2.17x Shares outstanding 238m 219m Beta 2.58 0.98 Stock price $18.79/sh. $159.00/sh. P/E ratio 4.97 23.9 (S&P 500 is…arrow_forwardQuincy Martin Manufacturing has assets of $5 million and liabilities of $3 million. The company has also issued 400,000 shares of common stock. What is the company's book value per share? Select one: O a. $10.25 O b. $7.50 O c. $5 O d. $2.50 O e. $1.00arrow_forwardLake Incorporated and River Incorporated reported net incomes of $275,000 and $231,000, respectively, for the most recent fiscal year. Both companies had 55,000 shares of common stock issued and outstanding. The market price per share of Lake's stock was $58, while River's sold for $62 per share. Required a. Determine the P/E ratio for each company. b. Based on the P/E ratios computed in Requirement a, which company do investors believe has the greater potential for growth in income? Complete this question by entering your answers in the tabs below. Required A Required B Determine the P/E ratio for each company. Note: Do not round intermediate calculations. Round your answers to the nearest whole number. Company Lake, Incorporated River, Incorporated P/E Ratioarrow_forward

- anapparel manufacturer, reported net income (amounts in thousands) for Year 4 of $58,615 onsales of $1,460,235. It declared preferred dividends of $21,122. Preferred shareholders’ equitytotaled $264,746 at both the beginning and end of Year 4. Common shareholders’ equitytotaled $296,157 at the beginning of Year 4 and $364,026 at the end of Year 4. Phillips-VanHeusen had no noncontrolling interest in its equity. Total assets were $1,439,283 at the beginningof Year 4 and $1,549,582 at the end of Year 4. Compute the rate of ROCE for Year 4 anddisaggregate it into profit margin for ROCE, assets turnover, and capital structure leverage ratiocomponents.arrow_forwardShareholders' equity in a firm is $500. The firm owes a total of $400 of which 75 percent is payable this year. In addition, credit sales to customers total 5000 of which 80 percent is due this year The firm has net fixed assets of $600. What is the amount of the net working capital? Options : a. $0 b. $3200 c. $3700 d. -$4200 e. -$4100arrow_forwardMaxwell Communications Corporation has after-tax earnings of $1,508,000 after paying $45,000 in dividends to its 10,000 preferred stockholders. If Maxwell has 500,000 common stockholders, its earnings per share are a. $3.05. b. $3.02. c. $4.50 d. $4.50arrow_forward

- James Corporation earned net income of $90,000 this year. The company began the year with 600 shares of common stock and issued 500 more on April 1. They issued $5,000 in preferred dividends for the year. What is the EPS for the year for James (rounded to the nearest dollar)?arrow_forwardXYZ Corporation had the following balance sheet information: Total assets: $500,000Total liabilities: $200,000Shareholders' equity: $300,000If XYZ Corporation has 50,000 shares outstanding, what is the book value per share?arrow_forwardZero Corp's total common equity at the end of last year was $350,000 and its net income was $70,000. What was its ROE? a. 19.40% b.24.20% O c. 17.00% d. 17.40% e. 20.00%arrow_forward

- Gadubhaiarrow_forwardProvided that Shareholders' equity in a firm is $500. The firm owes a total of $400 of which 75 percent is payable this year. In addition credit sales to customers total 5000 of which 80 percent is due this year The firm has net fixed assets of $600. What is the amount of the net working capital?arrow_forwardIf Pop Company exercises significant influence over Son Company and owns 40% of its common stock, then Pop Company: Would record 40% of the net income of Son Company as investment income each year. O Would increase its investment account when Son Company declares dividends. O All of these answer choices are correct. O Would record dividends received from Son Company as investment revenue.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education