Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

infoPractice Pack

Question

infoPractice Pack

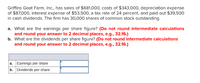

Transcribed Image Text:Griffins Goat Farm, Ic., has sales of $681,000, costs of $343,000, depreciation expense

of $87,000, interest expense of $53,500, a tax rate of 24 percent, and paid out $39,500

in cash dividends. The firm has 30,000 shares of common stock outstanding.

a. What are the earnings per share figure? (Do not round intermediate calculations

and round your answer to 2 decimal places, e.g., 32.16.)

b. What are the dividends per share figure? (Do not round intermediate calculations

and round your answer to 2 decimal places, e.g., 32.16.)

a. Earnings per share

b. Dividends per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Includes step-by-step video

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Helmuth Inc's latest net income was $1,415,000, and it had 250,000 shares outstanding. The company wants to pay out 45% of its income. What dividend per share should it declare? Do not round your intermediate calculations. a. $3.11 Ob. $1.91 c. $5.66 Od. $8.21 O e. $2.55arrow_forwardNFG investment company that has 4 million shares outstanding has total assets of $62 million and total liabilities of $12 million. If this investment company charges a load of 3.5%, how much would an investor have to pay to purchase one share? . (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16))arrow_forwardGreen Fire had Net Income for the year just ended of $34,000, and the firm paid out $8,000 in cash dividends. The company currently has 15,000 shares of common stock outstanding, and the stock currently sells for $89 per share. �What is the PE ratio?arrow_forward

- Byrd Lumber has 2 million shares of stock outstanding. On the balance sheet the company has $39 million worth of common equity. The company's stock price is $23 a share. What is the company's Market Value Added (MVA)? If negative, use the negative sign instead of parentheses, e.g. -130,000.arrow_forwardBunny Hip and Hop Brewery has $1,710,000 in assets and $661,000 of debt. It reports net income of $102,000 a. What is its ROA? (Do not round intermediate calculations, Round the final answer to 2 decimal places.) Return on assets b. What is the return on shareholders' equity? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Return on equity c. If the firm has an asset turnover ratio of 18 times, what is the profit margin? (Round the final answer to 2 decimal places) Profit marginarrow_forwardTop Rope Productions has 3.00 million shares outstanding that currently trade at $11.66. The firm has $16.00 million of long-term debt, and $6.00 million in cash. What is a rough estimate for the firm's enterprise value? (Express answer in millions. For example, $1,000,000 would be 1.00) Submit Answer format: Currency: Round to: 2 decimal places.arrow_forward

- I think answer is $5.05 after foundingarrow_forwardDove, Inc., had additions to retained earnings for the year just ended of $635,000. The firm paid out $80,000 in cash dividends, and it has ending total equity of $7.30 million. a. If the company currently has 670,000 shares of common stock outstanding, what are earnings per share? Dividends per share? What is book value per share? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. If the stock currently sells for $30.00 per share, what is the market-to-book ratio? The price-earnings ratio? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. If total sales were $10.6 million, what is the price-sales ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. b. C. Earnings per share Dividends per share Book value per share Market-to-book ratio Price-earnings ratio Price-sales ratio times times timesarrow_forwardMyers Drugs Inc. has 2.5 million shares of stock outstanding. Earnings after taxes are $6 million. Myers also has warrants outstanding that allow the holder to buy 100,000 shares of stock at $10 per share. The stock is currently selling for $50 per share. a. Compute basic earnings per share. (Do not round intermediate calculations and round your answer to 2 decimal places.) Basic earnings per share b. Compute diluted earnings per share considering the possible impact of the warrants. Assume the cash proceeds are used to repuchase shares. (Do not round intermediate calculations and round your answer to 2 decimal places.) Use the following formula: Earnings after taxes Shares outstanding + Assumed net increase in shares from the warrants Diluted earnings per sharearrow_forward

- Baker Industries' net income is $24,000, its interest expense is $4,000, and its tax rate is 25%. Its notes payable equals $24,000, long-term debt equals $75,000, and common equity equals $240,000. The firm finances with only debt and common equity, so it has no preferred stock. What are the firm's ROE and ROIC? Do not round intermediate calculations. Round your answers to two decimal places. ROE: ROIC: 10 Hide Feedback Partially Correctarrow_forwardBaker Industries' net income is $27,000, its interest expense is $5,000, and its tax rate is 25%. Its notes payable equals $26,000, long-term debt equals $75,000, and common equity equals $250,000. The firm finances with only debt and common equity, so it has no preferred stock. What are the firm's ROE and ROIC? Do not round intermediate calculations. Round your answers to two decimal places. ROE: ROIC: % %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education