Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

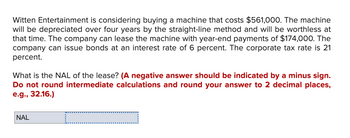

Transcribed Image Text:Witten Entertainment is considering buying a machine that costs $561,000. The machine

will be depreciated over four years by the straight-line method and will be worthless at

that time. The company can lease the machine with year-end payments of $174,000. The

company can issue bonds at an interest rate of 6 percent. The corporate tax rate is 21

percent.

What is the NAL of the lease? (A negative answer should be indicated by a minus sign.

Do not round intermediate calculations and round your answer to 2 decimal places,

e.g., 32.16.)

NAL

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Suppose you can buy a new Toyota corolla for $20000 and sell it for $12000 in third year. For simplication, assume you sell the car at the beginning of the third year but can keep driving it until the end of the third year. Alternatively you can lease the car for $300 per month for three years and return it at the end of the three years. For simplication, assume that lease payments are made yearly instead of monthly- i.e,, that they are $3600 per year and are made at the beginning of each of the three years. a. If the interest rate R is 4%, it is better to buy or lease? b. If the interest rate is 10%,it is better to buy or lease? c. At what interest rate would you be indifferent between buying and leasing the car in percent?arrow_forwardAn owner of the ATRIUM Tower Office Building is currently negotiating a five-year lease with ACME Consolidated Corporation for 20,000 rentable square feet of office space. ACME would like a base rent of $11 per square foot (PSF) with step-ups of $1 per year beginning one year from now. Required: a. What is the present value of cash flows to ATRIUM under the above lease terms? (Assume a 10% discount rate.) b. The owner of ATRIUM believes that base rent of $11 PSF in (a) is too low and wants to raise that amount to $15 with the same $1 step-ups. However, now ATRIUM would provide ACME a $53,000 moving allowance and $130,000 in tenant improvements (Tls). What would be the present value of this alternative to ATRIUM? c. ACME informs ATRIUM that it is willing to consider a $14 PSF with the $1 annual stepups. However, under this proposal, ACME would require ATRIUM to buyout the one year remaining on its existing lease in another building. That lease is $6 PSF for 20,000 SF per year. If ATRIUM…arrow_forwardRed Bull F1 plans to purchase or lease $277,764 worth of equipment. Ifpurchased, the equipment will be depreciated on a straight-line basis overfive years, after which it will be worthless. If leased, the annual leasepayments will be $42,922 per year at the end of every year for five years.Assume Red Bull F1's borrowing cost is 8%, the tax rate is 35%, and thelease qualifies as a true tax lease.If Red Bull F1 purchases the equipment, what is the amount of the lease equivalent loan?arrow_forward

- i need the answer quicklyarrow_forward30) can you please help with this question?arrow_forwardYou work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice with expensive, high-tech equipment). The scanner costs $5,000,000 and would be depreciated straight-line to zero over four years. Because of radiation contamination, it will actually be completely valueless in four years. Assume that the tax rate is 21 percent. You can borrow at 8 percent before taxes. What would the lease payment have to be for both the lessor and the lessee to be indifferent about the lease? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Break-even lease paymentarrow_forward

- Consider a firm A that wishes to acquire an equipment. The equipment is expected to reduce costs by $4200 per year. The equipment costs $25000 and has a useful life of 5 years. If the firm buys the equipment, they will depreciate it straight-line to zero over 5 years and dispose of it for nothing. They can lease it for 5 years with an annual lease payment of $5000. If the after-tax interest rate on secured debt issued by company A is 2% and tax rate is 35%, what is the Net Advantage to Leasing (NAL)?(keep two decimal places)arrow_forwardYou work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice with expensive, high-tech equipment). The scanner costs $6,000,000 and would be depreciated straight-line to zero over six years. Because of radiation contamination, it will actually be completely valueless in six years. Assume that the tax rate is 21 percent. You can borrow at 6 percent before taxes. What would the lease payment have to be for both the lessor and the lessee to be indifferent about the lease? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Break-even lease paymentarrow_forwardConsider a firm A that wishes to acquire an equipment. The equipment is expected to reduce costs by $5700 per year. The equipment costs $29000 and has a useful life of 7 years. If the firm buys the equipment, they will depreciate it straight-line to zero over 7 years and dispose of it for nothing. They can lease it for 7 years with an annual lease payment of $8000. If the after-tax interest rate on secured debt issued by company A is 7% and tax rate is 25%, what is the Net Advantage to Leasing (NAL)?(keep two decimal places) Answer: -18233.59arrow_forward

- Kuehner estimates that it can lease Parker Road Plaza for $18.50 per square foot (GLA) base rent with a 3 percent overage on gross sales in excess of $200 per square foot (GLA). The company expects rents to increase by 5 percent per year during the lease period and tenant reimbursements to run $8 per square foot (GLA) and to increase at the same rate as rents. Kuehner expects to have the shopping center 70 percent leased during the first year of operation After that, vacancies should average about 5 percent per year. The vacancy losses should be cal-culated on the entire gross potential income, which includes minimum rents, percentage rents and tenant reimbursements. Sales, which are expected to average $210 per square foot (GLA) for the first year of operation, should grow at 6 percent per year. The operating expenses are expected to average $14 per square foot of GLA for the first year and will increase at the same rate as the rents. Kuehner will collect an additional 5 percent of…arrow_forwardYou need a particular piece of equipment for your production process. An equipment - leasing company has offered to lease the equipment to you for $9 comma 700 per year if you sign a guaranteed 5-year lease (the lease is paid at the end of each year). The company would also maintain the equipment for you as part of the lease. Alternatively, you could buy and maintain the equipment yourself. The cash flows from doing so are listed here: LOADING... (the equipment has an economic life of 5 years). If your discount rate is 7.2 %, what should you do? \table[[Year 0, Year 1, Year 2, Year 3, Year 4, Year 5], [-$40, 200, $2,100, -$2,100,- $2,100, - $2,100, - $2,100 c Year 0 - $40,200 Year 1 - $2,100 Year 2 - $2,100 Year 3 Year 4 Year 5 - $2,100 - $2,100 - $2,100arrow_forwardRed Sun Rising Corporation has just signed a lease for its new manufacturing facility. The lease agreement calls for annual payments of $1,850,000 for 20 years with the first payment due today. If the interest rate is 3.55 percent, what is the value of this liability today?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education