Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

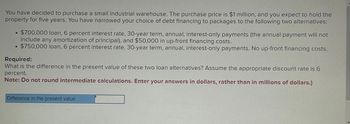

Transcribed Image Text:You have decided to purchase a small industrial warehouse. The purchase price is $1 million, and you expect to hold the

property for five years. You have narrowed your choice of debt financing to packages to the following two alternatives:

0

$700,000 loan, 6 percent interest rate, 30-year term, annual, interest-only payments (the annual payment will not

include any amortization of principal), and $50,000 in up-front financing costs.

$750,000 loan, 6 percent interest rate, 30-year term, annual, interest-only payments. No up-front financing costs.

Required:

What is the difference in the present value of these two loan alternatives? Assume the appropriate discount rate is 6

percent.

Note: Do not round intermediate calculations. Enter your answers in dollars, rather than in millions of dollars.)

Difference in the present value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Give typing answer with explanation and conclusion Assume you want to borrow $300,000 and have been presented with two options. The first option is a fully amortizing loan with an interest rate of 3% and $4000 of origination fees and points. The second option is an interest only loan with an interest rate of 4% and $5000 of origination fees and points. Both loans are for 30 years and have monthly payments. Further assume that if the borrower chooses the interest only loan, any money saved on the monthly payment can be invested with a projected return of 7%. Also assume that the proceeds from the investment will first be used to pay off any remaining balance on the loan. How much money will the investor have left at the end of 30 years after repaying the loan? Group of answer choices None, the investor will owe $12,373.42 $323,060.72 $22,063.08 $30,750.78arrow_forwardSuppose you obtain a five-year lease for a Porsche and negotiate a selling price of $157,000. the annual interest-rate is 8.4%, the residual value is $76,000, and you make a down payment of $5000. Find each of the following. A) the net capitalized cost B) the money factor (round to 4 decimal places) C) the average monthly finance charge (round to the nearest cent) D) the average monthly depreciation (round to the nearest cent) and E) the monthly lease amount (round to the nearest cent)arrow_forwardIsland News purchased a piece of property for $1.82 million. The firm paid a down payment of 20 percent in cash and financed the balance. The loan terms require monthly payments for 20 years at an APR of 4.00 percent, compounded monthly. What is the amount of each mortgage payment?arrow_forward

- Jackson wants to buy a Corolla Cross 1.8 Hybrid by means of a financing plan. The price is R481 700. GL Finance, a vehicle finance company, will finance 70% of the purchase price over a period of three years at a nominal interest rate of 14% per year (NACM). Instalments are payable in advance. What is the monthly instalment (Report answer in absolute terms)?arrow_forwardTeal and Associates needs to borrow $65,000. The best loan they can find is one at 12% that must be repaid in monthly installments over the next 5 1/2 1 2 years. How much are the monthly payments? (a) State the type. A. ordinary annuityB.sinking fund C.present valueD.amortizationE.future value (b) Answer the question. (Round your answer to the nearest cent.)arrow_forwardThe Odessa Supply Company is considering obtaining a loan from a sales finance company secured by inventories under a field warehousing arrangement. Odessa would be permitted to borrow up to $320,000 under such an arrangement at an annual interest rate of 10 percent. The additional cost of maintaining a field warehouse is $20,000 per year. Assume that there are 365 days per year. Determine the annual financing cost of a loan under this arrangement if Odessa borrows the following amounts: $320,000. Round your answer to two decimal places. % $240,000. Round your answer to two decimal places. %arrow_forward

- 4arrow_forwardprepare an amortization schedule showing the first four payments for each loan. Large semitrailer trucks cost $110,000 each. Ace Trucking buys such a truck and agrees to pay for it by a loan that will be amortized with 9 semiannual payments at 8% compounded semiannually.arrow_forwardGoran plans to buy a used truck that costs $15,000. The dealer requires a 20% down payment. The rest of the cost is financed with a 3-year, fixed-rate amortized auto loan at 5.5% annual interest with monthly payments. Complete the parts below. Do not round any intermediate computations. Round your final answers to the nearest cent if necessary. If necessary, refer to the list of financial formulas.arrow_forward

- A property is available for sale that could be financed with a fully amortizing $250,000 loan at 8% with a monthly payment over 30 years. The builder is offering buyers a mortgage that reduces the payment by 20% for first and second year. After the second year, regular payment would be made for the remainder of the loan term. What is the first-year monthly payment for buyer? 1467.53 1657.32 1723.56arrow_forward3) You are purchasing a car and have the option to pay $25,000 in cash (upfront) OR assume a lease with end of the month payments of $399 for five years. By purchasing, you will receive an estimated residual value (or scrap value) by selling the car for $2,500 at the end of the 5 years. If interest is 2.7% compounded annually, which financing option would you prefer? (16.1 DCF)arrow_forwardWhen purchasing a $100,000 house, a borrower is comparing two loan alternatives. The first loan is an 80% loan at 4% with monthly payments of $591.75 for 15 years. The second loan is 90% loan at 5% with monthly payments of $526.13 over 25 years. What is the incremental cost of borrowing the extra money assuming the loan will be held for the full term? O 6.50% O 13.21% O 7.20% O 13.70%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education