FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

With the

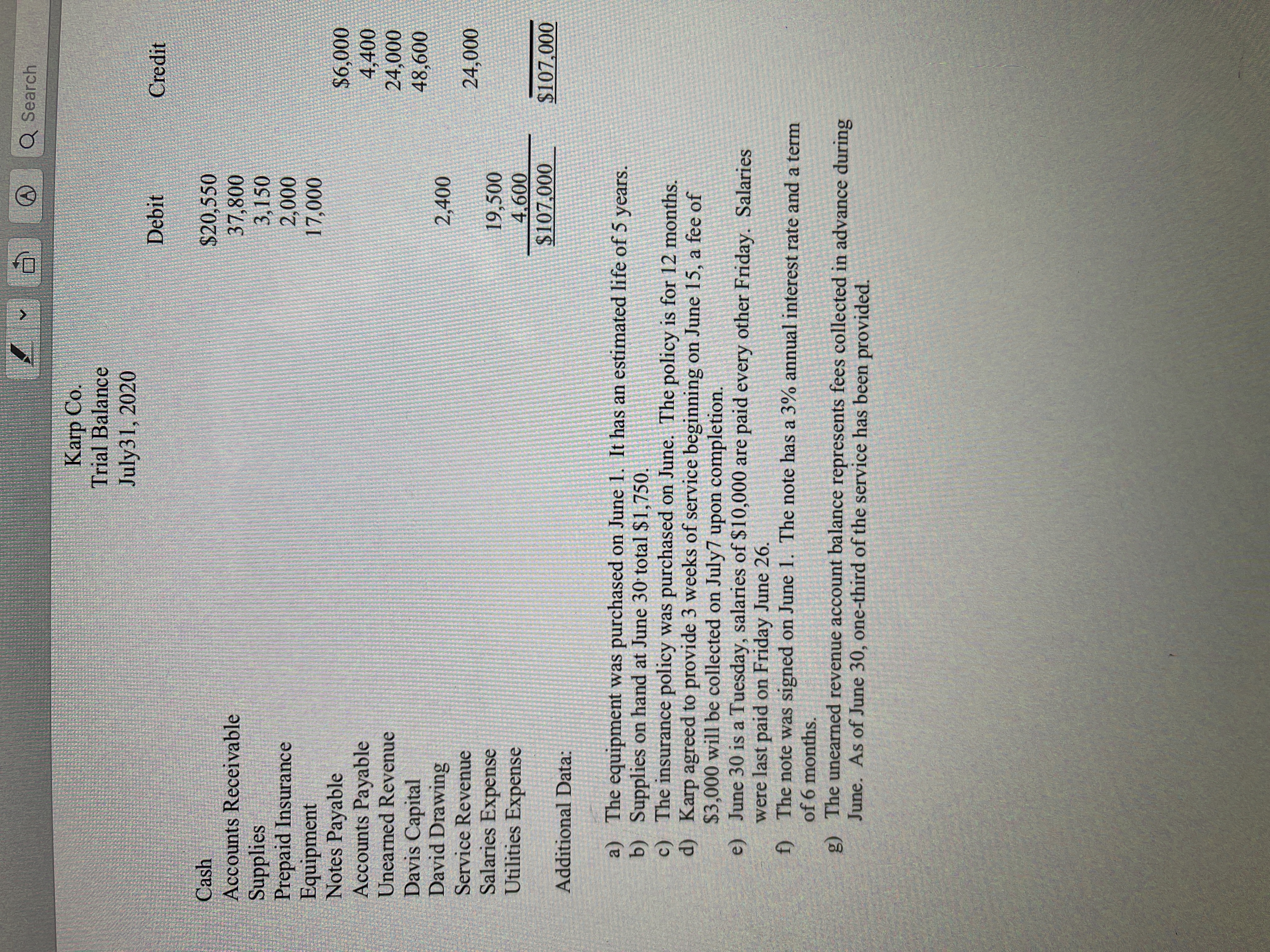

I don't understand how to do because there are many amounts of money in the additional Data. Can you show how to do it, thank you.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Nicole's Getaway Spa (NGS) continues to grow and develop. Nicole is now evaluating a computerized accounting system and needs your help in understanding how source documents inform accounting processes. She also needs some help reconciling NGS's bank account. Required: 1. For each source information shown below, prepare the appropriate journal entry. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) a. Purchase order dated October 13 for massage chairs costing $840 and oil supplies costing $315. b. Remittance advice from customer for $108, received October 17. c. Receiving report indicating October 22 receipt of October 13 order. Also received supplier invoice totaling $1,155. d. NGS check for payment in full of October 13 order.arrow_forwardI started it but I'm not exactly sure I'm getting the corrected numbers. Can you help? there's more balance sheets for this problem but I've exceeded the photo limit for one question . Please let me know if I should add more on a separate question. Thank you.arrow_forwardFor a tutoring center, cash and accounts receivable are two of the assets that they own and will benefit in the future. Please list examples with two assets specifically on the tutoring center.arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardI need help with this practice exercise E 310 and E 311. I can't do the practice because I don't understand them.arrow_forwardI am not exactly sure what this question is asking me to do. The attached image is the information that is given to me. Below are the questions that I need to solve. The answer to question A is 3,650. That was given to me in the problem.Unknown Amounts Requireda. Total cash received $3,650b. Total cash collected from credit customersc. Notes payable repaid during the periodd. Good and services received from suppliers on accounte. Net income, assuming that no dividends were paidarrow_forward

- Hi I asked this question previously and the individual did not explain things clearly. For instance he provided the I'm guessing standard method of finding a missing amount on a certain type of T-Account but then would turn around and solve it using a different method. I am posting the response that were not clear below. If you could tell me what the actual method is and if there exceptions and if so what those are.Answer #1 I needed the BEGINNING balance of a debit account. As you can see the response below the individual provided a formula that included the BB which is UNKOWN because that is WHAT I NEED. At the bottom they change around the equation to come to the answer. So what is the proper way???Part-1. Begining balance of cash account is missing. The cash account is having a debit balance always. The formula for Cash account is as under:Ending balance of Cash Account = Begining Balance of cash account + All debits - All creditsHere,Ending Balance of cash = 9800All debits…arrow_forward3. Zach had surgery, which was his third claim of the year. He had a bill of $5000. Considering the prior visits, what is Zach's portion of this bill, and what is the responsibility of the insurance carrier? 4. How much is Zach responsible for so far this year considering his first three visits?arrow_forwardIf a $335.00 debit item in the general journal is posted as a credit: By how much will the trial balance be out of balance? Explain how you might detect such an error.arrow_forward

- An employee working on her first trial balance discovers that the Equipment account has a credit balance of $2500 and a customer's A/R account has a credit balance of $25. Based on the knowledge you have gained in this course and how account balances are recorded and increase/decrease, has the accountant made a mistake in her records or are these situations possible?arrow_forwardI got to find if my general ledger is complete. So, In the general ledger, I add all the debits side and the credit side got a matching balance between the debit and credit in the general ledger. However, in the trial balance the total balance for the debit and credit does not match also differ from the general ledger. I will state that is not a complete because of those reasons. Let me know if I am correct or not. Please do example your reasoning?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education