Concept explainers

PARRISH 2-7 (T-ACCOUNTS)

Please show and tell me how to find the missing amounts in this T-Account. I asked this question before and the individual failed miserably at "answering" my question. I am asking not only for the answering for the missing amount in this T-Account, BUT how you solve for that missing amount. I would like it explained clearly and not through simply a shot from an Excel spreadsheet. I have attached their answer so you can see what I am referring to and how it did not help in anyway. Thank you.

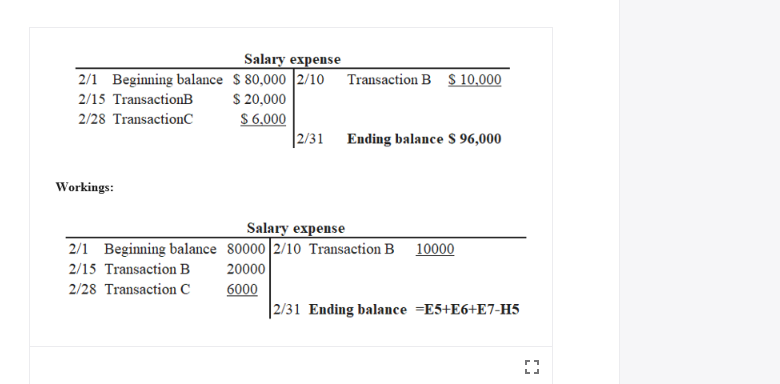

SALARY EXPENSE

Left Side of T-Account

2/1 Beginning Balance $80000

2/15 Transaction B $20000

2/28 Transaction C $6000

ENDING BALANCE ???

Right Side of T-Account

2/10 Transaction B $10000

ENDING BALANCE???

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Nonearrow_forwardPARRISH 2-7 (T-ACCOUNTS)Please solve the missing amount for this T-Account and explain how you go about solving the missing amount. DO NOT SOLVE THIS SIMPLY BY ENTERING NUMBERS IN AN EXCEL SPREADSHEET AND POSTING THE ANSWER. WRITE OUT AND EXPLAIN IN A MATHEMATICAL EQUATION TYPE FORMAT HOW I WOULD GO ABOUT SOLVING A MISSING AMOUNT FOR A T-ACCOUNT! Accounts Payable Left Side of T-Account6/4 Transaction A $15006/8 Transaction C $2000 Rigth Side of T-Account6/1 Beginning Balance $30006/6 Transaction B UNKNOWN6/29 Transaction D $3400Ending Balance $6700arrow_forwardRequired information [The following information applies to the questions displayed below.] Nicole's Getaway Spa (NGS) continues to grow and develop. Nicole is now evaluating a computerized accounting system and needs your help in understanding how source documents inform accounting processes. She also needs some help reconciling NGS's bank account. Required: 1. For each source information shown below, prepare the appropriate journal entry. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) a. Purchase order dated October 13 for massage chairs costing $840 and oil supplies costing $315. b. Remittance advice from customer for $108, received October 17. c. Receiving report indicating October 22 receipt of October 13 order. Also received supplier invoice totaling $1,155. d. NGS check for payment in full of October 13 order.arrow_forward

- Hi I asked this question previously and the individual did not explain things clearly. For instance he provided the I'm guessing standard method of finding a missing amount on a certain type of T-Account but then would turn around and solve it using a different method. I am posting the response that were not clear below. If you could tell me what the actual method is and if there exceptions and if so what those are.Answer #1 I needed the BEGINNING balance of a debit account. As you can see the response below the individual provided a formula that included the BB which is UNKOWN because that is WHAT I NEED. At the bottom they change around the equation to come to the answer. So what is the proper way???Part-1. Begining balance of cash account is missing. The cash account is having a debit balance always. The formula for Cash account is as under:Ending balance of Cash Account = Begining Balance of cash account + All debits - All creditsHere,Ending Balance of cash = 9800All debits…arrow_forwardWith the information given from the first picture, I need the general ledger filled out, although with how the second pictures showing the layout. I need the transaction of the general ledger in cash, office supplies, office equipment, accounts payable, Diane Bernick capital, Diane Bernice drawing, consulting fees, wage expense, rent expense, phone expense, utilities expense, and miscellaneous expense, thank you!arrow_forward3. Zach had surgery, which was his third claim of the year. He had a bill of $5000. Considering the prior visits, what is Zach's portion of this bill, and what is the responsibility of the insurance carrier? 4. How much is Zach responsible for so far this year considering his first three visits?arrow_forward

- An employee working on her first trial balance discovers that the Equipment account has a credit balance of $2500 and a customer's A/R account has a credit balance of $25. Based on the knowledge you have gained in this course and how account balances are recorded and increase/decrease, has the accountant made a mistake in her records or are these situations possible?arrow_forwardI got to find if my general ledger is complete. So, In the general ledger, I add all the debits side and the credit side got a matching balance between the debit and credit in the general ledger. However, in the trial balance the total balance for the debit and credit does not match also differ from the general ledger. I will state that is not a complete because of those reasons. Let me know if I am correct or not. Please do example your reasoning?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education