Quickbooks Online Accounting

3rd Edition

ISBN: 9780357391693

Author: Owen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

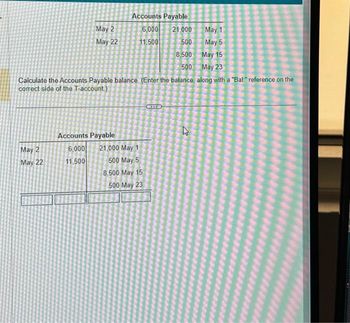

Transcribed Image Text:May 2

May 22

May 2

May 22

21,000

May 1

500

May 5

8,500

May 15

500

May 23

Calculate the Accounts Payable balance. (Enter the balance, along with a "Bal" reference on the

correct side of the T-account)

Accounts Payable

6,000

11.500

Accounts Payable

6,000

11,500

21,000 May 1

500 May 5

8,500 May 15

500 May 23

KXTYB

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On May 2, 20X1, HPF Vacations received its April bank statement from First City Bank and Trust. Enclosed with the bank statement, which appears below, was a debit memorandum for $160 that covered an NSF check issued by Doris Fisher, a credit customer. The firm's checkbook contained the following information about deposits made and checks issued during April. The balance of the Cash account and the checkbook on April 30, 20X1, was $3,972. DATE TRANSACTIONS April 1 Balance 1 Check 1207 3 Check 1208 5 Deposit 5 Check 1209 $6,089 100 300 350 275 10 Check 1210 17 Check 1211 19 Deposit 2,000 50 150 22 Check 1212 23 Deposit 150 26 Check 1213 200 28 Check 1214 18 30 Check 1215 15 30 Deposit 200arrow_forwardonly 1b question photo thanks!arrow_forwardA ezto.mheducation.com sijon 17A - Connect Data_Sales.xlsx: fa21cob204 Computer Information Systems Dashb on 1-7-6A - Connect Saved Help The accounts receivable balance for Renue Spa at December 31, Year 1, was $86,000. Also on that date, the balance in the Allowance for Doubtful Accounts was $2,500. During Year 2, $1.900 of accounts receivable were written off as uncollectible. In addition, Renue unexpectedly collected $130 of receivables that had been written off in a previous accounting period. Services provided on account during Year 2 were $211,000, and cash collections from receivables were $212,936. Uncollectible accounts expense was estimated to be 1 percent of the sales on account for the period. Required a. Record the transactions in general journal form and post to T-accounts. b. Based on the preceding information, compute (after year-end adjustment): (1) Balance of allowance for doubtful accounts at December 31, Year 2. (2) Balance of accounts receivable at December 31,…arrow_forward

- Journalizing Purchases Returns and Allowances and Posting to General Ledger and Accounts Payable Ledger Transactions for July and the beginning balances for selected general ledger and accounts payable ledger accounts are shown. July 7 Returned merchandise to Starcraft Industries, $750. 15 Returned merchandise to XYZ, Inc., $530. 27 Returned merchandise to Datamagic, $820. General Ledger Account No. Account Balance July 1, 20-- 202 Accounts Payable $10,640 501.1 Purchases Returns and Allowances Accounts Payable Ledger Name Balance July 1, 20-- Datamagic $2,680 Starcraft Industries 4,310 XYZ, Inc. 3,650 Required: Using page 3 of a general journal and the general ledger accounts and accounts payable ledger accounts, journalize and post the transactions. GENERAL JOURNAL PAGE 3 DATE DESCRIPTION POST. REF. DEBIT CREDIT 20-- Jul. 7 Jul. 15 Jul. 27 GENERAL LEDGER ACCOUNT Accounts Payable ACCOUNT NO. 202 BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT 20-- Jul. 1 Balance 10,640.00arrow_forwardA ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fblackboard.waketech.edu%252Fwebapps%252Fportal%252Fframeset.jsp%253Ftab tab gr Jill bought a $730 rocking chair. The terms of her revolving charge are 2% on the unpaid balance from the previous month. If she pays $100 per month, complete a schedule for the first 3 months like Table 14.3. Be sure to use the U.S. Rule. (Round your final answers to the nearest cent.) Monthly Outstanding Amount of Outstanding balance due 2.0% interest Reduction in рayment number monthly payment balance due payment balance due acer 3.arrow_forwardSolve this accounting questionarrow_forward

- Account Number XXXX XXXX XXXX XXXX February 21, 2012 to March 22, 2012 Payment Information New Balance Minimum Payment Due Payment Due Date Summary of Account Activity Previous Balance Payments Other Credits Purchases Balance Transfers Cash Advances Past Due Amount Fees Charged Interest Charged New Balance $535.07 $450.00 $1,784.53 1 $53.00 $13.45 *$529.57 *5785.00Late Payment Warning: If we do not receive your minimum +$318 4/20/12 vment by the date listed above, you may have to pay a $35 fee and your APRS may be increased up to the Penalty Rof 28.99% Minimum Payment Warning: If you make only the minim payment each period, you will pay more in interest and it take you longer to pay off your balance. For example 3. $ 10.89 $1,784.53 4) Credit limit Available credit Statement closing date Days in billing cycle $2.000 00 $215.47 3/22/2012 You will pay off the fyou make no additional charges using this card and each month you pay.. And you will balance shown on end up paying an estimated…arrow_forwardquestion attached aprpeicate the hlep lewpha wehl 4p2 y1 pyl15yp15ly51py15ypo51hotp 1th 5arrow_forwardbe Preview File Edit View V Go mgt120h-a17.pdf Page 3 of 10 DOLAY Tools Window Help risinin D .. .. .. ... ... O V C. For an amount that the company estimates it will not collect. d. Several times during the accounting period. ܐ. . .. . . Search (Cª 5. Under the allowance method for uncollectible accounts, Bad Debts Expense is recorded a. When an individual account is written off. b. When the loss amount is known. Sat Apr 15 3:04 PM 6. A company sells an asset that originally cost $150,000 for $50,000 on December 31, 2016. The accumulated depreciation account had a balance of $60.000 after the current year'e Cost-Volume-Profit Analysis The Effect Of Prepaid Taxes On Assets Debenture Valuation And Liabili... 90 77arrow_forward

- Help me pleasearrow_forward16% D Fri le Edit View History Bookmarks Window Help A education.wiley.com W https://msroederbhs.weebly.com/uploads/2/2/4/0/= NWP Assessment Player UI Application - Quiz 2 -/3 E Question 9 of 10 < View Policies Current Attempt in Progress At August 31, Coffman Company has this bank information: cash balance per bank $6,450; outstanding checks $2,762; deposits in transit $1,700; and a bank service charge $20. Determine the adjusted cash balance per bank at August 31, 2021. Adjusted cash balance per bank 2$ Attempts: 0 of 1 used Submit Answer Save for Later 7.288 MAR 4 étv P. Maclook A 000 80 DII DD F1 F2 F3 F4 F5 F6 F7 F8 F9 F10 @ # $ % A & * 2 3 5 6 8arrow_forwardChap 11arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning