FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

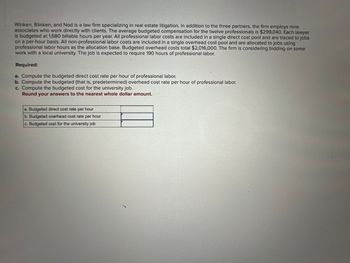

Transcribed Image Text:Winken, Blinken, and Nod is a law firm specializing in real estate litigation. In addition to the three partners, the firm employs nine

associates who work directly with clients. The average budgeted compensation for the twelve professionals is $299,040. Each lawyer

is budgeted at 1,680 billable hours per year. All professional labor costs are included in a single direct cost pool and are traced to jobs

on a per-hour basis. All non-professional labor costs are included in a single overhead cost pool and are allocated to jobs using

professional labor hours as the allocation base. Budgeted overhead costs total $2,016,000. The firm is considering bidding on some

work with a local university. The job is expected to require 190 hours of professional labor.

Required:

a. Compute the budgeted direct cost rate per hour of professional labor.

b. Compute the budgeted (that is, predetermined) overhead cost rate per hour of professional labor.

c. Compute the budgeted cost for the university job.

Round your answers to the nearest whole dollar amount.

a. Budgeted direct cost rate per hour

b. Budgeted overhead cost rate per hour

c. Budgeted cost for the university job

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dewey, Cheatum & Howe, LLP, is a legal firm. The lawyers are paid $150 per hour and overhead is allocated at a rate of $100 per direct labor hour. A Salt & Buttery, Inc., is a client that was charged for 16 direct labor hours and $1,000 for materials used. Calculate the price of the job given Dewey, Cheatum & Howe markup its costs by 60%.arrow_forwardExpress Delivery Company (EDC) is considering outsourcing its Payroll Department to a payroll processing company for an annual fee of $223,200. An internally prepared report summarizes the Payroll Department’s annual operating costs as follows: Supplies $ 33,200 Payroll clerks’ salaries 123,200 Payroll supervisor’s salary 61,200 Payroll employee training expenses 13,200 Depreciation of equipment 23,200 Allocated share of common building operating costs 18,200 Allocated share of common administrative overhead 31,200 Total annual operating cost $ 303,400 EDC currently rents overflow office space for $39,200 per year. If the company closes its Payroll Department, the employees occupying the rented office space could be brought in-house and the lease agreement on the rented space could be terminated with no penalty. If the Payroll Department is outsourced the payroll clerks will not be retained; however, the supervisor would be transferred to the company’s Human…arrow_forwardUniversity Printers has two service departments (Maintenance and Personnel) and two operating departments (Printing and Developing). Management has decided to allocate maintenance costs on the basis of machine-hours in each department and personnel costs on the basis of labor-hours worked by the employees in each. The following data appear in the company records for the current period: Maintenance Personnel Printing Developing 3,000 2,000 $29,500 Machine-hours 1,000 1,000 Labor-hours 500 500 Department direct costs $14,000 $38,500 $43,500 University Printers estimates that the variable costs in the Personnel Department total $17,750 and in the Maintenance Department variable costs total $8,100. Avoidable fixed costs in the Personnel Department are $5,600. Required: If University Printers outsources the Personnel Department functions, what is the maximum it can pay an outside vendor without increasing total costs? (Do not round intermediate calculations.) Maximum Amountarrow_forward

- Your Companey has two service departments – Personnel and Maintenance. The Maintenance Department's costs of $160,000 are allocated on the basis of standard hours used. The Personnel Department's costs of $40,000 are allocated based on the number of employees. The costs of the operating Departments A and B are $80,000 and $120,000, respectively. Data on standard service hours and number of employees are as follows: Standard Service Maintenance Dept. Personnel Dept. Production Depts. A B Hours used - 400 480 320 Number of Employees 20 - 80 240 What is the cost of the Maintenance Department allocated to Department B using the direct method? What is the cost of the…arrow_forwardAmbassador Suites Inc., operates a downtown hotel property that has 300 rooms. On average, 80% of Ambassador Suites's rooms are occupied on weekdays, and 40% are occupied during the weekend. The manager has asked you to develop a direct labor budget for the housekeeping and restaurant staff for weekdays and weekends. You have determined that the housekeeping staff requires 40 minutes to clean each occupied room. The housekeeping staff is paid $10 per hour. The restaurant has 6 full-time staff (eight-hour day) on duty, regardless of occupancy. However, for every 20 occupied rooms, an additional person is brought in to work in the restaurant for the eight-hour day. The restaurant staff is paid $8 per hour. Determine the estimated housekeeping, restaurant, and total direct labor cost for an average weekday and average weekend day. Enter percentages as whole numbers. Ambassador Suites Inc. Direct Labor Cost Budget For a Weekday or a Weekend Day Weekday Weekend Day Room occupancy Room…arrow_forwardJamison Company has two service departments and two producing departments. Square footage of space occupied by each department follows: Custodial services 1,700 feet General administration 3,700 feet Producing Department A 8,700 feet Producing Department B 8,700 feet 22,800 feet The department costs of Custodial Services are allocated on a basis of square footage of space. If Custodial Services costs are budgeted at $45,000, the amount of cost allocated to General Administration under the direct method would be: Multiple Choice $7,400. $9,432. $7,303. $0.arrow_forward

- Banc Corporation Trust is considering either a bank-wide overhead rate or department overhead rates to allocate $398,000 of indirect costs. The bank-wide rate could be based on either direct labor-hours (DLH) or the number of loans processed. The departmental rates would be based on direct labor-hours for Consumer Loans and a dual rate based on direct labor-hours and the number of loans processed for Commercial Loans. The following information was gathered for the upcoming period: Department Consumer Commercial Multiple Choice O How much of the $398,000 indirect costs should be allocated to the Consumer Department, if Banc Corporation Trust uses a bank-wide rate based on the number of loans processed? Note: Round the bank-wide rate to the nearest dollar. O O $298,000 $298.500 $290,000 DLH 18,000 6,000 $108,000 Loans Processed 750 250 Direct Costs $ 290,000 $ 170,000arrow_forwardAllocation Busters (AB) is a dispute mediation firm offering services to firms in disputes about cost allocations with government agencies. For March, AB worked 453 hours for Massive Airframes and 679 hours for Gigantic Drydocks. AB bills clients at the rate of $512 per hour; labor cost for its professional staff is $200 per hour. Overhead costs in March totaled $40,090. Overhead is applied to clients at $42 per labor-hour. In addition, AB had $198,700 in marketing and administrative costs. All transactions are on account. All services were billed. Transaction Description (a) Record Labor cost (b) Record Applied Service Overhead (c) Record Cost of services billed (d) Record Actual Service Overhead Required: a. Show labor and overhead cost flows through T-accounts. b. Prepare an income statement for the company for March.arrow_forwardJamison Company has two service departments and two producing departments. Square footage of space occupied by each department follows: Custodial services 2,700 feet General administration 4,700 feet Producing Department A 9,700 feet Producing Department B 9,700 feet 26,800 feet The department costs of Custodial Services are allocated on a basis of square footage of space. If Custodial Services costs are budgeted at $55,000, the amount of cost allocated to General Administration under the direct method would be:arrow_forward

- Heidt Cleaning Services (HCS) is a local custodial service company serving both the residential and commercial markets. The owner is considering dropping the commercial clients because that business seems only marginally profitable. Twenty-five employees worked a total of 45,300 hours last year, 30,200 on commercial jobs and 15,100 on residential jobs. Wages were $20 per hour for all work done. Any materials used are included in overhead as supplies. All overhead is allocated on the basis of labor-hours worked, which is also the basis for customer charges. Given current economic conditions and competition, HCS bills residential clients $40 per hour and commercial clients $30 per hour. Required: If overhead for the year was $404,580, what were the profits of the residential and commercial services using labor-hours as the allocation base? Note: Do not round intermediate calculations. Round final answers to the nearest whole dollar. Overhead consists of costs of supervision,…arrow_forwardRutland Business Services (RBS) provides miscellaneous consulting and services to local businesses. In August, RBS worked for three clients. It worked 270 hours for Selden Contracting, 170 hours for Moenhart Insurance, and 230 hours for Englewood Medical Center. RBS bills clients at $500 an hour; its labor costs are $125 an hour. A total of 750 hours were worked in August with 80 hours not billable to clients. Overhead costs of $60,000 were incurred and were assigned to clients on the basis of direct labor-hours. Because 80 hours were not billable, some overhead was not assigned to jobs. RBS had $57,000 in marketing and administrative costs. All transactions were on account. Required: What are the revenue and cost per client? Prepare an income statement for August.arrow_forwardLambie Custodial Services (LCS) offers residential and commercial janitorial services. Clients are billed monthly but can cancel the service at the end of any month. In addition to the employees who do the actual cleaning, the firm employs two managers who handle the administrative tasks (human resources, accounting, and so on) and one dispatcher, who assigns the cleaning employees to jobs on a daily basis. On average, residential clients pay $600 per month for weekly cleaning services and the commercial clients pay $2,600 per month for daily service (weekdays only). A typical residential client requires 15 hours a month for cleaning and a typical commercial client requires 69 hours a month. In September, LCS had 75 commercial clients and 80 residential clients. Cleaners are paid $20 per hour and are only paid for the hours actually worked. Supplies and other variable costs are estimated to cost $10 per hour of cleaning. Other monthly costs (all fixed) are $29,000 selling, general, and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education