FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

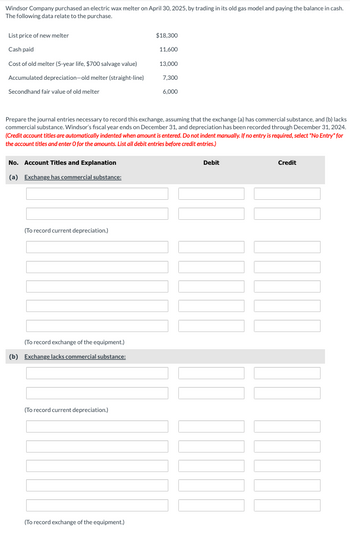

Transcribed Image Text:**Windsor Company Electric Wax Melter Purchase and Exchange Recording**

On April 30, 2025, Windsor Company purchased an electric wax melter by trading in its old gas model and paying the remaining balance in cash. Below are the relevant details of the purchase:

- **List price of new melter:** $18,300

- **Cash paid:** $11,600

- **Cost of old melter:** $13,000 (5-year life, $700 salvage value)

- **Accumulated depreciation—old melter (straight-line):** $7,300

- **Secondhand fair value of old melter:** $6,000

**Objective:** Prepare the journal entries necessary to record this exchange, considering both scenarios: (a) the exchange has commercial substance, and (b) the exchange lacks commercial substance. Windsor's fiscal year ends on December 31, with the provided depreciation recorded through December 31, 2024.

**Instructions:** List all debit entries before credit entries. If no entry is needed, select "No Entry" and enter 0 for amounts.

### (a) Exchange has commercial substance:

- **Account Titles and Explanation:**

- Debit and Credit sections with multiple lines for entries

- A note for recording current depreciation

- A separate section to record the exchange of equipment

### (b) Exchange lacks commercial substance:

- **Account Titles and Explanation:**

- Similar to part (a), providing spaces for entries

- A note for recording current depreciation

- Another section to record the exchange of equipment

No diagrams or graphs are included within this text. The focus is on tabulating and analyzing financial journal entries for accounting purposes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current Attempt in Progress Blossom Company purchased an electric wax melter on April 30, 2025, by trading in its old gas model and paying the balance in cash. The following data relate to the purchase. List price of new melter Cash paid Cost of old melter (5-year life, $1,100 salvage value) Accumulated depreciation-old melter (straight-line) Secondhand fair value of old melter $23,100 14,600 16,400 9,200 7,600 Prepare the journal entries necessary to record this exchange, assuming that the exchange (a) has commercial substance, and (b) lacks commercial substance. Blossom's fiscal year ends on December 31, and depreciation has been recorded through December 31, 2024. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) No. Account Titles and Explanation (a) Exchange has commercial substance: Debit…arrow_forwardTinker Bell Company sold a delivery wing truck on March 1, 2022. Tinker had acquired the wing truck on January 1, 2019, for $ 52,000. At acquisition, Tinker had estimated that the truck would have a useful life of 6 years and a residual value of $4,000. On December 31, 2021, the truck had a book value of $ 28,000. Required: Prepare the journal entries to recognized the depreciation expense for 2022 prior to the sale and the sale of the truck assuming the truck sold at the following different prices (you will have 3 entries total): $32,000 26,000arrow_forwardBramble Company purchased an electric wax melter on April 30, 2025, by trading in its old gas model and paying the balance in cash. The following data relate to the purchase. List price of new melter Cash paid Cost of old melter (5-year life, $800 salvage value) Accumulated depreciation-old melter (straight-line) Secondhand fair value of old melter $20,200 No. Account Titles and Explanation (a) Exchange has commercial substance: 12,800 14,300 8,100 6,700 Prepare the journal entries necessary to record this exchange, assuming that the exchange (a) has commercial substance, and (b) lacks commercial substance. Bramble's fiscal year ends on December 31, and depreciation has been recorded through December 31, 2024. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Debit Creditarrow_forward

- On July 1, 2018, Mundo Corporation purchased factory equipment for $50,000. Residual value was estimated at $2,000. The equipment will be depreciated over 10 years using the doubledeclining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depreciation expense of:arrow_forwardThe following information is available on a depreciable asset: Purchase date January 1, Year 1 Purchase price $96,000 Salvage value $10,000 Useful life 10 years Depreciation method straight-line The asset's book value is $78,800 on January 1, Year 3. On that date, management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000. Based on this information, the amount of depreciation expense the company should recognize during Year 3 would be: Multiple Choice $7,880.00 $9,225.00 $8,600.00 $7,380.00 $9,850.00arrow_forwardRecording Asset Exchanges Minneapolis Inc. has equipment with an original cost of $52,500 and accumulated depreciation of $30,000. This equipment was traded in for new equipment with a list price of $60,000. The new machine can be purchased without a trade-in for $56,250 cash. The difference between the fair value of the new asset and the market value of the old asset will be paid in cash. Prepare the entry to record acquisition of the new machine under each of the following separate cases. a. The new machine is purchased for cash with no trade-in. b. The transaction has commercial substance. The old equipment is traded in, and $37,500 cash is paid. c. The same as in part b except that the transaction lacks commercial substance. a. Account Name Dr. Cr. Answer Answer b. Account Name Dr. Cr. Answer Answer Answer Answer Answer Answer Answer Answer C. Account Name Dr. Cr. Answer…arrow_forward

- Nonearrow_forwardByrd Inc., a calendar year-end company, purchased a machine on 1/1/X1 with the following attributes: Cost $ 50,000 Salvage Value $ 2,000 Useful life 4 years Assuming that Byrd uses the straight-line depreciation method, answer each of the following questions: (do not include decimals or cents) Question #1: How much depreciation expense should be recorded in 20X2 (the second year of the asset's life)? Answer: $ Question #2: What should be the balance in the "Accumulated Depřeciation" account at the end of 20X2, after all year-end journal entries? Answer: $ Question #3: What should be the book value of the machine at the end of 20X2, after all year-end journal entries? Answer: $arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Onslow Company purchased a used machine for $144,000 cash on January 2. On January 3, Onslow paid $ 8,000 to wire electricity to the machine. Onslow paid an additional $1,600 on January 4 to secure the machine for operation. The machine will be used for six years and have a $17, 280 salvage value. Straight line depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of. 3. Prepare journal entries to record the machine's disposal under each separate situation: (a) it is sold for $24, 500 cash and (b) it is sold for $98, 000 cash.arrow_forward

- Intangibles: Balance Sheet Presentation and Income Statement Effects Clinton Company has provided information on intangible assets as follows: A patent was purchased from Lou Company for $1,680,000 on January 1, 2018. Clinton estimated the remaining useful life of the patent to be 10 years. The patent was carried in Lou's accounting records at a net book value of $1,440,000 when Lou sold it to Clinton. During 2019, a franchise was purchased from Rink Company for $500,000. In addition, 6% of revenue from the franchise must be paid to Rink. Revenue from the franchise for 2019 was $1,800,000. Clinton estimates the useful life of the franchise to be 10 years and takes a full year's amortization in the year of purchase. Clinton incurred R&D costs in 2019 as follows: Materials and equipment $125,000 Personnel 162,000 Indirect costs 78,000 $365,000 Clinton estimates that these costs will be recouped by December 31, 2020. On January 1, 2019, Clinton estimates, based on new…arrow_forwardPurchased a used heavy duty truck for $83,500 on January2, 2016, It was repaired at a cost of $3,420 and installed on a new platform costing $1,080. The useful life will be 6 years,. Residual value is $14,800 on Sep30, 2021, it was retired: 1) sold it for 15,000 2) sold it for $19,500 Please prepare all the calculation and related entries.arrow_forwardSwann Company sold a delivery truck on April 1, 2019. Swann had acquired the truck on January 1, 2015, for $42,000. At acquisition, Swann had estimated that the truck would have an estimated life of 5 years and a residual value of $5,000. Swann uses the straight-line method of depreciation. At December 31, 2018, the truck had a book value of $12,400. Required: 1. Prepare any necessary journal entries to record the sale of the truck, assuming it sold for: a. $12,000 b. $9,000 2. How should the gain or loss on disposal be reported on the income statement? 3. Assume that Swann uses IFRS and sold the truck for $12,000. In addition, Swann had previously recorded a revaluation surplus related to this machine of $4,000. What journal entries are required to record the sale?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education