FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

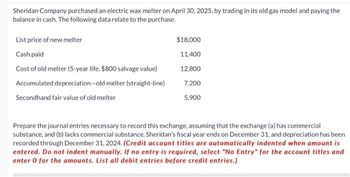

Transcribed Image Text:Sheridan Company purchased an electric wax melter on April 30, 2025, by trading in its old gas model and paying the

balance in cash. The following data relate to the purchase.

List price of new melter

Cash paid

Cost of old melter (5-year life, $800 salvage value)

Accumulated depreciation-old melter (straight-line)

Secondhand fair value of old melter

$18,000

11,400

12,800

7,200

5,900

Prepare the journal entries necessary to record this exchange, assuming that the exchange (a) has commercial

substance, and (b) lacks commercial substance. Sheridan's fiscal year ends on December 31, and depreciation has been

recorded through December 31, 2024. (Credit account titles are automatically indented when amount is

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and

enter 0 for the amounts. List all debit entries before credit entries.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sandhill company owns equipment that cost $120,000 when purchased on January 1, 2018. It has been depreciated using the straight line method based on estimated salvage value of $16,500 and an estimated useful life of 5 years. Prepare sandhill company's journal entries to record the sale of the equipment in these four independent situations. Sold for $59,000 on Jan 1, 2021 Sold for $59,000 on May 1, 2021 Sold for $38,500 on Jan 1, 2021 Sold for $38,500 on October 1, 2021arrow_forwardCurrent Attempt in Progress Blossom Company purchased an electric wax melter on April 30, 2025, by trading in its old gas model and paying the balance in cash. The following data relate to the purchase. List price of new melter Cash paid Cost of old melter (5-year life, $1,100 salvage value) Accumulated depreciation-old melter (straight-line) Secondhand fair value of old melter $23,100 14,600 16,400 9,200 7,600 Prepare the journal entries necessary to record this exchange, assuming that the exchange (a) has commercial substance, and (b) lacks commercial substance. Blossom's fiscal year ends on December 31, and depreciation has been recorded through December 31, 2024. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) No. Account Titles and Explanation (a) Exchange has commercial substance: Debit…arrow_forwardTinker Bell Company sold a delivery wing truck on March 1, 2022. Tinker had acquired the wing truck on January 1, 2019, for $ 52,000. At acquisition, Tinker had estimated that the truck would have a useful life of 6 years and a residual value of $4,000. On December 31, 2021, the truck had a book value of $ 28,000. Required: Prepare the journal entries to recognized the depreciation expense for 2022 prior to the sale and the sale of the truck assuming the truck sold at the following different prices (you will have 3 entries total): $32,000 26,000arrow_forward

- Bramble Company purchased an electric wax melter on April 30, 2025, by trading in its old gas model and paying the balance in cash. The following data relate to the purchase. List price of new melter Cash paid Cost of old melter (5-year life, $800 salvage value) Accumulated depreciation-old melter (straight-line) Secondhand fair value of old melter $20,200 No. Account Titles and Explanation (a) Exchange has commercial substance: 12,800 14,300 8,100 6,700 Prepare the journal entries necessary to record this exchange, assuming that the exchange (a) has commercial substance, and (b) lacks commercial substance. Bramble's fiscal year ends on December 31, and depreciation has been recorded through December 31, 2024. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Debit Creditarrow_forwardFunseth Farms Inc. purchased a tractor in 2018 at a cost of $34,800. The tractor was sold for $3,400 in 2021. Depreciation recorded through the disposal date totaled $30,000. (1) Prepare the journal entry to record the sale. (2) Now assume the tractor was sold for $11,200; prepare the journal entry to record the sale. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 Record the sale of the tractor for $3,400. Note: Enter debits before credits. Event 1 Record entry General Journal Clear entry Debit Credit View general journal >arrow_forwardNonearrow_forward

- Oklahoma Company purchased a machine on January 1, 2020. The machine had a cost of $520,000 with a $20,000 residual value. The estimated useful life of the machine was eight years. On January 1, 2022, due to technological innovations, the estimated useful life was reduced by two years from the original life and the residual value was reduced by 50%. The company uses straight-line depreciation. Required: Prepare the journal entry to record the annual depreciation on December 31, 2022. Show your calculations before you post the journal entry.arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Onslow Company purchased a used machine for $144,000 cash on January 2. On January 3, Onslow paid $ 8,000 to wire electricity to the machine. Onslow paid an additional $1,600 on January 4 to secure the machine for operation. The machine will be used for six years and have a $17, 280 salvage value. Straight line depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of. 3. Prepare journal entries to record the machine's disposal under each separate situation: (a) it is sold for $24, 500 cash and (b) it is sold for $98, 000 cash.arrow_forwardSwann Company sold a delivery truck on April 1, 2019. Swann had acquired the truck on January 1, 2015, for $42,000. At acquisition, Swann had estimated that the truck would have an estimated life of 5 years and a residual value of $5,000. Swann uses the straight-line method of depreciation. At December 31, 2018, the truck had a book value of $12,400. Required: 1. Prepare any necessary journal entries to record the sale of the truck, assuming it sold for: a. $12,000 b. $9,000 2. How should the gain or loss on disposal be reported on the income statement? 3. Assume that Swann uses IFRS and sold the truck for $12,000. In addition, Swann had previously recorded a revaluation surplus related to this machine of $4,000. What journal entries are required to record the sale?arrow_forward

- Brown Company paid cash to purchase the assets of Coffee Company on January 1, 2019. Information is as follows: Total cash paid $4,500,000 Assets acquired: Land $800,000 Building $700,000 Machinery $800,000 Patents $700,000 The building is depreciated using the double-declining balance method. Other information is: Salvage value $70,000 Estimated useful life in years 20 The machinery is depreciated using the units-of-production method. Other information is: Salvage value, percentage of cost 10% Estimated total production output in units 100,000 Actual production in units was as follows: 2019: 20,000 2020: 20,000 2021: 30,000 The patents are amortized on a straight-line basis. They have no salvage value. Estimated useful life of patents in years 40 On December 31, 2020, the value of the patents was estimated to be $100,000 Where applicable, the company uses the ½ year rule to calculate depreciation and amortization expense in the years of acquisition and disposal. Its fiscal year-end is…arrow_forwardPlease do not give solution in image format ?.arrow_forwardThe Vermont Construction Company purchased a hauling truck on January 1 of 2019, at a cost of $35,000. The truck has a useful life of eight years with an estimated salvage value of $6,000. Determine the book depreciation amount to be taken over the useful of the truck using straight-line method and double declining balance methods.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education