FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Wildhorse Productions Corp purchased ice fishing huts on December 1, 2023, for a total of $122,000 in cash. At that time, these huts were estimated to have a useful life of 10 years and a residual value of $25,000. The huts were disposed of on July 31, 2026. Wildhorse uses double-diminishing-balance method at two times the straight-line depreciation raye, has a March 31 year end, and makes

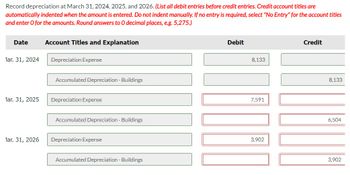

Transcribed Image Text:Record depreciation at March 31, 2024, 2025, and 2026. (List all debit entries before credit entries. Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles

and enter O for the amounts. Round answers to O decimal places, e.g. 5,275.)

Date

lar. 31, 2024

lar. 31, 2025

lar. 31, 2026

Account Titles and Explanation

Depreciation Expense

Accumulated Depreciation - Buildings

Depreciation Expense

Accumulated Depreciation - Buildings

Depreciation Expense

Accumulated Depreciation - Buildings

Debit

8,133

7,591

3,902

Credit

8,133

6,504

3,902

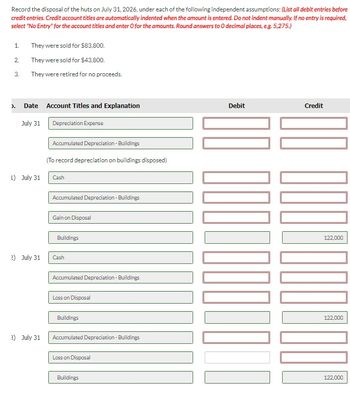

Transcribed Image Text:Record the disposal of the huts on July 31, 2026, under each of the following independent assumptions: (List all debit entries before

credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required,

select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, e.g. 5,275.)

1.

2.

3.

).

They were sold for $83,800.

They were sold for $43,800.

They were retired for no proceeds.

Date

July 31

L) July 31

2) July 31

3) July 31

Account Titles and Explanation

Depreciation Expense

Accumulated Depreciation - Buildings

(To record depreciation on buildings disposed)

Cash

Accumulated Depreciation - Buildings

Gain on Disposal

Buildings

Cash

Accumulated Depreciation - Buildings

Loss on Disposal

Buildings

Accumulated Depreciation - Buildings

Loss on Disposal

Buildings

Debit

10000⁰

Credit

1001

122,000

122,000

122,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Oklahoma Company purchased a machine on January 1, 2020. The machine had a cost of $520,000 with a $20,000 residual value. The estimated useful life of the machine was eight years. On January 1, 2022, due to technological innovations, the estimated useful life was reduced by two years from the original life and the residual value was reduced by 50%. The company uses straight-line depreciation. Required: Prepare the journal entry to record the annual depreciation on December 31, 2022. Show your calculations before you post the journal entry.arrow_forwardSassy's Sweets Shoppe purchased equipment on January 1. The cost was $15,000, and the equipment had a residual value of $5,000. The equipment was given a useful life of 10 years. After the end of two years, it was determined that the equipment would be obsolete in 5 more years and the residual value would still be $5,000. What will be the depreciation under the straight – line method to the nearest dollar be for the third year? O A. $1,600 O B. $1,500 O C. $8,000 O D. $1,000arrow_forwardOn January 1, 2021, Montana Enterprises purchased a $100,000 semi-trailer truck. In 2021 and 2022, Montana depreciated the truck using the straight-line method with an estimated 10 year useful life and an estimated $10,000 salvage value. At the beginning of 2023, Montana decided to adjust the initial estimates. The company now believes the truck will last a total of 15 years and have a salvage value of $17,000. At December 31, 2023, what will be the truck's adjusted book value reflecting the change in estimate? Multiple Choice O $73,000 $83,400 $85,000 $77,000arrow_forward

- On January 1, 2018, Hobart Mfg. Co. purchased a drill press at a cost of $21,900. The drill press is expected to last 10 years and has a residual value of $5.100. During its 10- year life, the equipment is expected to produce 500,000 units of product. In 2018 and 2019, 20,500 and 75,000 units, respectively, were produced. Required: Compute depreciation for 2018 and 2019 and the book value of the drill press at December 31, 2018 and 2019, assuming the units-of-production method is used. (Round depreciation per unit to 2 decimal places.) 2018 2019 Depreciation Book Valuesarrow_forwardVita Water purchased a used machine for $117,200 on January 2, 2020. It was repaired the next day at a cost of $4,900 and installed on a new platform that cost $1,700. The company predicted that the machine would be used for six years and would then have a $32,720 residual value. Depreciation was to be charged on a straight-line basis to the nearest whole month. A full year’s depreciation was recorded on December 31, 2020. On September 30, 2025, it was retired.Required:1. Prepare journal entries to record the purchase of the machine, the cost of repairing it, and the installation. Assume that cash was paid. 2. Prepare entries to record depreciation on the machine on December 31 of its first year and on September 30 in the year of its disposal. (Round intermediate calculations to the nearest whole dollar.) 3. Prepare entries to record the retirement of the machine under each of the following unrelated assumptions: a. It was sold for $35,000. b. It was sold for $38,000. c.…arrow_forwardOn November 1, 2023, the company purchased additional equipment at a cost of $50,000. This equipment has a $15,000 salvage value, a 5 year life and is depreciated using the straight-line method. Annual depreciation expense for all other equipment is $108,000. The annual depreciation expense for the buildings is $52,000. (Hint: Debit Depreciation expense for the total but book the accumulated depreciation to the building and equipment to separate accounts.) What is the adjusting entry?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education