Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

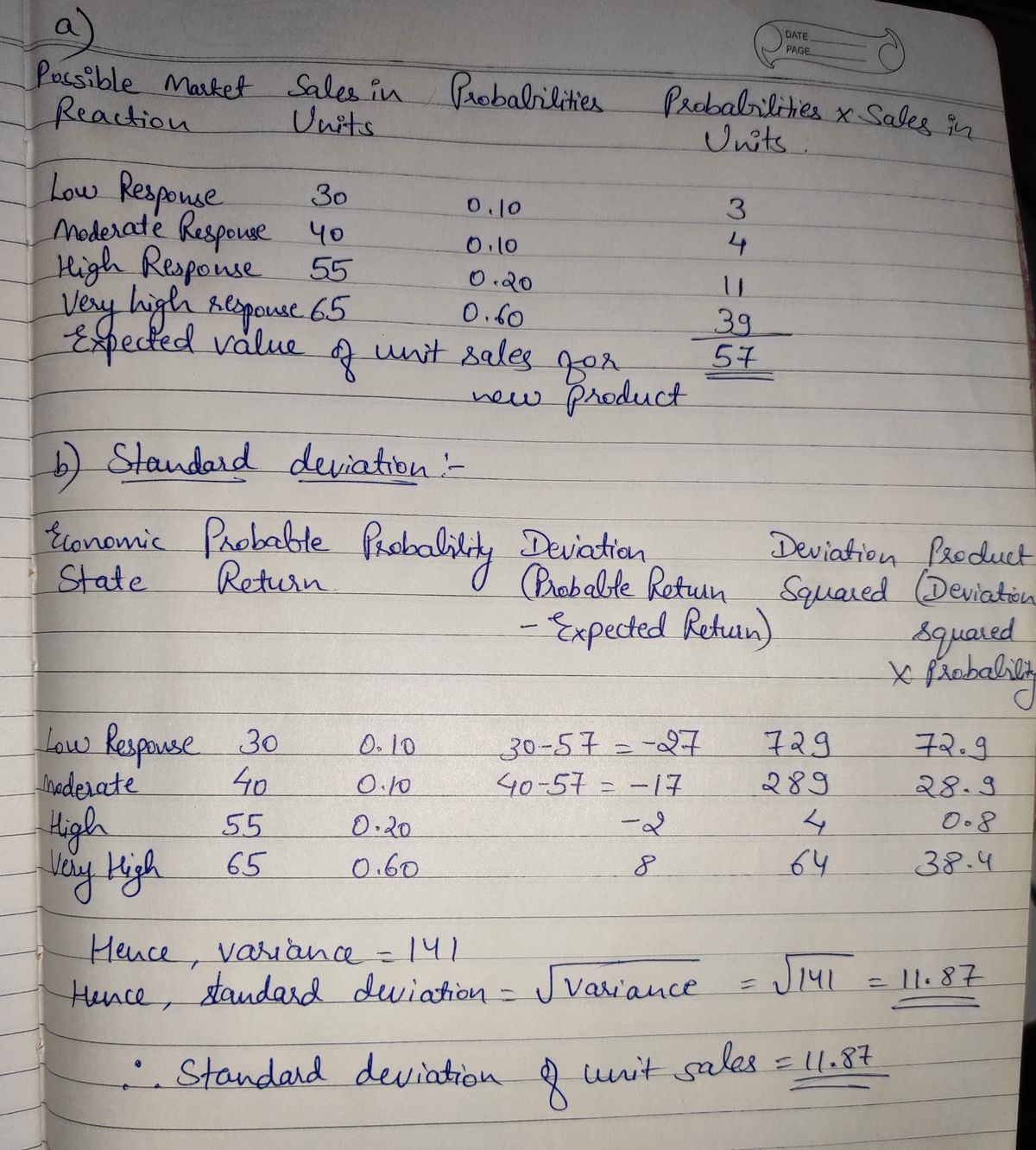

Myers Business Systems is evaluating the introduction of a new product. The possible levels of unit sales and the probabilities of their occurrence are given next:

| Possible Market Reaction | Sales in Units | Probabilities | ||||

| Low response | 30 | 0.10 | ||||

| Moderate response | 40 | 0.10 | ||||

| High response | 55 | 0.20 | ||||

| Very high response | 65 | 0.60 | ||||

a. What is the expected value of unit sales for the new product? (Do not round intermediate calculations and round your answer to the nearest whole unit.)

b. What is the standard deviation of unit sales? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Expert Solution

arrow_forward

Step 1

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider a company faced with a competitor's price reduction. Should the company also reduce price in order to maintain market share or should the company maintain its current price? The company has conducted some preliminary research showing the financial outcomes of each decision under two competitor responses: the competition maintains its price or the competition lowers its price further. The company feels pretty confident that the competitor cannot lower its price further and assigns that outcome a probability (p) of 0.7, which means the other outcome would have only a 30 percent chance of occurring (1-p=0.3). These outcomes are shown in the table below:Competitive ResponseCompany action Maintain Price, p=0.7 Reduce Price, (1-p)=0.3Reduce Price $155,000 $125,000Maintain Price $165,000 $95,000What is the expected value of perfect information (EMV Subscript PI)? Should the research be conducted? Assume that conducting more research costs $15,000.arrow_forwardHighknob Co is thinking about introducing a new product.Below are the possible levels of unit sales and the probabilities of their occurrence. What is the expected value of the new product? Possible Market Reaction Sales in Units Probabilities Low Response 20 .10 Moderate Response 40 .20 High Response 65 .40 Very High Response 80 .30arrow_forwardMetal manufacturing has isolated four alternatives for meeting for increased production capacity. The following summarized datea gathered relative to each of these alternatives. Alternative Expected Return Standard Deviation A 21% 8.3% B 25% 8.8% C 16% 6.1% D 13% 4.4% Calculate the coefficient of variation for each alternative If the firm wishes to minimize risk, which alternative do you recommend?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education