FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

HW 8. Please complete all requirements :)

Transcribed Image Text:Members of the board of directors of Security Check have received the following operating income data for the year ended May 31, 2018:

E (Click the icon to view the operating income data.)

Members of the board are surprised that the industrial systems product line is not profitable. They commission a study to determine whether the company should drop the line. Company accountants estimate that dropping industrial systems

decrease fixed cost of goods sold by $80,000 and decrease fixed selling and administrative expenses by $12,000.

Read the reguirements.

Data Table

Requirement 1. Prepare a differential analysis to show whether Security Check should drop the industrial systems product line.

Security Check

Income Statement

For the Year Ended May 31, 2018

Product Line

Household

Systems

Industrial

in operating income

Systems

Total

Net Sales Revenue

$

360,000 $

380,000 $ 740,000

Cost of Goods Sold:

Variable

37,000

47,000

84,000

260,000

63,000

323,000

Fixed

297,000

110,000

407,000

Total Cost of Goods Sold

Gross Profit

63,000

270,000

333,000

Selling and Administrative Expenses:

Choose from any list or enter any number in the input fields and then click Check Answer.

Variable

64,000

73,000

137,000

44,000

26,000

70,000

Fixed

Heln Me Selve Thie

Vidoo

Get Mere Heln

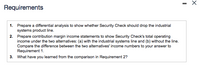

Transcribed Image Text:Requirements

1. Prepare a differential analysis to show whether Security Check should drop the industrial

systems product line.

2. Prepare contribution margin income statements to show Security Check's total operating

income under the two alternatives: (a) with the industrial systems line and (b) without the line.

Compare the difference between the two alternatives' income numbers to your answer to

Requirement 1.

3. What have you learned from the comparison in Requirement 2?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education