Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

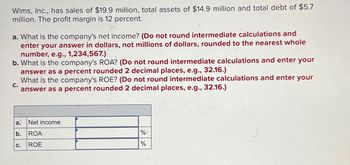

Transcribed Image Text:Wims, Inc., has sales of $19.9 million, total assets of $14.9 million and total debt of $5.7

million. The profit margin is 12 percent.

a. What is the company's net income? (Do not round intermediate calculations and

enter your answer in dollars, not millions of dollars, rounded to the nearest whole

number, e.g., 1,234,567.)

b. What is the company's ROA? (Do not round intermediate calculations and enter your

answer as a percent rounded 2 decimal places, e.g., 32.16.)

C.

What is the company's ROE? (Do not round intermediate calculations and enter your

answer as a percent rounded 2 decimal places, e.g., 32.16.)

Net income

a.

b. ROA

C. ROE

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Green Fire, Inc., has sales of $60 million, total assets of $42 million, and total debt of $18 million. If the profit margin is 9 percent, what is the ROA?arrow_forward5. Shelton, Inc., has sales of $14 million, total assets of $12 million, and total debt of $6.7 million. Assume the profit margin is 7 percent. (a) What is the company's net income? (b) What is the company's ROA? (c) What is the company's ROE?arrow_forwardHere and Gone, Inc., has sales of $17,680,797, total assets of $8,472,354, and total debt of $4,415,615. If the profit margin is 12 percent, what is ROE? Enter the answer with 4 decimal places (e.g. 0.1234).arrow_forward

- Two firms have sales of $1.4 million each. Other financial information is as follows: Firm A B EBIT $ 340,000 $ 340,000 Interest expense 20,000 80,000 Income tax 45,000 15,000 Debt 1,990,000 410,000 Equity 1,450,000 2,040,000 What are the operating profit margins and the net profit margins for these two firms? Round your answers to two decimal places. Operating profit margins: Firm A: % Firm B: % Net profit margins: Firm A: % Firm B: % What are their returns on assets and on equity? Round your answers to two decimal places. Return on assets: Firm A: % Firm B: % Return on equity: Firm A: % Firm B: %arrow_forwardLast year, Genten Company had sales of $7465 million. If Genten’s net profit margin was 0.41 and its return on assets was 0.37, what was Genten’s total assets?arrow_forwardYou are given the following information for Troiano Pizza Company: sales = $84,700; costs = $58,900; addition to retained earnings = $8,100; dividends paid = $3,500; interest expense = $3,210; tax rate = 23 percent. Calculate the depreciation expense for the company. Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.arrow_forward

- Local Co. has sales of $10.4 million and cost of sales of $6.3 million. Its selling, general and administrative expenses are $490,000 and its research and development is $1.2 million. It has annual depreciation charges of $1.2 million and a tax rate of 28%. a. What is Local's gross margin? b. What is Local's operating margin? c. What is Local's net profit margin? a. What is Local's gross margin? Local's gross margin is%. (Round to two decimal places.)arrow_forwardNeed Help with this Questionarrow_forwardFlamengo Co is a sporting goods manufacturing. It had an operating income of $57,000, sales of $222.000, and a turnover ratio of 0.55. What is Flamengo's return on investment (ROI)? (Note: Round all numbers to two decimal places.) O 64.60% O Flamengo's ROI cannot be determined from this information. O 18.75% O 50.60% O 14.30%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education