FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

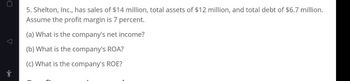

Transcribed Image Text:5. Shelton, Inc., has sales of $14 million, total assets of $12 million, and total debt of $6.7 million.

Assume the profit margin is 7 percent.

(a) What is the company's net income?

(b) What is the company's ROA?

(c) What is the company's ROE?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 40. JoelEmbi, Inc. has an ROA (return on assets) of 15.2 percent, total assets of $4,500,000 and a net profit margin of 7.6 percent. What are JoelEmbi, Inc.'s annual sales? Enter your answer a whole number (i.e., rounded to zero decimal places. 41. JimmyButle, LLC. has a debt-to-total assets ratio of 39.6%. What is the company's debt-to-equity ratio? Enter your answer as a ratio (that is, do not convert to a percent), rounded to 2 decimal places. 42. JohCol, Inc has a debt ratio of 27.0% and ROE = 20.2%. What is JohCol, Inc.'s ROA? Enter your answer as a percent rounded to 1 decimal place. Enter 43. PauGeo, Inc. has an ROA of 18.2% and a debt/equity ratio of 0.83. The firm's ROE is answer as a percent rounded to 1 decimal place. 44. Assume that TraeYoung, Inc. has: Debt ratio 60% ● Net profit margin = 15.2% ● Return on assets (ROA) = 52% Find Trae Young's Total Asset Turnover ratio. Enter answer as a ratio (that is, do not convert to a percent), rounded to 2 decimal places.arrow_forwardNeed Answer please provide Solutions with explanation of thisarrow_forwardNeed answerarrow_forward

- Use the information below to build a properly formatted income statement. A: The firm has 25,280,000 shares outstanding and its earnings per share is $2.40. Calculate Net Income. B: The firm's corporate tax rate is 40%. Calculate the firm's EBT. C: After completing A and B above, what is the firm's corporate tax expense? D: The firm's operating income is 1.80 times its Net Income. Determine the firm's EBIT. E: Given your answer to D, calculate the firm's Interest Expense. F: After completing the above: Gross Profit is 18.00 times its Interest Expense. Calculate Gross Profit. G: Finally, the firm's Revenue is 1.50 times its EBIT. Calculate the firm's Revenue. INSTRUCTIONS: Write ratios involving dollar amounts out to the penny, with no dollar sign: 1000.00. All ratios and interest rates should be calculated as follows: 11.28 (no percent sign) For this problem: Net Income = Earnings before Taxes = Тах еxpens 3 Earnings before Taxes & Interest = Interest expense = Gross profit = Revenue =arrow_forwardProvide solutionsarrow_forwardWims, Inc., has sales of $19.9 million, total assets of $14.9 million and total debt of $5.7 million. The profit margin is 12 percent. a. What is the company's net income? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) b. What is the company's ROA? (Do not round intermediate calculations and enter your answer as a percent rounded 2 decimal places, e.g., 32.16.) C. What is the company's ROE? (Do not round intermediate calculations and enter your answer as a percent rounded 2 decimal places, e.g., 32.16.) Net income a. b. ROA C. ROE % %arrow_forward

- Recreational Supplies Co. has net sales of $9,359,409, an ROE of 15.60 percent, and a total asset turnover of 3.48 times. If the firm has a debt-to-equity ratio of 1.23, what is the company's net income?arrow_forwardWhat is the equity multiplier if the total assets are $9,878.20 and total shareholder equity is $6,230.20?arrow_forwardWant the Correct answer of whatarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education