Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Wilson manufacturing 2023 income statement solve this accounting questions

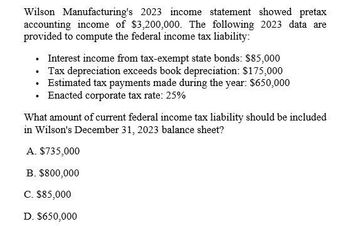

Transcribed Image Text:Wilson Manufacturing's 2023 income statement showed pretax

accounting income of $3,200,000. The following 2023 data are

provided to compute the federal income tax liability:

•

Interest income from tax-exempt state bonds: $85,000

⚫ Tax depreciation exceeds book depreciation: $175,000

⚫ Estimated tax payments made during the year: $650,000

⚫ Enacted corporate tax rate: 25%

What amount of current federal income tax liability should be included

in Wilson's December 31, 2023 balance sheet?

A. $735,000

B. $800,000

C. $85,000

D. $650,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Caramel Corp's 2023 income statement showed pretax accounting income of $2,500,000. To compute the federal income tax liability, the following 2023 data are provided: Income from exempt municipal bonds- $100,000 Depreciation deducted for tax purposes in excess of depreciation deducted for financial statement purposes- $200,000 Income Tax Rate- 20% The entry to record Caramel Corp's income tax expense and income tax payable for 2023 will includearrow_forwardCaramel Compnay's 2023 Income Statement shpwed pretax accounting income of $2,500,000. To compute the federal income tax liability, the following 2023 data are provided: Income from exempt municipal bonds- $100,000 Depreciation deducted for tax purposes in excess of depreciation deducted for financial statement purposes- 200,000 Income tax rate- 20% What amount of current federal income tax liability should be included in caramel Company's December 31. 2023 balance sheet?arrow_forwardexpert answer wantedarrow_forward

- Harper Company began operations at the beginning of 2021. The following information pertains to this company. 1. Pretax financial income:2021 $ 850,0002022 1,250,0002023 2,875,0002. The tax rate enacted for 2021 is 20%.3. Differences between the 2021 income statement and tax return are listed below: (a) Interest revenue earned on an investment in tax-exempt municipal bonds amounts to $3,000 in 2021, $1,500 in 2022, and $2,000 in 2023.(b) Revenue in 2023 on a construction contract is $800,000 for tax purposes. For financial statement purposes, revenue will amount to $100,000 in 2021, $300,000 in 2022, and the remainder in 2023. This is Harper’s only construction contract during 2021-2023.(c) Depreciation of equipment for financial reporting purposes is calculated using the straight-line method. Harper purchased equipment on January 1, 2022 at a cost of $50,000. The equipment has a life of 5 years and a $5,000 salvage value. Depreciation of the equipment for the tax return will be based…arrow_forwardABC Corporation provides you with the following information for the 2020 tax year, which was the company’s first year of operation:Book Income Before Taxes $100,000,000Book Depreciation $ 5,000,000MACRS Depreciation $ 7,500,000Foreign Sourced Income $ 40,000,000Assume a federal tax rate of 21%, disregard state taxes.a. Calculate federal taxable income.b. Calculate the federal tax payable and federal tax expense.c. Given your answer above in b., is a deferred tax asset or a deferred tax liability created? Provide the journal entry needed to reflect this.arrow_forwardCrane Corp.'s 2021 income statement showed pretax accounting income of $1300000. To compute the federal income tax liability, the following 2021 data are provided: Income from exempt municipal bonds Depreciation deducted for tax purposes in excess of depreciation deducted for financial statement purposes Estimated federal income tax payments made Enacted corporate income tax rate $88000 $82400 $100000 $226400 $66400 80000 160000 What amount of current federal income tax liability should be included in Crane's December 31, 2021 balance sheet? 20%arrow_forward

- Need Solution Tag. general accountarrow_forwardShierling Ltd. reported pre-tax accounting income of $750,000 for calendar 2023. To calculate the income tax liability, the following data were considered: Non-taxable portion of capital gains $ 30,000 CCA in excess of depreciation 60,000 Instalment tax payments made during 2023 150,000 Enacted income tax rate for 2023 30% What amount should Shierling report as its current income tax liability on its December 31, 2023 SFP? a) $198,000 b) $75,000 c) $66,000 d) $48,000arrow_forward2. Haag Corp.'s 2021 income statement showed pretax accounting income of $2,500,000. To compute the federal income tax liability, the following 2021 data are provided: Income from exempt municipal bonds $ 100,000 Depreciation deducted for tax purposes in excess of depreciation deducted for financial statement purposes 200,000 Estimated federal income tax payments made 330,000 Enacted corporate income tax rate 20% What amount of current federal income tax liability should be included in Hagg's December 31, 2021 balance sheet? a. $110,000 b. $150,000 c. $170,000 d. $440,000 -1-arrow_forward

- In the year 2018, a corporation made $18.5Million in revenue, $2.1 Million of operating expenses, and depreciation expenses of $6.9 Million. The state income tax rate is 10% and the federal income tax rate is 21%. The approximate state income tax rate is 3 decimals The approximate federal tax is The combined effective income tax rate is The ATCF for the year 2018 is 3 decimals Nearest decimal 3 decimal placesarrow_forwardCSX Corporation reported the following in its tax footnote to its 2019 financial statements. Use this information to answer the requirements. $ millions Net income Interest expense, net 737 639 546 Average total assets 37,493 36,234 35,577 Compute (a) return on assets and (b) the adjusted return on assets for each of the three years. Assume a statutory tax rate of 37% for 2017 and 22% for 2018 and 2019. a. Compute return on assets (ROA) for 2017, 2018, and 2019 Note: 1. Select the appropriate numerator and denominator used to compute ROA from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute ROA for each year. Year Numerator Net income 2019 2018 2017 $3,331 $3,309 $5,471 2017 $ 2018 $ 2019 $ 2017 $ 2018 S 2019 $ Denominator + Average total assets ÷ 35,577 5,471 $ 3,309 $ 3,331 $ ÷ b. Compute adjusted return on assets (ROA) for 2017, 2018, and 2019 Note: 1. Select the appropriate numerator and denominator used to compute adjusted ROA from the…arrow_forwardRequired: 1. Determine the amounts necessary to record Allmond's income taxes for 20: Allmond Corporation, organized on January 3, 2021, had pretax accounting income of $25 million and taxable income of $33 million 2. What is Allmond's 2021 net income? for the year ended December 31, 2021. The 2021 tax rate is 25%. The only difference between accounting income and taxable income is estimated product warranty costs. Assume that expected payments and scheduled tax rates (based on recently enacted tax legislation) are as follows: Complete this question by entering your answers in the tabs below. Required 1 Calculation Required 1 GJ Required 2 Prepare the appropriate journal entry. (If no entry is required for a transaction/e account field. Enter your answers in millions rounded to 2 decimal places (i.e., 5 View transaction list 1 Record 2021 income taxes. X Cr 2022 2023 2024 2025 $2 million 2 million 1 million 3 million 35% 35% 35% 25% Required: 1. Determine the amounts necessary to…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you