SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

expert answer wanted

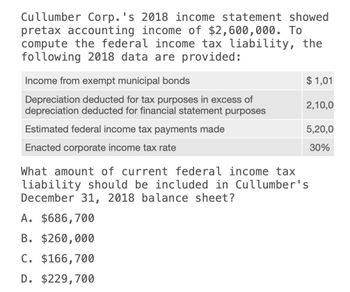

Transcribed Image Text:Cullumber Corp.'s 2018 income statement showed

pretax accounting income of $2,600,000. To

compute the federal income tax liability, the

following 2018 data are provided:

Income from exempt municipal bonds

Depreciation deducted for tax purposes in excess of

depreciation deducted for financial statement purposes

Estimated federal income tax payments made

Enacted corporate income tax rate

What amount of current federal income tax

liability should be included in Cullumber's

December 31, 2018 balance sheet?

$ 1,01

2,10,0

5,20,0

30%

A. $686,700

B. $260,000

C. $166,700

D. $229,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Barth James Inc. has the following deferred tax assets and liabilities: 12,000 noncurrent deferred tax asset, and 10,500 noncurrent deferred tax liability. Show how Barth James would report these deferred tax assets and liabilities on its balance sheet.arrow_forwardCrane Corp.'s 2021 income statement showed pretax accounting income of $1300000. To compute the federal income tax liability, the following 2021 data are provided: Income from exempt municipal bonds Depreciation deducted for tax purposes in excess of depreciation deducted for financial statement purposes Estimated federal income tax payments made Enacted corporate income tax rate $88000 $82400 $100000 $226400 $66400 80000 160000 What amount of current federal income tax liability should be included in Crane's December 31, 2021 balance sheet? 20%arrow_forwardCSX Corporation reported the following in its tax footnote to its 2019 financial statements. Use this information to answer the requirements. $ millions Net income Interest expense, net 737 639 546 Average total assets 37,493 36,234 35,577 Compute (a) return on assets and (b) the adjusted return on assets for each of the three years. Assume a statutory tax rate of 37% for 2017 and 22% for 2018 and 2019. a. Compute return on assets (ROA) for 2017, 2018, and 2019 Note: 1. Select the appropriate numerator and denominator used to compute ROA from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute ROA for each year. Year Numerator Net income 2019 2018 2017 $3,331 $3,309 $5,471 2017 $ 2018 $ 2019 $ 2017 $ 2018 S 2019 $ Denominator + Average total assets ÷ 35,577 5,471 $ 3,309 $ 3,331 $ ÷ b. Compute adjusted return on assets (ROA) for 2017, 2018, and 2019 Note: 1. Select the appropriate numerator and denominator used to compute adjusted ROA from the…arrow_forward

- Caramel Corp's 2023 income statement showed pretax accounting income of $2,500,000. To compute the federal income tax liability, the following 2023 data are provided: Income from exempt municipal bonds- $100,000 Depreciation deducted for tax purposes in excess of depreciation deducted for financial statement purposes- $200,000 Income Tax Rate- 20% The entry to record Caramel Corp's income tax expense and income tax payable for 2023 will includearrow_forwardHonesty Company reported pre-tax financial income of P400,000 for 2022. In the computation of income taxes, the following data were gathered: Non-taxable gain - P175,000 Depreciation deducted for tax purposes in excess of depreciation deducted for book purposes - P25,000 Tax payment made during 2022 - P27,500 Enacted tax rate - 35% What amount shall be reported as current tax liability?arrow_forward13. What is the total deferred tax asset to be presented in the 2021 Statement of Financial Position?14. What is the total income tax expense for the year?15. What is the net income after tax? Please answer in good accounting form. Thank you!arrow_forward

- Cullumber corp.s 2018 income statement showed pretax accounting incomearrow_forwardHarper Company began operations at the beginning of 2021. The following information pertains to this company. 1. Pretax financial income:2021 $ 850,0002022 1,250,0002023 2,875,0002. The tax rate enacted for 2021 is 20%.3. Differences between the 2021 income statement and tax return are listed below: (a) Interest revenue earned on an investment in tax-exempt municipal bonds amounts to $3,000 in 2021, $1,500 in 2022, and $2,000 in 2023.(b) Revenue in 2023 on a construction contract is $800,000 for tax purposes. For financial statement purposes, revenue will amount to $100,000 in 2021, $300,000 in 2022, and the remainder in 2023. This is Harper’s only construction contract during 2021-2023.(c) Depreciation of equipment for financial reporting purposes is calculated using the straight-line method. Harper purchased equipment on January 1, 2022 at a cost of $50,000. The equipment has a life of 5 years and a $5,000 salvage value. Depreciation of the equipment for the tax return will be based…arrow_forwardBonita Inc. reports the following pretax income (loss) for both book and tax purposes. Pretax Year Income (Loss) Tax Rate 2018 $124,000 20 % 2019 86,000 20 % 2020 (89,000 ) 25 % 2021 126,000 25 % The tax rates listed were all enacted by the beginning of 2018. Prepare the journal entries for years 2018-2021 to record income tax expense (benefit) and income taxes payable, and the tax effects of the loss carryforward, assuming that based on the weight of available evidence, it is more likely than not that one-half of the benefits of the loss carryforward will not be realized. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forward

- 1. How much is the taxable income for the year?2. How much is the current tax expense for the year?arrow_forwardA bhaliyaarrow_forwardFor the year ended December 31, 2021, Fidelity Engineering reported pretax accounting income of $1,020,000. Selected information for 2021 from Fidelity's records follows: Interest income on municipal governmental bonds Depreciation claimed on the 2021 tax return in excenn of depreciation on the income statement Carrying amount of depreciable anseta in excess of their tax basis at year-end Warranty expense reported on the income statement Actual warranty expenditures in 2021 $ 76,000 100,000 176,000 48,000 38,000 Fidelity's income tax rate is 25%. At January 1, 2021, Fidelity's records indicated balances of zero and $19,000 in its deferred tax asset and deferred tax liability accounts, respectively. Required: 1. Determine the amounts necessary to record income taxes for 2021, and prepare the appropriate journal entry. 2. What is Fidelity's 2021 net income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning