Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

What is the total

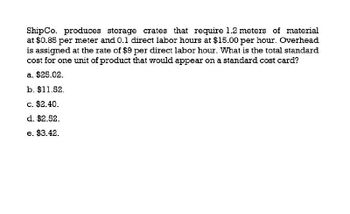

Transcribed Image Text:Ship Co. produces storage crates that require 1.2 meters of material

at $0.85 per meter and 0.1 direct labor hours at $15.00 per hour. Overhead

is assigned at the rate of $9 per direct labor hour. What is the total standard

cost for one unit of product that would appear on a standard cost card?

a. $25.02.

b. $11.52.

c. $2.40.

d. $2.52.

e. $3.42.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardWrappers Tape makes two products: Simple and Removable. It estimates it will produce 369,991 units of Simple and 146,100 of Removable, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: Â How much is the overhead allocated to each unit of Simple and Removable?arrow_forwardShipCo. produces storage crates that require 1.2 meters of material at $0.85 per meter and 0.1 direct labor hours at $15.00 per hour. Overhead is assigned at the rate of $9 per direct labor hour. What is the total standard cost for one unit of product that would appear on a standard cost card? a. $25.02. b. $11.52. c. $2.40. d. $2.52. e. $3.42.arrow_forward

- Ship Co. produces storage crates that require 1.2 meters of material at $.85 per meter and 0.1 direct labor hours at $15.00 per hour. Overhead is applied at the rate of $9 per direct labor hour. What is the total standard cost for one unit of product that would appear on a standard cost card?arrow_forwardGeneral Accounting Question solve this onearrow_forwardSteelMax produces metal containers that require 2.5 meters of material at $1.20 per meter and 0.3 direct labor hours at $18.00 per hour. Overhead is assigned at the rate of $12 per direct labor hour. What is the total standard cost for one unit of product that would appear on a standard cost card?need answerarrow_forward

- SteelMax produces metal containers that require 2.5 meters of material at $1.20 per meter and 0.3 direct labor hours at $18.00 per hour. Overhead is assigned at the rate of $12 per direct labor hour. What is the total standard cost for one unit of product that would appear on a standard cost card? correct answerarrow_forwardA standard cost card for one unit of a product may look like the following: Direct materials (4 pounds @ $1.25 per pound) $5.00 Direct labor (0.1 DLH @ $18 per hour) 1.80 Variable overhead (0.1 DLH @ $2.00 per hour) 0.20 Fixed overhead (0.1 DLH @ $4.60 per hour) 0.46 Total cost per unit $7.46 The standard cost to produce one unit is $7.46. The standard cost to produce 600 units are $ Of course, this is a simplification as the standard cost does not take fixed and variable costs into account. However, if the firm is producing at or near capacity, then the cost per unit of $7.46 could be multiplied by total units to get total standard cost. The standard cost card gives both unit and cost standards. The direct materials total of $5.00 is based on the use of four pounds of material at $1.25 per pound. Similarly, it should take six minutes (0.1 direct labor hour) to produce one unit. This makes it easy to determine total quantities and cost would be for multiple units. If 400 units were…arrow_forwardNeed help with this general accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College