EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Compute

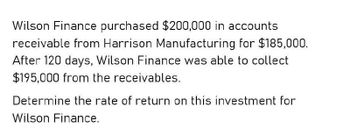

Transcribed Image Text:Wilson Finance purchased $200,000 in accounts

receivable from Harrison Manufacturing for $185,000.

After 120 days, Wilson Finance was able to collect

$195,000 from the receivables.

Determine the rate of return on this investment for

Wilson Finance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give full calcarrow_forwardFind the rate of return on this investment for donnearrow_forwardSummit Holdings has $280,000 in accounts receivable that will be collected within 70 days. The company needs cash urgently and decides to factor them, receiving $260,000. Skyline Factoring Company, which took the receivables, collected $275,000 after 85 days. Find the rate of return on this investment for Skyline.arrow_forward

- Blake Corporation has $200,000 in accounts receivable that will be collected within 80 days. Since Blake needs cash immediately, it has decided to factor them and has received $185,000. Everest Factoring Company, which took the receivables, could collect only $195,000 after 100 days. Find the rate of return on this investment for Everest.arrow_forwardPlease need answer the general accounting questionarrow_forwardLeven Corporation negotiated a short-term loan of $685,000. The loan is due in 10 months and carries a 6.86 interest rate. Use simple interest to calculate the total amount of thetioan. If necessary, round the answer to the nearest cent.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT