FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

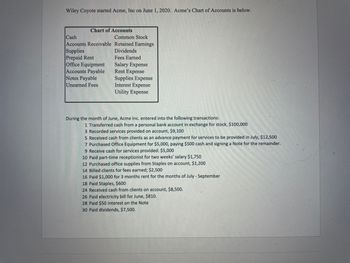

Transcribed Image Text:Wiley Coyote started Acme, Inc on June 1, 2020. Acme's Chart of Accounts is below.

Chart of Accounts

Cash

Accounts Receivable

Supplies

Prepaid Rent

Office Equipment

Accounts Payable

Notes Payable

Unearned Fees

Common Stock

Retained Earnings

Dividends

Fees Earned

Salary Expense

Rent Expense

Supplies Expense

Interest Expense

Utility Expense

During the month of June, Acme Inc. entered into the following transactions:

1 Transferred cash from a personal bank account in exchange for stock, $100,000

3 Recorded services provided on account, $9,100

5 Received cash from clients as an advance payment for services to be provided in July, $12,500

7 Purchased Office Equipment for $5,000, paying $500 cash and signing a Note for the remainder.

9 Receive cash for services provided: $5,000

10 Paid part-time receptionist for two weeks' salary $1,750

12 Purchased office supplies from Staples on account, $1,200

14 Billed clients for fees earned; $2,500

16 Paid $1,000 for 3 months rent for the months of July - September

18 Paid Staples, $600

24 Received cash from clients on account, $8,500.

26 Paid electricity bill for June, $810.

28 Paid $50 interest on the Note

30 Paid dividends, $7,500.

Transcribed Image Text:ASSETS

Current Assets:

Total Current Assets

Property, Plant & Equipment

Total Assets

Total Property, Plant & Equipment

Acme Inc.

Income Statement

Total Expenses

Balances, June 1, 2020

Issued Common Stock

Acme Inc.

Statement of Stockholders' Equity

Balances, June 30, 2020

Common

Stock

LIABILITIES

Current abilities:

Retained

Earning

Total Stockholders' Equity

Total Liabilities & Stockholders' Equity

Total

Page

of 7

O

Expert Solution

arrow_forward

Step 1

- An income statement is a financial report that indicates the revenue and expenses of a business. It also indicates when a business is profitable or losing money for a given time span.

- The difference between total assets and total liabilities, which is often reported monthly, quarterly, or yearly, is the statement of stockholders' equity. It may be located on the balance sheet, one of three crucial financial records for all small firms.

- The assets, liabilities, and stockholders' equity of a company are listed on a balance sheet at a certain point in time. They represent a glimpse of the assets and liabilities of your corporation, as well as the sum of investment made by its stockholders, all disclosed on a single day. You can better grasp a company's financial situation by knowing how much it is worth at any one time by looking at its balance sheet.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At December 31, Year 1, Kale Co. had the following balances in the accounts it maintains at First State Bank: Checking account #101 Checking account #201 Money market account 90-day certificate of deposit, due 2/28/Y2 180-day certificate of deposit, due 3/15/Y2 $175,000 (10,000) O $320,000 O $240,000 O $200,000 O $190,000 25,000 50,000 80.000 Kale classifies investments with original maturities of three months or less as cash equivalents. In its December 31, Year 1, balance sheet, what amount should Kale report as cash and cash equivalents?arrow_forwardOn December 31, 2021, the cash account of Coco Corp, showed a balance of P391,480. The bank statement on that date showed a balance of P409,500. Upon examining the cash records and the bank statement, the following information were determined.a. There was a bank service charge of P 1,500 for the month of December 2021.b. There was a credit memo for a note collected by the bank for oOco Corp. The customer’s note is P90,000 with interest of P2,600. The bank charged a collection fee of P550c. December 31, 2021 receipts for P289,000 were deposited only on January 2, 2022d. Checks issued which have not yet cleared the bank as at December 31,2021 amounts to P186,610e. There is a debit memo for P45,320 for a customer’s check returned marked “DAIF”f. A receipt of P90,000 had been entered as P60,000 in the cash book. Check # 12345 issued amounting to P49,100 was erroneously recorded as P41,900 and check # 12346 issued in the correct amount of P5,820 had been taken up as P58,200.What is the…arrow_forwardA company's Cash account shows a balance of $5,630 at the end of the month. Comparing the company's Cash account with the monthly bank statement reveals several additional cash transactions such as deposits outstanding ($1,270), checks outstanding ($2,410), bank service fees ($44), an NSF check from a customer ($240), a customer's note receivable collected by the bank ($570), and interest earned ($70). Prepare the necessary entries to adjust the balance of cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list :X: A Record the entries that increase cash. Record the entries that decrease cash. Credit Note : = journal entry has been entered %D Record entry Clear entry View general journal :X:arrow_forward

- The accountant of Universe Manufacturing collected the following information: The balance as per bank statement is $2,560.32 on 30 June 2020. On this date, the balance of the company’s book is $3,730.32. In addition, the accountant found the following items: a) Deposits in transit $1,460 b) Outstanding checks: $730 c) Bank statement shows a bank collection from bill receivables $1,000 d) Bank statement shows Interest received of $150 e) Bank service charge in the bank statement is $340 Required: prepare bank reconciliation statement at 30 June 2020.arrow_forwardA company's Cash account shows a balance of $3,420 at the end of the month. Comparing the company's Cash account with the monthly bank statement reveals several additional cash transactions such as bank service fees ($60), an NSF check from a customer ($400), a customer's note receivable collected by the bank $(1,400), and interest earned $(170). Prepare the necessary entries to adjust the balance of cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardPlease solve thisarrow_forward

- The cash account of Sheffield Co. showed a ledger balance of $7,088.13 on June 30, 2020. The bank statement as of that date showed a balance of $7,470. Upon comparing the statement with the cash records, the following facts were determined. 1. 2. 3. 4. 5. 6. 7. (a) There were bank service charges for June of $45. A bank memo stated that Bao Dai's note for $2,160 and interest of $64.80 had been collected on June 29, and the bank had made a charge of $9.90 on the collection. (No entry had been made on Sheffield's books when Bao Dai's note was sent to the bank for collection.) Receipts for June 30 for $6,102 were not deposited until July 2. Checks outstanding on June 30 totaled $3,844.89. The bank had charged the Sheffield Co.'s account for a customer's uncollectible check amounting to $455.76 on June 29. A customer's check for $162 (as payment on the customer's Accounts Receivable) had been entered as $108 in the cash receipts journal by Sheffield on June 15. Check no. 742 in the amount…arrow_forwardPlease give me answer for this questionarrow_forwardNovak Enterprises owns the following assets at December 31, 2025. Cash in bank-savings account $67,800 Cash on hand Cash refund due from IRS 8,710 Cash to be reported $ 33,800 What amount should be reported as cash? Checking account balance Postdated checks Certificates of deposit (180-day) $22,500 850 94,980arrow_forward

- Infinity Emporium Company received the monthly statement for its bank account, showing a balance of $67,300 on August 31. The balance in the Cash account in the company's accounting system at that date was $72,628. The company's accountant reviewed the statement and the company's accounting records and noted the following. 1. 2. 3. After comparing the cheques written by the company with those deducted from the bank account in August, the accountant determined that all six cheques (totalling $6,180) that had been outstanding at the end of July were processed by the bank in August. However, five cheques written in August, totalling $4,500, were outstanding on August 31. A review of the deposits showed that a deposit made by the company on July 31 for $11,532 was recorded by the bank on August 1, and an August 31 deposit of $13,300 was recorded in the company's accounting system but had not yet been recorded by the bank. The August bank statement also showed: a service fee of $24 a…arrow_forwardThe cash records and bank statement for the month of July for Eagle Incorporated are shown below. Description DEP Customer deposit INT Interest earned SF Service feesNOTE Note collected CHK Customer check NSF Nonsufficient fundsEFT Electronic funds transfer DC Debit card Additional information: The difference in the beginning balances in the company’s records and the bank statement relates to check number 530, which is outstanding as of June 30, 2024. The debit card transaction for the purchase of equipment on 7/19 is correctly processed by the bank. The EFT on July 26 in the bank statement relates to the purchase of office supplies.arrow_forwardBourne Incorporated reports a cash balance at the end of the month of $2,620. A comparison of the company's cash records with the monthly bank statement reveals several additional cash transactions: bank service fees ($85), an NSF check from a customer ($350), a customer’s note receivable collected by the bank ($1,000), and interest earned ($35). Required: Record the necessary entries to adjust the balance of cash.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education