FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

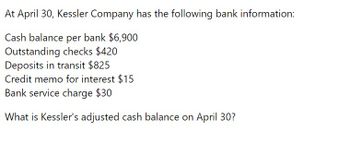

Transcribed Image Text:At April 30, Kessler Company has the following bank information:

Cash balance per bank $6,900

Outstanding checks $420

Deposits in transit $825

Credit memo for interest $15

Bank service charge $30

What is Kessler's adjusted cash balance on April 30?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is available for Ellen's Fashions, Inc. for the current month. Book balance end of month $6,900 Outstanding checks 675 Deposits in transit 4,500 Service charges 105 Interest revenue 50 What is the adjusted book balance on the bank reconciliation? A. $6,845 B. $7,520 C. $10,570 D. $6745arrow_forwardSahara Company's Cash account shows an ending balance of $650. The bank statement shows a $29 service charge and an NSF check for $150. A $240 deposit is in transit, and outstanding checks total $420. What is Sahara's adjusted cash balance? $829 $1 $291 $471arrow_forwardThe following information is available for Ellen's Fashions, Inc. for the current month. Book balance end of month $6,900 Outstanding checks 675 Deposits in transit 4,500 Service charges 120 Interest revenue 35 What is the adjusted book balance on the bank reconciliation? A. $7,490 B. $6,745 C. $6,815 D. $10,570arrow_forward

- 1arrow_forwardGiven this book and bank statement information, create an October bank reconciliation for Arrowhead company. And the journal entries required for the book side. BOOK INFO: Cash Date Debit Credit Balance 10/1/2020 Beginning Balance 8,259.86 10/1/2020 Ck 10102 Accounts Payable 1,374.12 6,885.74 10/2/2020 Ck 10103 Rent 3,420.00 3,465.74 10/2/2020 Ck 10104 Utilities 689.00 2,776.74 10/4/2020 Deposit 3,743.10 6,519.84 10/4/2020 Ck 10105 Advertising 344.21 6,175.63 10/4/2020 Ck 10106 Subscription 102.84 6,072.79 10/9/2020 Ck 10107 Internet 74.97 5,997.82 10/9/2020 Deposit 4,859.47 10,857.29 10/9/2020 Ck 10108 Telephone 221.00 10,636.29 10/9/2020 Deposit 11,339.64 21,975.93 10/12/2020 Ck 10109 Accounts Payable 1,680.00 20,295.93 10/13/2020 Ck 10110 Wages…arrow_forwardThe following extract from the cash book of Jon for the month of January shows thecompany’s bank transactions:RM RM01 Jan Balance b/f 600 18 Jan Ali 14513 Jan Uno 224 28 Jan PBA 7231 Jan Latif 186 30 Jan TNB 10931 Jan Balance c/f 6841,010 1,010…3/-3The company’s bank statement for the same period is as follows:Debit (RM) Credit (RM) Balance (RM)01 Jan Balance 63503 Jan Halim 35 60013 Jan Uno 224 82423 Jan Ali 145 67931 Jan Standing order 30 649Required:a. Prepare a corrected cash book using the information given above b. Draw up a bank reconciliation statement.arrow_forward

- Franklin Company deposts all cash receipts on the day they are received and makes all cash payments by check. At the dove of business on August 31. as Cash account shows a debit balance of $13362 Franke's August tiank statement shows a $14.237 balance in the bank Determine the adjusted cash balance using the following information Deposit in transit Outstanding checks Bank service fees, not yet recorded by company The bank collected on a note receivable, not yet recorded by the company The adjusted cash balance should be O O O C $1873 $10.333 SHUBEY saja Help Seve&ait $4,500 $3,000 $50 $1,725arrow_forwardDaarrow_forwardUsing the following information: The bank statement balance is $5,289. The cash account balance is $5,764. Outstanding checks amounted to $751. Deposits in transit are $1,174. The bank service charge is $43. A check for $71 for supplies was recorded as $62 in the ledger. Prepare a bank reconciliation for Candace Co. for May 31. Candace Co.Bank ReconciliationMay 31 Cash balance according to bank statement $fill in the blank 1 Adjustments: $fill in the blank 3 fill in the blank 5 Total adjustments fill in the blank 6 Adjusted balance $fill in the blank 7 Cash balance according to company's records $fill in the blank 8 Adjustments: $fill in the blank 10 fill in the blank 12 Total adjustments fill in the blank 13 Adjusted balance $fill in the blank 14arrow_forward

- Michelle Lansbury Company deposits all receipts and makes all payments by check. The following information is available from the cash records June 30 Bank Reconciliation Balance per bank $36,400 Add Deposits in transit 8,008 Deduct: Outstanding checks (10.400) Balance per books $34,008 Month of July Results Per Bank Balance July 31 July deposits July checks July note collected (not included in July deposits) July bank service charge $44.980 Per Books $48.100 23,400 30.212 20.800 16,120 7.800 78 July NSF check from a customer, returned by the bank (recorded by bank as a chargel 1742 (a) Your answer is correct Prepare a bank reconciliation going from balance per bank and balance per book to correct cash balance, Outstanding checks from the June reconciliation cleared the bank in Julyarrow_forwardThe following information for the month of March is available from Butters Cookies, Inc.'s accounting records: Balance per bank statement, March 31, 2020 $12,100 Cash balance per books, March 31, 2020 15,295 Deposit made on February 28; recorded by bank on March 3 3,600 March 31, 2016, outstanding checks: #2346 438 #2348 231 #2355 107 Bank service charge for March (not recorded yet by Butters) 54 NSF check of customer returned by bank with March statement 832 A check drawn on Moore Company was erroneously charged to Butters 275 A $347 check to a supplier in payment of account was erroneously recorded on Batters' books as $437 ? Deposit made on March 31, recorded by bank on April 3 2,900 Required: a. Prepare a March 31, 2020, bank reconciliation. b. Prepare any related adjusting entries that are necessary on March 31, 2020.arrow_forwardThe cash records and bank statement for the month of July for Eagle Incorporated are shown below. Description DEP Customer deposit INT Interest earned SF Service feesNOTE Note collected CHK Customer check NSF Nonsufficient fundsEFT Electronic funds transfer DC Debit card Additional information: The difference in the beginning balances in the company’s records and the bank statement relates to check number 530, which is outstanding as of June 30, 2024. The debit card transaction for the purchase of equipment on 7/19 is correctly processed by the bank. The EFT on July 26 in the bank statement relates to the purchase of office supplies.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education