Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

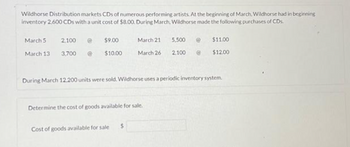

Transcribed Image Text:Wildhorse Distribution markets CDs of numerous performing artists. At the beginning of March, Wildhorse had in beginning

inventory 2,600 CDs with a unit cost of $8.00. During March, Wildhorse made the following purchases of CDs.

March 5

March 13

2,100

3,700

$9.00

$10.00

March 21

March 26

Determine the cost of goods available for sale.

Cost of goods available for sale

5,500

2,100

During March 12,200 units were sold. Wildhorse uses a periodic inventory system.

$11.00

$12.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cullumber Distribution markets CDs of numerous performing artists. At the beginning of March, Cullumber had in beginning inventory 2,800 CDs with a unit cost of $8.00. During March, Cullumber made the following purchases of CDs. March 5 March 13 1,900 @ 3,200 @ Cost of goods available for sale $ $9.00 S $10.00 Determine the cost of goods available for sale. During March 11,600 units were sold. Cullumber uses a periodic inventory system. Weighted average cost per unit $ eTextbook and Media Ending inventory $ March 21 Calculate weighted average cost per unit. (Round answer to 3 decimal places, eg. 5.125.) Cost of goods sold $ March 26 eTextbook and Media i Determine (1) the ending inventory and (2) the cost of goods sold under each of the assured cost flow methods (FIFO, LIFO, and average-cost). (Round answers to O decimal places, eg. 125.) FIFO 5,200 @ 1,900 $ $11.00 $12.00 $ LIFO AVERAGE-COSTarrow_forwardWHAT IS THE COST OF GOODS AVAILABLE FOR SALE BASE OF THE CHART ?? Vaughn Distribution markets CDs of the performing artist Unique. At the beginning of October, Vaughn had in beginning inventory 2,000 of Unique’s CDs with a unit cost of $5. During October, Vaughn made the following purchases of Unique’s CDs. Oct. 3 2,500 @ $6 Oct. 19 3,000 @ $8 Oct. 9 3,500 @ $7 Oct. 25 4,000 @ $9 During October, 10,850 units were sold. Vaughn uses a periodic inventory system.arrow_forwardWHAT IS THE " COST PER UNIT "?? Vaughn Distribution markets CDs of the performing artist Unique. At the beginning of October, Vaughn had in beginning inventory 2,000 of Unique’s CDs with a unit cost of $5. During October, Vaughn made the following purchases of Unique’s CDs. Oct. 3 2,500 @ $6 Oct. 19 3,000 @ $8 Oct. 9 3,500 @ $7 Oct. 25 4,000 @ $9 During October, 10,850 units were sold. Vaughn uses a periodic inventory system.arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardHOW DO I FIGURE OUT THE FIFO, LIFO AND AVERAGE-COST . FOR THE ENDING INVENTORY AND THE COST OF GOODS SOLD? Vaughn Distribution markets CDs of the performing artist Unique. At the beginning of October, Vaughn had in beginning inventory 2,000 of Unique’s CDs with a unit cost of $5. During October, Vaughn made the following purchases of Unique’s CDs. Oct. 3 2,500 @ $6 Oct. 19 3,000 @ $8 Oct. 9 3,500 @ $7 Oct. 25 4,000 @ $9 During October, 10,850 units were sold. Vaughn uses a periodic inventory system.arrow_forwardim.9arrow_forward

- Options for last question are FIFO, LIFO, and Average-costarrow_forwardDetermine cost of goods sold and ending inventory using FIFO, LIFO, and average-cost with analysis. P6-2A Mullins Distribution markets CDs of numerous performing artists. At the begin- ning of March, Mullins had in beginning inventory 2,500 CDs with a unit cost of $7. Dur- ing March, Mullins made the following purchases of CDs. March 5 2,000 @ $8 3,500 @ $9 March 21 5,000 @ $10 (LO 2), AP 2,000 @ $11 XLS March 13 March 26 During March 12,000 units were sold. Mullins uses a periodic inventory system. (b) Cost of goods sold: FIFO LIFO Instructions (a) Determine the cost of goods available for sale. (b) Determine (1) the ending inventory and (2) the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO, and average-cost). Prove the accuracy of the $105,000 $115,500 $109,601 Average Problems: Set A cost of goods sold under the FIFO and LIFO methods. (Note: For average-cost, round cost per unit to three decimal places.) (c) Which cost flow method results in (1) the…arrow_forwardThree identical units of merchandise were purchased during March, as shown: Steele Plate Units Cost Mar. 3 Purchase 1 $ 830 10 Purchase 1 840 19 Purchase 1 880 Total 3 $2,550 Assume that one unit is sold on March 23 for $1,125. What is the gross profit for March using FIFO? a.$1,670 b.$295 c.$245 d.$1,720arrow_forward

- Hi Please help with question attached, thanks so much.arrow_forwardAssume Ava Co. has the following purchases of inventory during the first month of operations Number of Units Cost per unit First Purchase 140 2.4 Second Purchase 105 4.7 Assuming Ava Co sells 120 units at $14 each, what is the cost of goods sold if they use LIFO?arrow_forwardDetermine cost of goods sold and ending inventory using FIFO, LIFO, and average-cost with analysis Express Distribution markets CDs of the performing artist Fishe. At the beginning of October, Express had in beginning inventory 2,000 of Fishe's CDs with a unit cost of $7. During October, Express made the following purchases of Fishe's CDs. Oct. 3 2,500 @ $8 Oct. 19 3,000 @ $10 Oct. 9 3,500 @$9 Oct. 25 4,000 @ $11 During October, 10,900 units were sold. Express uses a periodic inventory system. Instructions (a) Determine the cost of goods available for sale. (b) Determine (1) the ending inventory and (2) the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO and average cost). Prove the accuracy of the cost of goods sold under the FIFO and LIFO methods. (c ) Which cost flow method results in (1) the highest inventory amount for the balance sheet and (2) the highest cost of goods sold for the income statement? NOTE: Enter a number in cells requesting a value;…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning