EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Wilderness Kayak

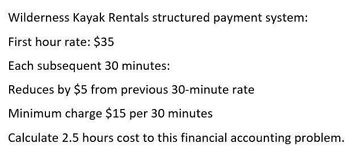

Transcribed Image Text:Wilderness Kayak Rentals structured payment system:

First hour rate: $35

Each subsequent 30 minutes:

Reduces by $5 from previous 30-minute rate

Minimum charge $15 per 30 minutes

Calculate 2.5 hours cost to this financial accounting problem.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate 2.5 hours costarrow_forwardCalculate the average daily balance and finance charge. (Round your answers to the nearest cent.): 30-day billing cycle 9/16 Billing date. Previous balance. $1,300 9/19 Payment: $53 cr. 9/30 Charge: home depot: $1,150 10/3 Payment: $53 cr. 10/7 Cash advance: $63 Finance charge is 1% on average daily balance. Average daily balance: ? Finance charge: ?arrow_forwardCalculate the average daily balance and finance charge. (Round your answers to the nearest cent.) 30-day billing cycle 9/16 Billing date Previous balance $ 2,400 9/19 Payment $ 64 cr. 9/30 Charge: Home Depot 1,700 10/3 Payment 64 cr. 10/7 Cash advance 74 Finance charge is 1.25% on average daily balance.arrow_forward

- Calculate the table factor, the finance charge, and the monthly payment (in $) for the loan by using the APR table, Table 13-1. (Round your answers to the nearest cent.) Monthly Payment Amount Number of Table Finance APR Financed Payments Factor Charge $9,300 36 13% $ Need Help? Read It Viewing Saved Work Revert to Last Response Submit Answerarrow_forwardCalculate the average daily balance and finance charge. (Round your answers to the nearest cent.) 30-day billing cycle Previous balance 9/16 Billing date Payment Charge: Home Depot Payment Cash advance $ 1,400 9/19 54 cr. 9/30 10/3 10/7 1,200 54 cr. 64 Finance charge is 1.25% on average daily balance. Average daily balance Finance charge %24arrow_forwardComplete the following table: Amount Number of monthly Amount of monthly Total of monthly Total finance Purchase price of product Schwinn Mountain Bike Down payment financed payments payments payments charge 238 %24 100 12 12.50 acer %24 %24arrow_forward

- A $15,000 personal loan charges a rate of 6%, compounded monthly and charges a $250 administration fee at the outset. What is the effective cost of the loan? 6.06% 6.10% 6.17% 6.27% The answer is 6.27% but I would like to know how to solve this problem. Thank you.arrow_forwardCalculate the average daily balance and finance charge. (Round your answers to the near 9/16 Billing date 9/19 Payment 9/30 Charge: Home Depot 10/3 Payment 10/7 Cash advance. 30-day billing cycle 4 Average daily balance Finance charge Previous balance Finance charge is 1% on average daily balance. S 62 cr. 1,600 62 cr. 72 $2,200arrow_forwardPurchase Costs Down payment Loan payment Estimated value at end of loan Opportunity cost interest rate Leasing Costs Security deposit Buying and Leasing Total purchase cost Total leasing cost $ 1,700 + $ 620 for 36 months $ 4,500 Lease payment $ 530 for 36 months. $ 740 End of lease charges. Based on the costs listed in the table above, calculate the costs of buying and of leasing a motor vehicle. Note: Round your answers to the nearest whole number. 4 percent $ 1,180 Pro 4 of 4 Next Chearrow_forward

- Calculate the average daily balance and finance charge. (Round your answers to the nearest cent.) 30-day billing cycle Previous balance $ 2,600 Billing date Payment Charge: Home Depot Payment Cash advance 9/16 9/19 66 cr. 1,800 66 cr. 9/30 10/3 10/7 76 Finance charge is 1.5% on average daily balance. es Average daily balance Finance charge %24arrow_forwardI need correct answer accounting questionarrow_forwardcalculate the monthly finance charge for the credit card transaction assume that it takes 10 days for the payment to be received and recorded and the month is 30 days long (round your answer to the nearest cent) $675 balance 15%, $625 payment, average daily balance method $___________arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT