FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

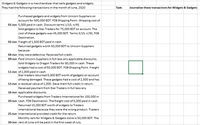

Transcribed Image Text:Widgets & Gadgets in a merchandiser that sells gadgets and widgets.

They had the following transactions in the month of June, 2020

Journalize these transactions for Widgets & Gadgets

Task:

Purchased gadgets and widgets from Unicorn Suppliers on

account for 500,000 BDT. FOB Shipping Point-Shipping cost of

01-Jun 5,000 paid in cash. Discount terms 1/10, n/45.

Sold gadgets to Star Traders for 75,000 BDT on account. The

cost of these gadgets was 45,000 BDT. Terms 3/15, n/30, FOB

Destination.

02-Jun Freight of 1,500 BDT paid in cash.

Returned gadgets worth 50,000 BDT to Unicorn Suppliers

because

04-Jun they were defective. Received full credit.

09-Jun Paid Unicorn Suppliers in full less any applicable discounts.

Sold Widgets to Dragon Traders for 80,000 in cash. These

widgets had a cost of 50,000 BDT. FOB Shipping Point. Freight

11-Jun of 2,000 paid in cash.

Star traders returned 5,000 BDT worth of gadgets on account

of being damaged. These gadgets had a cost of 2,500 and has

13-Jun a residual value of 1,000. Gave them full credit in return.

Received payment from Star Traders in full less any

16-Jun applicable discounts.

Purchased widgets from Traders International for 100,000 in

20-Jun cash. FOB Destination. The freight cost of 5,000 paid in cash.

Returned 15,000 BDT worth of widgets to Traders

international because they were the wrong product. Traders

25-Jun International provided credit for the return.

Monthly rent for Widgets & Gadgets store is 50,000 BDT. The

30-Jun rent of June will be paid in the first week of July.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Questtion A: why not there will be accounts recevable? "Purchased widgets from Traders International for 100,000 in 20-Jun cash. FOB Destination. The freight cost of 5,000 paid in cash" Buyer paid on be half of seller.

Question B: Please share followings:

- Prepare the ledgers for revenue and expenses only

- Prepare the closing journal for revenue and expenses

- the

trial balance

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Questtion A: why not there will be accounts recevable? "Purchased widgets from Traders International for 100,000 in 20-Jun cash. FOB Destination. The freight cost of 5,000 paid in cash" Buyer paid on be half of seller.

Question B: Please share followings:

- Prepare the ledgers for revenue and expenses only

- Prepare the closing journal for revenue and expenses

- the

trial balance

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Crane's Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Information relating to Crane's purchases of Xpert snowboards during September is shown below. During the same month, 121 Xpert snowboards were sold. Crane's uses a perpetual inventory system. Date Sept. 1 Sept. 12 Sept. 19 Sept. 26 Date Sept. 5 Sept. 16 Sept. 29 Explanation Units Inventory Purchases Purchases Purchases Totals Sale Sale Sale Totals Units 59 23 121 45 20 44 132 12 HK$1.592 50 Unit Price Show Transcribed Text Unit Cost HK$776 Show Transcribed Text Ending Inventory FIFO 1,624 The ending inventory HK$ 1.672 Show Transcribed Text 816 832 840 Total Cost HK$ 17,848 HK$ Ending Inventory Average HK$ 36,720 16,640 36,960 Compute ending inventory at September 30 using FIFO and moving-average cost. (Round per unit cost to 2 decimal places, e.g. 15.25 and final answers to O decimal places, e.g. 125.) HK$108,168 Total Cost HK$19.104 HK$198,952 81,200 98.648 Compare ending inventory using a perpetual…arrow_forwardFill in the blanks for question: Dec. 15: Received a check from Stewart Office Supply for full amount owed on Nov. 15 sale. Transactions with dates are in picture/ screenshot.arrow_forwardREI sells snowboards. Assume the following information relates to REI's purchases of snowboards during September. During the same month, 106 snowboards were sold. REI uses a periodic inventory system. Date Sept. 1 Sept. 12 Sept. 19 Sept. 26 Explanation Units Unit Cost Inventory Purchases Purchases Purchases Totals 15 42 57 21 135 $100 103 104 105 Total Cost $1,500 4,326 5,928 2,205 $13,959arrow_forward

- Dorothy's Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Information relating to Dorothy's purchases of Xpert snowboards during September is shown below. During the same month, 126 Xpert snowboards were sold. Dorothy's uses a periodic inventory system. Date Sept. 1 Sept. 12 Sept. 19 Sept. 26 (a) Explanation Inventory Purchases (b) Purchases Purchases Totals Units Unit Cost 29 Cost of goods sold 45 20 Your Answer Correct Answer (Used) 50 e Textbook and Media 144 $95 102 104 105 The ending inventory at September 30 $ Total Cost $ $ 2,755 Compute the ending inventory at September 30 and cost of goods sold using the FIFO and LIFO methods. 4,590 2,080 5,250 $14,675 FIFO The sum of ending inventory and cost of goods sold $ 1,890 12,785 For both FIFO and LIFO, calculate the sum of ending inventory and cost of goods sold. $ FIFO $ LIFO 1.710 12.965 LIFOarrow_forwardNow record the cost of the putters sold on the 6th. Date Nov. 6 Accounts and Explanation Cost of Goods Sold Merchandise Inventory To record the cost of goods sold. Debit Creditarrow_forwardUse the following information for the Quick Study below. (Algo) (11-14) [The following information applies to the questions displayed below.] Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Monson uses a perpetual inventory system. Also, on December 15, Monson sells 15 units for $32 each. Purchases on December 7 Purchases on December 14 Purchases on December 21 10 units @ $18.00 cost 20 units @ $24.00 cost 15 units @ $26.00 cost QS 5-11 (Algo) Perpetual: Assigning costs with FIFO LO P1 Required: Determine the costs assigned to the December 31 ending inventory based on the FIFO method.arrow_forward

- The question is on the photo. Thanks!arrow_forwardRequired information Use the following information for the Quick Study below. (Algo) (11-14) Skip to question [The following information applies to the questions displayed below.]Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Monson uses a perpetual inventory system. Also, on December 15, Monson sells 15 units for $27 each. Purchases on December 7 10 units @ $13.00 cost Purchases on December 14 20 units @ $19.00 cost Purchases on December 21 15 units @ $21.00 cost QS 5-14 (Algo) Perpetual: Inventory costing with specific identification LO P1 Of the units sold, eight are from the December 7 purchase and seven are from the December 14 purchase. Determine the costs assigned to ending inventory when costs are assigned based on specific identification.arrow_forwardHi Please help with questions attached, thanks so much.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education