Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

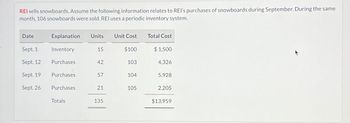

Transcribed Image Text:REI sells snowboards. Assume the following information relates to REI's purchases of snowboards during September. During the same

month, 106 snowboards were sold. REI uses a periodic inventory system.

Date

Sept. 1

Sept. 12

Sept. 19

Sept. 26

Explanation Units Unit Cost

Inventory

Purchases

Purchases

Purchases

Totals

15

42

57

21

135

$100

103

104

105

Total Cost

$1,500

4,326

5,928

2,205

$13,959

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- REI sells snowboards. Assume the following information relates to REI's purchases of snowboards during September. During the same month, 109 snowboards were sold. REI uses a periodic inventory system. Date Explanation Units Unit Cost Total Cost Sept. 1 Inventory 14 $102 $1,428 Sept. 12 Purchases 48 105 5,040 Sept. 19 Purchases 50 106 5,300 Sept. 26 Purchases 23 107 2,461 Totals 135 $14,229 (a) Your answer is correct. Compute the ending inventory at September 30 using FIFO, LIFO, and average-cost. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to O decimal places, e.g. 125.) (b) Ending inventory at September 30 $ eTextbook and Media FIFO 2779 $ LIFO 2688 $ AVERAGE-COST 2740 Attempts: 2 of 3 used Compute the cost of goods sold for the month using the FIFO, LIFO, and average-cost methods. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to O decimal places, e.g. 125.) Cost of goods sold $ FIFO $ LIFO AVERAGE-COST $arrow_forwardREI sells snowboards. Assume the following information relates to REI's purchases of snowboards during September. During the same month, 102 snowboards were sold. REI uses a periodic inventory system. Date Sept. 1 Sept. 12 Sept. 19 Sept. 26 (a) Explanation Units Inventory Purchases Purchases Purchases Totals 13 Your answer is correct. 49 53 20 135 Unit Cost $107 110 111 112 Total Cost $1,391 5,390 5,883 2,240 $14,904 Compute the ending inventory at September 30 using FIFO, LIFO, and average-cost. (Round average cost per unit to 3 decimal SU places, e.g. 125.153 and final answers to 0 decimal places, e.g. 125.)arrow_forwardREI sells snowboards. Assume the following information relates to REI's purchases of snowboards during September. During the same month, 108 snowboards were sold. REI uses a periodic inventory system. Date Explanation Units Unit Cost Total Cost Sept. 1 Inventory 11 $116 $1,276 Sept. 12 Purchases 48 119 5,712 Sept. 19 Purchases 60 120 7,200 Sept. 26 Purchases 21 121 2,541 Totals 140 $16,729 Your answer is partially correct. Compute the ending inventory at September 30 using FIFO, LIFO, and average-cost. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to O decimal places, e.g. 125.) Ending inventory at September 30 eTextbook and Media FIFO 3861 $ LIFO 3775 AVERAGE-COST 3824 * Your answer is incorrect. Compute the cost of goods sold for the month using the FIFO, LIFO, and average-cost methods. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to O decimal places, e.g. 125.) FIFO Cost of goods sold $ 3861 LIFO 3808…arrow_forward

- REI sells snowboards. Assume the following information relates to REI's purchases of snowboards during September. During the same month, 107 snowboards were sold. REI uses a periodic inventory system. Date Explanation Units Unit Cost Total Cost Sept. 1 Inventory 13 $110 $1,430 Sept. 12 Purchases 49 113 5,537 Sept. 19 Purchases 53 114 6,042) Sept. 26 Purchases Totals 135 335 20 115 2,300 $15,309 Compute the ending inventory at September 30 using FIFO, LIFO, and average cost. (Round average cost per unit to 3 decimal places, eg. 125.153 and final answers to O decimal places, e.g. 125.) Ending inventory at September 30 eTextbook and Media FIFO LIFO $ AVERAGE-COST Compute the cost of goods sold for the month using the FIFO, LIFO, and average cost methods. (Round average cost per unit to 3 decimal places, eg. 125.153 and final answers to O decimal places, eg. 125) FIFO LIFO AVERAGE-COSTarrow_forwardREI sells snowboards. Assume the following information relates to REI's purchases of snowboards during September. During the same month, 100 snowboards were sold. REI uses a periodic inventory system Date: Sept. 1 Sept. 12 Sept. 19 Sept. 26 (a) Explanation Units Inventory Purchases Purchases Purchases Totals 10 45 50 20 125 * Your answer is incorrect Unit Cost $100 103 104 105 Total Cost $1,000 4.635 5.200 2,100 $12,935 Compute the ending inventory at September 30 using FIFO, LIFO, and average-cost. (Round average cost per unit to 3 decimal places, eg. 125.153 and final answers to 0 decimal places, e.g. 125.) SUPPORTarrow_forwardREI sells snowboards. Assume the following information relates to REI's purchases of snowboards during September. During the same month, 102 snowboards were sold. REI uses a periodic inventory system. Date Explanation Units Unit Cost Total Cost Sept. 1 Sept. 12 Inventory 12 $102 $1,224 Purchases 45 105 4,725 Sept. 19 Purchases 57 106 6,042 Sept. 26 Purchases 24 107 2,568 Totals 138 $14,559 Compute the ending inventory at September 30 using FIFO, LIFO, and average-cost. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to O decimal places, e.g. 125.) Ending inventory at $ September 30 FIFO SA LIFO AVERAGE-COST $ SUPPORTarrow_forward

- REI sells snowboards. Assume the following information relates to REI's purchases of snowboards during September. During the same month, 102 snowboards were sold. REI uses a periodic inventory system. Date Sept. 1 Sept. 12 Sept. 19 Sept. 26 (a) Explanation Units Inventory Purchases Purchases Purchases Totals 13 49 53 20 135 Your answer is incorrect. Unit Cost $107 110 111 112 Total Cost $ 1,391 5,390 5,883 2,240 $14,904 Compute the ending inventory at September 30 using FIFO, LIFO, and average-cost. (Round average cost per unit to 3 decimal places, eg. 125.153 and final answers to O decimal places, e.g. 125.)arrow_forwardREI sells snowboards. Assume the following information relates to REI's purchases of snowboards during September. During the same month, 103 snowboards were sold. REI uses a periodic inventory system. Date Sept. 1 Explanation Units Unit Cost Total Cost Inventory 14 $110 $1,540 Sept. 12 Purchases 50 113 5,650 Sept. 19 Purchases 54 114 6,156 Sept. 26 Purchases 22 115 2,530 Totals 140 $15,876 (a) Your Answer Correct Answer -Your answer is partially correct. Compute the ending inventory at September 30 using FIFO, LIFO, and average-cost. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to O decimal places, e.g. 125.) (b) Ending inventory at September 30 eTextbook and Media Solution FIFO 814 +9 $ LIFO 518 $ AVERAGE-COST 4195.8 Attempts: 3 of 3 used Compute the cost of goods sold for the month using the FIFO, LIFO, and average-cost methods. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to O decimal places, e.g. 125.)arrow_forwardREI sells snowboards. Assume the following information relates to REI's purchases of snowboards during September. During the same month, 107 snowboards were sold. REI uses a periodic inventory system. Date Sept. 1 Sept. 12 Sept. 19 Sept. 26 (a) Ending inventory at Explanation Inventory Purchases September 30 Purchases Purchases Totals Units 15 49 51 25 140 FIFO Unit Cost $110 113 114 115 Total Cost $ 1,650 5,537 5,814 Compute the ending inventory at September 30 using FIFO, LIFO, and average-cost. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to 0 decimal places, e.g. 125.) 2,875 $15,876 LIFO VA AVERAGE-COSTarrow_forward

- REI sells snowboards. Assume the following information relates to REI's purchases of snowboards during September. During the same month, 103 snowboards were sold. REl uses a periodic inventory system. \table[[Date,Explanation,Units,Unit Cost,Total Cost],[Sept. 1,Inventory,10,$111,$1,110 b) compute the cost of goods sold for the month using the fifo lifo and average cost methodsarrow_forwardREI sell snowboards. Assume the following information relates to REI's purchases of snowbourds during tegnember During the same month, 100 snowboards were sold REloses a periodic inventory system Dale Sept. 1 Sept. 12 Sept 19 Sept. 26 Explanation Unit Unit Cont Inventory 15 $110 Purchases 48 113 Purchases 33 114 Purchases 24 115 Totals 140 Compute the ending inventory at September 30 using FIFO LIFO, and average-cost. (Round average cost per 3 decimal places eg. 125.153 and final answers to 0 decimal places 125 Ending inventory at September 30 eTextbook and Media FIFO Your answer is incorrect Cost of goods sold 2775 FIFO $1.630 5,424 6042 3.760 $15.876 13654 LIFO Compute the cost of goods sold for the month using the FIFO, LIFO, and average-cost methock Mound average cost per unit to 3 decimal ploces, eg 125 153 end final enmers to 0 alecimal places, 1253 1344 UFD ETDA AVERAGE-COST $ 3402 AVERAGE-COST 130825arrow_forwardREI sells snowboards. Assume the following information relates to REI's purchases of snowboards during September. During the same month, 106 snowboards were sold. REI uses a periodic inventory system. Date Sept. 1 Sept. 12 Sept. 19 Sept. 26 Explanation Units Unit Cost Inventory $100 103 Purchases Purchases Purchases Totals 15 Ending inventory at September 30 42 eTextbook and Media 57 21 * Your answer is incorrect. 135 104 $ 105 Total Cost FIFO $1,500 4,326 Compute the ending inventory at September 30 using FIFO, LIFO, and average-cost. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to O decimal places, e.g. 125.) 5,928 2,205 $13,959 2705 $ LIFO 5826 $ AVERAGE-COSTarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning